- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Is Crescent Energy's $3.9 Billion Credit Facility Transforming the Investment Case for CRGY?

Reviewed by Sasha Jovanovic

- Crescent Energy announced in the past week that it completed its fall borrowing base redetermination, boosting its reserve-based revolving credit facility by 50% to US$3.9 billion and extending its maturity to five years.

- This development reduces the company's near-term debt obligations and improves financial flexibility, while early cost synergies from the Vital Energy deal have already contributed to lower expenses.

- We will explore how Crescent Energy's larger credit facility and improved debt profile could influence its future investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Crescent Energy Investment Narrative Recap

To be a shareholder in Crescent Energy, you need to believe that disciplined capital allocation, operational improvements, and a portfolio approach to U.S. oil and gas assets will support steady earnings growth despite sector volatility. The recent expansion and extension of the company’s borrowing base materially improves Crescent’s shorter-term financial flexibility, softening concerns about liquidity, but does not eliminate the integration risks that come with relying on acquisitions for growth, still the most important risk facing the business today. The completion of Crescent’s tender offer for its high-yield 2028 Senior Notes stands out among recent announcements, as it is closely tied to the reduced near-term debt burden and supports the themes of balance sheet improvement and interest savings, possibly giving management greater room to pursue operational catalysts such as increased production efficiency. However, investors should also be aware that despite these improvements, the risks tied to ever-larger acquisitions and integration remain, particularly if new assets fail to deliver on expected returns...

Read the full narrative on Crescent Energy (it's free!)

Crescent Energy is projected to reach $5.2 billion in revenue and $672.6 million in earnings by 2028. This outlook assumes a 14.8% annual revenue growth rate and an increase in earnings of $649.5 million from the current $23.1 million.

Uncover how Crescent Energy's forecasts yield a $14.78 fair value, a 83% upside to its current price.

Exploring Other Perspectives

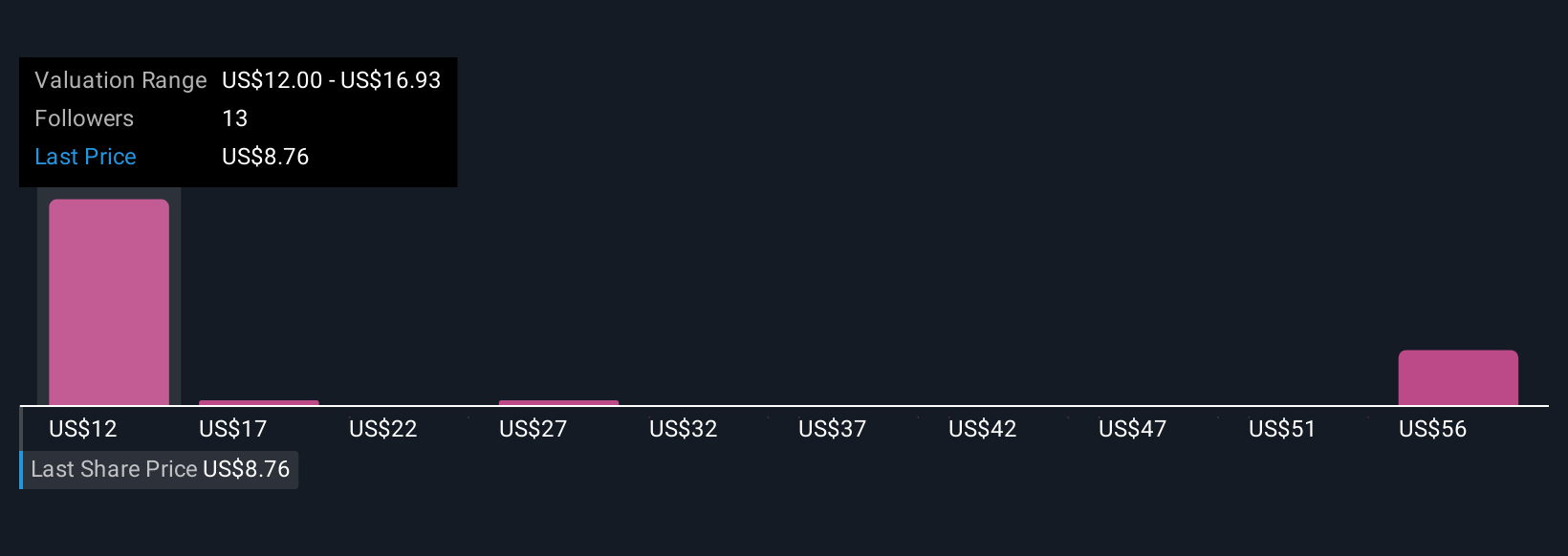

Five individual fair value estimates in the Simply Wall St Community span from US$12 to nearly US$60 per share, reflecting highly varied expectations. While some investors anticipate strong earnings growth, integration risks from Crescent’s acquisition-driven model may shape future performance, consider the range of views before forming your own.

Explore 5 other fair value estimates on Crescent Energy - why the stock might be worth over 7x more than the current price!

Build Your Own Crescent Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crescent Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crescent Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crescent Energy's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives