Stock Analysis

- United States

- /

- Metals and Mining

- /

- NYSE:AMR

Are Contura Energy's (NYSE:CTRA) Statutory Earnings A Good Guide To Its Underlying Profitability?

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Contura Energy (NYSE:CTRA).

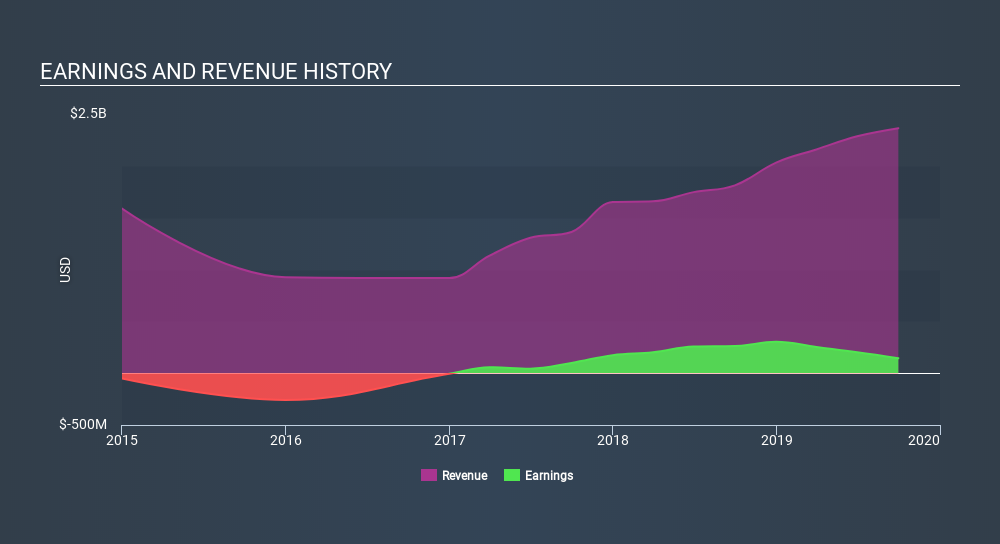

It's good to see that over the last twelve months Contura Energy made a profit of US$144.6m on revenue of US$2.36b. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

View our latest analysis for Contura Energy

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. Therefore, today we'll take a look at Contura Energy's cashflow, share issues and unusual items with a view to better understanding the nature of its statutory earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Contura Energy's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Contura Energy has an accrual ratio of 0.24 for the year to September 2019. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. In the last twelve months it actually had negative free cash flow, with an outflow of US$50m despite its profit of US$144.6m, mentioned above. Unfortunately, we don't have data on Contura Energy's free cash flow for the prior year; that's not necessarily a bad thing, though we do generally prefer to be able to see a bit of a company's history.

Having said that, there is more to consider. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Contura Energy issued 86% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Contura Energy's historical EPS growth by clicking on this link.

How Is Dilution Impacting Contura Energy's Earnings Per Share? (EPS)

Contura Energy was losing money three years ago. And even focusing only on the last twelve months, we see profit is down 45%. Sadly, earnings per share fell further, down a full 70% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

If Contura Energy's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

Unfortunately (in the short term) Contura Energy saw its profit reduced by unusual items worth US$121m. If this was a non-cash charge, it would have made the accrual ratio better, if cashflow had stayed strong, so it's not great to see in combination with an uninspiring accrual ratio. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Contura Energy took a rather significant hit from unusual items in the year to September 2019. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Contura Energy's Profit Performance

In conclusion, Contura Energy's accrual ratio suggests that its statutory earnings are not backed by cash flow; but the fact unusual items actually weighed on profit may create upside if those unusual items to not recur. And the dilution means that per-share results are weaker than the bottom line might imply. Based on these factors, we think that Contura Energy's statutory profits probably make it seem better than it is on an underlying level. Ultimately, this article has formed an opinion based on historical data. However, it can also be great to think about what analysts are forecasting for the future. At Simply Wall St, we have analyst estimates which you can view by clicking here.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:AMR

Alpha Metallurgical Resources

A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

Flawless balance sheet and undervalued.