- United States

- /

- Oil and Gas

- /

- NYSE:CVI

CVR Energy (CVI): Exploring Valuation Narratives After an 83% 1-Year Total Shareholder Return

Reviewed by Simply Wall St

CVR Energy (CVI) has been catching the eye of investors as its stock continued a steady climb over the past year, delivering an impressive 83% return. This performance stands out given the modest recent revenue growth and some profit headwinds.

See our latest analysis for CVR Energy.

After a stellar run that has put CVR Energy's 1-year total shareholder return at 83.2%, short-term share price momentum has eased. This reflects both the sector's cyclical swings and recent shifts in risk outlook. Still, the overall long-term performance signals robust growth potential for patient investors.

If you're searching for what's next in the market, this could be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

Given the strong returns and some recent pullback, is CVR Energy’s current share price reflecting hidden value? Or is the market already anticipating further gains and pricing in future growth?

Most Popular Narrative: 24% Overvalued

CVR Energy's fair value, according to the most prominent narrative, is estimated at $27.67 per share. This is well below its last close of $34.34. This creates a direct contrast between analyst expectations and current market optimism, setting the stage for a closer look at the logic fueling this forecast.

“Bullish analysts point to positive sector tailwinds and expect global supply disruptions to support refining margins, which may benefit CVR Energy's performance. Several believe the company is well-positioned to reinstate its dividend by year end. This could enhance shareholder returns and drive valuation higher.”

What’s really behind this eye-catching valuation cutoff? The full narrative reveals some surprising future profit assumptions and margin forecasts that could reshape your expectations. Ready to see exactly which sector dynamics and financial projections drive this fair value estimate? Dive deep to spot the pivotal numbers and tensions powering the market’s current debate.

Result: Fair Value of $27.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressures and unexpected refinery downtimes could quickly challenge the optimistic outlook on margins and future profitability for CVR Energy.

Find out about the key risks to this CVR Energy narrative.

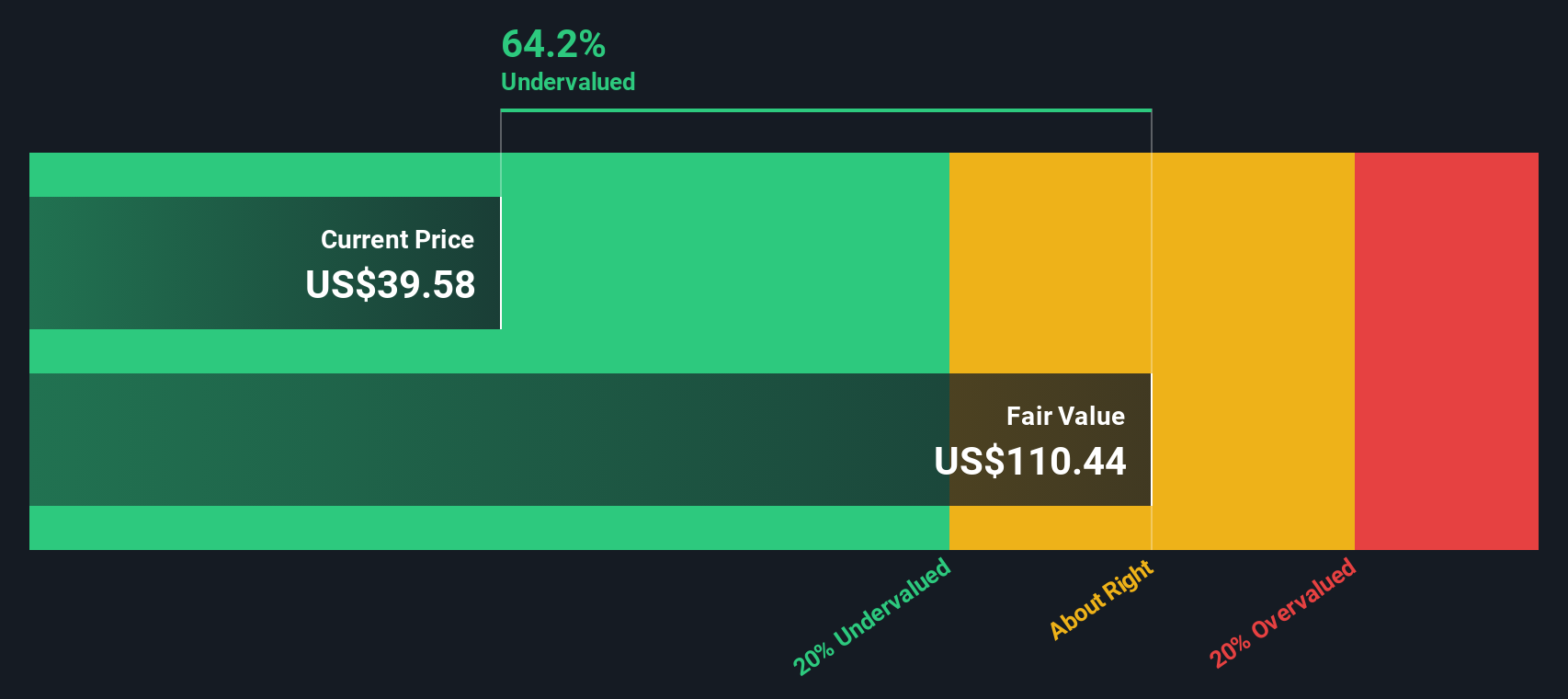

Another View: DCF Suggests Hidden Value

While analysts see CVR Energy as trading well above their price targets based on future earnings estimates, the SWS DCF model offers a much more optimistic perspective. According to our DCF model, CVR Energy is currently valued at less than half of its fair value. This suggests significant potential upside if cash flow trends play out as projected. Is the market missing something, or is the gap justified by risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CVR Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CVR Energy Narrative

If you have a different perspective or want to dig into the numbers yourself, it takes just a few minutes to craft your own interpretation. Do it your way

A great starting point for your CVR Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your portfolio and gain an edge by tapping into unique stock picks using tools trusted by savvy market-watchers.

- Spot long-term winners and enjoy reliable income by targeting these 16 dividend stocks with yields > 3% with strong yields and high payout potential.

- Seize the surge in digital finance by backing these 81 cryptocurrency and blockchain stocks, which is leading the evolution of secure, blockchain-powered ecosystems.

- Uncover future giants by finding these 916 undervalued stocks based on cash flows that the market has yet to fully recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVI

CVR Energy

Engages in renewable fuels and petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

Solid track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives