- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Why Comstock Resources (CRK) Surged 14.8% After Record Earnings Despite Lower Production

Reviewed by Sasha Jovanovic

- Comstock Resources recently reported its third quarter and nine-month 2025 operating and earnings results, revealing a decrease in both natural gas and oil production but a sharp increase in revenue to US$449.85 million and net income of US$111.13 million for the quarter, reversing a net loss a year prior.

- A key insight is that higher natural gas prices along with successful drilling in the Haynesville and Bossier shales allowed the company to achieve record quarterly earnings despite declining production volumes.

- We will review how Comstock’s strong revenue growth and improved profitability, driven by higher natural gas prices, impact its long-term investment thesis.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Comstock Resources Investment Narrative Recap

Owning Comstock Resources stock requires confidence in sustained demand and strong price realizations for Haynesville shale natural gas, as well as faith that operational efficiency can offset regional production risks. The latest quarterly earnings jump, despite another drop in production volumes, highlights the company’s exposure to commodity prices as the most important near-term catalyst, with ongoing concentration in the Haynesville remaining the single largest risk. At this point, the news does not materially change the fundamental risk profile for shareholders.

Among recent announcements, Comstock’s divestiture of legacy Haynesville assets to pay down debt stands out in the context of recent profit growth. By reallocating proceeds toward strengthening the balance sheet, the company is working to maintain financial flexibility even as revenue growth hinges on favorable gas prices.

By contrast, investors should also be aware of what happens if regional gas prices reverse or Haynesville-specific challenges increase operating costs...

Read the full narrative on Comstock Resources (it's free!)

Comstock Resources' narrative projects $2.5 billion revenue and $733.2 million earnings by 2028. This requires 14.6% yearly revenue growth and an earnings increase of $805.8 million from current earnings of -$72.6 million.

Uncover how Comstock Resources' forecasts yield a $18.82 fair value, a 25% downside to its current price.

Exploring Other Perspectives

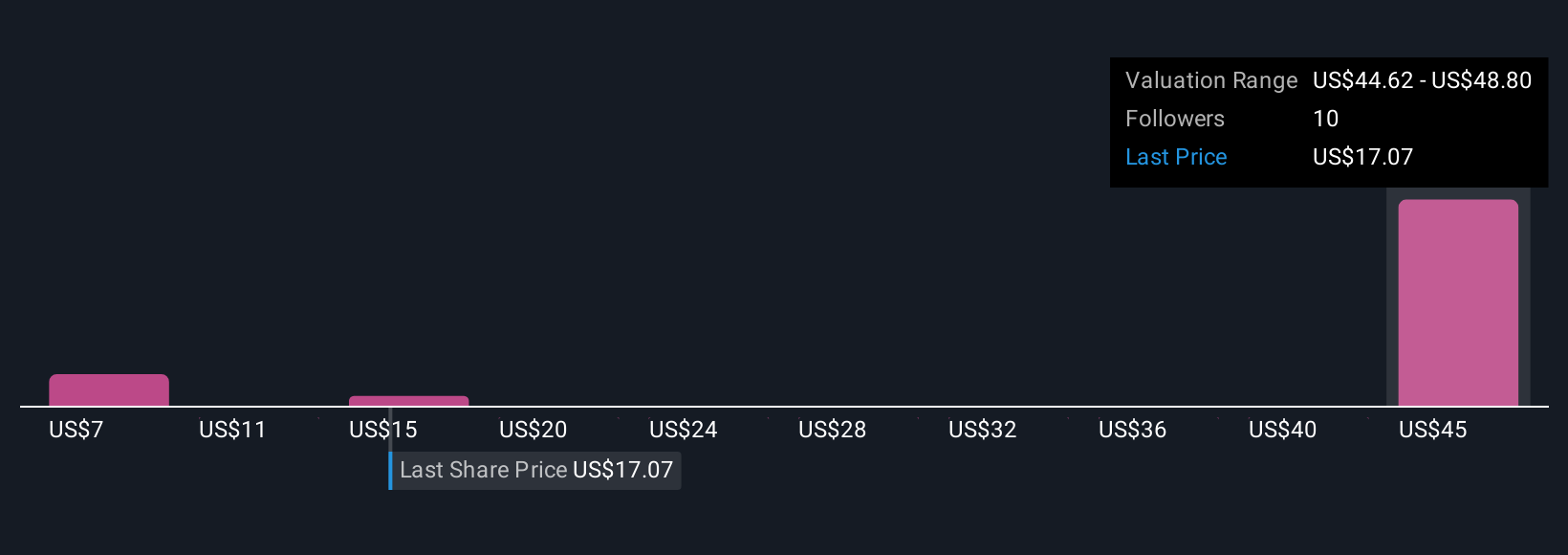

Five members of the Simply Wall St Community estimate Comstock's fair value between US$6.97 and US$18.82, reflecting wide-ranging outlooks. A reliance on Haynesville production makes these views especially relevant as you compare risks and possible outcomes for future company performance.

Explore 5 other fair value estimates on Comstock Resources - why the stock might be worth less than half the current price!

Build Your Own Comstock Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comstock Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comstock Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives