- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Chevron (CVX) Valuation: Is There Opportunity After Recent 3% Share Price Pullback?

Reviewed by Simply Wall St

Chevron (CVX) stock tends to capture investors’ attention whenever the broader energy sector faces shifts in sentiment or macroeconomic events. Over the past month, Chevron has seen a decline of about 3%, prompting fresh discussions around its current valuation and outlook.

See our latest analysis for Chevron.

While Chevron's share price has fallen nearly 3% over the past month, the bigger picture shows steady upward momentum this year, with a 5.8% year-to-date share price return and a 7.8% total return over the past twelve months. Over the longer term, the total shareholder return of 167% over five years hints at the strength of its capital return and business execution, even with recent volatility reflecting shifting risk perceptions and energy market sentiment.

If energy stocks like Chevron have you rethinking your watchlist, now’s a great moment to discover new opportunities with fast growing stocks with high insider ownership

Yet with Chevron’s recent pullback, the question remains: is this an undervalued opportunity for those seeking long-term growth, or has the market already accounted for the company’s future prospects in its current share price?

Most Popular Narrative: 8% Undervalued

Chevron’s narrative consensus sets a fair value of $168.78 per share, which sits about 8% above the recent closing price. This positions Chevron as an attractively valued prospect given its story of operational leverage and forward-looking investments.

Record production growth, especially in the Permian and from the Hess acquisition (Guyana, Bakken), positions Chevron to meet the rising energy demand from global population growth and emerging markets. This supports higher baseline revenues and longer-term cash generation.

Want to discover what growth assumptions are powering this bullish outlook? The narrative is underpinned by bold revenue and margin projections. Find out which financial gambits analysts are betting on and see exactly what is driving Chevron’s fair value higher.

Result: Fair Value of $168.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Chevron's heavy dependence on oil production and slow pace in renewables could undermine long-term earnings if energy transition trends accelerate.

Find out about the key risks to this Chevron narrative.

Another View: Multiples Raise Caution

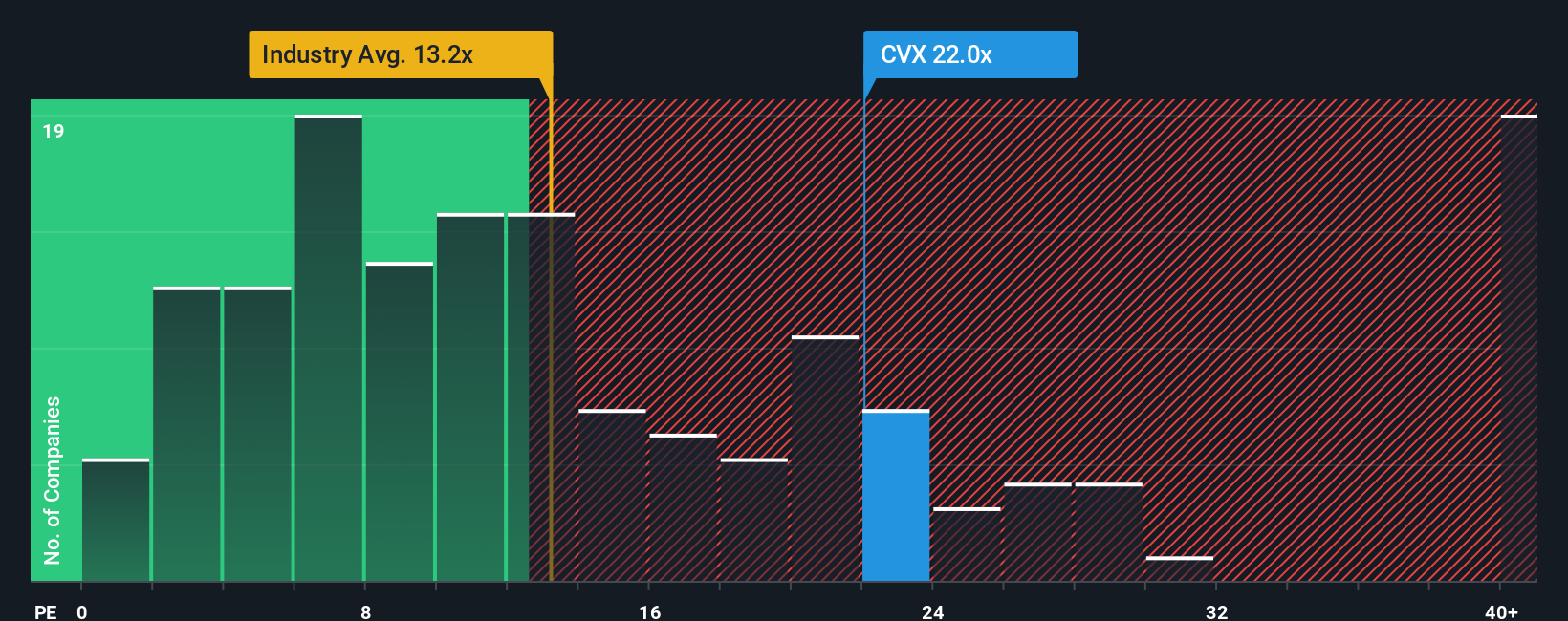

While the consensus narrative sees Chevron as undervalued, a look at its price-to-earnings ratio tells a more cautious story. Chevron trades at 23 times earnings, noticeably higher than the US Oil and Gas industry average of 12.8 and its peer average of 20.3. Even when compared with its fair ratio of 22.3, the current level suggests investors are paying a premium. This premium could limit near-term upside if expectations fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chevron Narrative

Not convinced by the prevailing view or want to dig deeper into the numbers yourself? Craft your own Chevron take from scratch in minutes; your insights could show a whole new angle. Do it your way

A great starting point for your Chevron research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to expand your portfolio beyond Chevron? The Simply Wall Street Screener can help you spot hidden gems and stay ahead of emerging trends that others might overlook.

- Accelerate your growth strategy by checking out these 3554 penny stocks with strong financials which combine surprising strength with real financial discipline.

- Boost your potential income when you browse these 19 dividend stocks with yields > 3% offering yields above 3% for reliable returns in uncertain markets.

- Tap into tomorrow’s breakthroughs with these 34 healthcare AI stocks and discover companies harnessing artificial intelligence to transform healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives