- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Crescent Energy (CRGY) Reports Quarterly Loss Amid Nine-Month Profit—Is Sustainable Profitability in Sight?

Reviewed by Sasha Jovanovic

- Crescent Energy Company released its third quarter and nine-month earnings results, reporting third-quarter revenue of US$866.58 million and a net loss of US$9.51 million, while nine-month revenue reached US$2.71 billion with net income of US$141.57 million.

- An interesting detail from the announcement is that, despite a quarterly net loss, Crescent Energy achieved substantial year-over-year revenue growth and turned a profit over the nine-month period, highlighting improved financial performance through 2025.

- We’ll assess how Crescent Energy’s strong nine-month revenue and return to profitability may influence its longer-term investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Crescent Energy Investment Narrative Recap

To be a shareholder in Crescent Energy today, you have to believe in the company’s ability to deliver profitable growth and weather sector volatility, especially as it balances large-scale acquisitions with operational improvements. The recent third-quarter earnings highlight strong year-over-year revenue gains and a return to nine-month profitability; however, this does not appear to be a material catalyst for any near-term re-rating, and ongoing integration risk from growth strategies remains the most significant challenge.

Among several announcements, the October borrowing base increase, from US$2.6 billion to US$3.9 billion, stands out as most relevant. Expanding borrowing capacity demonstrates Crescent’s access to capital for further acquisitions or operational investments, but this step is tightly connected to the underlying risk that heavy reliance on acquisitions could impact margins if asset integration falls short of expectations.

By contrast, the most important risk investors should be mindful of is that Crescent’s growth through acquisitions and asset deals could come with hidden costs and...

Read the full narrative on Crescent Energy (it's free!)

Crescent Energy's outlook forecasts $5.2 billion in revenue and $672.6 million in earnings by 2028. Achieving this would require a 14.8% annual revenue growth rate and an increase in earnings of $649.5 million from the current $23.1 million.

Uncover how Crescent Energy's forecasts yield a $14.18 fair value, a 52% upside to its current price.

Exploring Other Perspectives

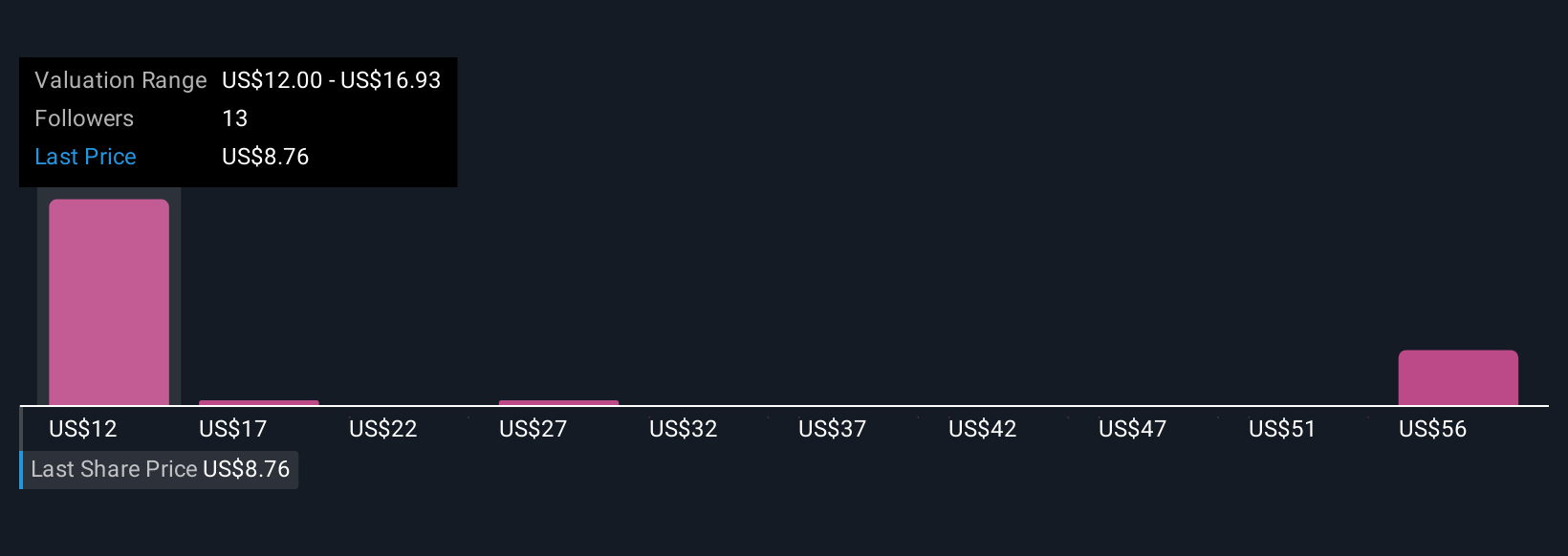

Simply Wall St Community members submit fair value estimates from US$12 to US$63.47 across five perspectives. Coupled with Crescent’s continued reliance on acquisitions for growth, this wide range reminds you to consider multiple viewpoints on the company’s future potential.

Explore 5 other fair value estimates on Crescent Energy - why the stock might be worth over 6x more than the current price!

Build Your Own Crescent Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crescent Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crescent Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crescent Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives