- United States

- /

- Oil and Gas

- /

- NYSE:CTRA

How Coterra Energy's (CTRA) Derivative Gains and Leadership Hire May Influence Its Investment Story

Reviewed by Sasha Jovanovic

- Coterra Energy recently reported net cash gains of US$36 million from derivative settlements for its third quarter ended September 30, 2025, and announced the appointment of Gregory F. Conaway as Vice President and Chief Accounting Officer.

- These developments highlight Coterra's operational focus and leadership changes, signaling ongoing efforts to strengthen both financial performance and corporate governance.

- We'll explore how this combination of positive derivative settlements and a key management appointment aligns with and potentially impacts Coterra's broader investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Coterra Energy Investment Narrative Recap

Being a Coterra Energy shareholder means believing in the company's ability to drive sustained earnings and cash flow through disciplined production growth and tight cost control, amid fluctuating natural gas prices. The recent US$36 million net cash gain from derivative settlements offers a small buffer but does not fundamentally change the short-term catalyst, which remains the stabilization of natural gas prices; persistent weakness in those prices is still the most immediate risk and is largely unaffected by this news.

Of recent developments, the appointment of Gregory F. Conaway as Vice President and Chief Accounting Officer is most relevant here, signaling an added layer of oversight as Coterra focuses on capturing value and maintaining operational discipline. Leadership changes like this can support the company’s efforts to sustain margins and execute its growth strategies, especially as robust financial controls become increasingly important for oil and gas producers navigating market volatility.

By contrast, it’s the underlying risk of prolonged low natural gas prices that investors should be aware of, especially if...

Read the full narrative on Coterra Energy (it's free!)

Coterra Energy's outlook anticipates $9.6 billion in revenue and $1.9 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 15.5% and an earnings increase of $0.3 billion from the current earnings of $1.6 billion.

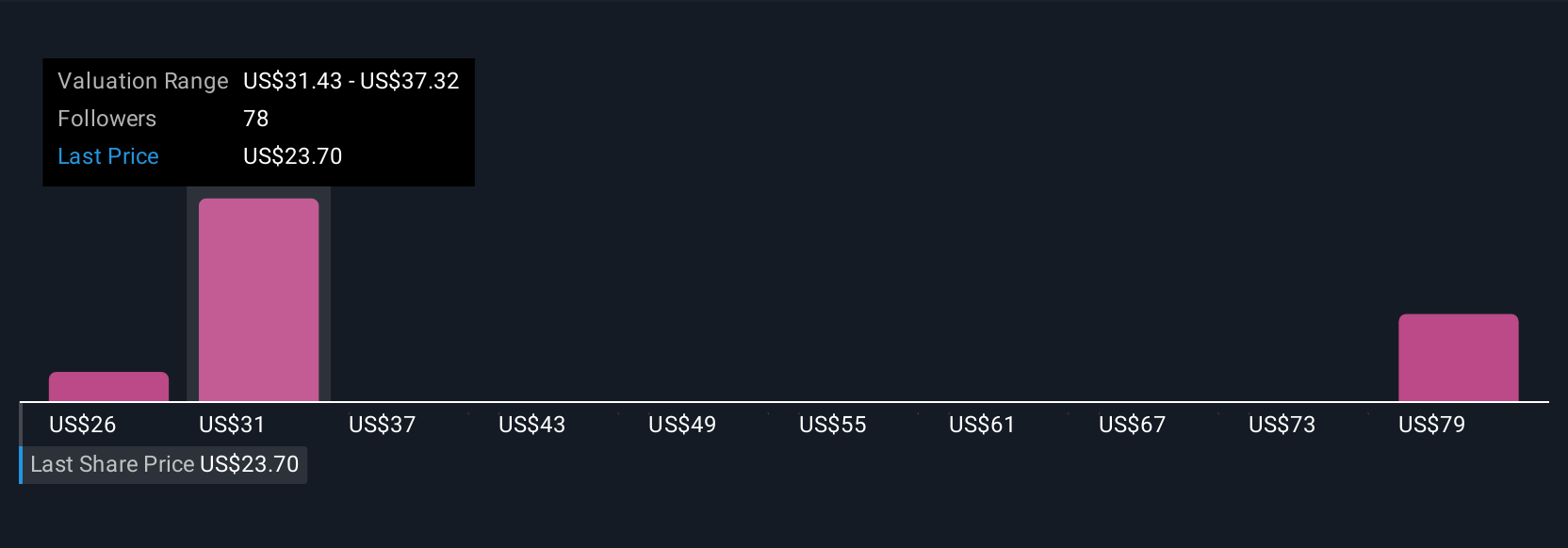

Uncover how Coterra Energy's forecasts yield a $32.29 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Six individual fair value estimates from the Simply Wall St Community range widely, from US$25.55 up to US$77.27 per share. At the same time, persistent volatility in US natural gas prices continues to shape the company's near-term prospects so you may want to see how other investors interpret these risks and opportunities.

Explore 6 other fair value estimates on Coterra Energy - why the stock might be worth just $25.55!

Build Your Own Coterra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coterra Energy research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coterra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coterra Energy's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRA

Coterra Energy

An independent oil and gas company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives