- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Crescent Energy (CRGY): Evaluating Valuation After Expanded Credit Facility and New Cost Synergies

Reviewed by Simply Wall St

Crescent Energy (CRGY) has just completed a significant step forward by increasing its borrowing base by 50% and extending its revolving credit facility to five years. This move reduces short-term debt pressures and provides greater flexibility for future growth.

See our latest analysis for Crescent Energy.

After trending lower most of the year, Crescent Energy’s 1-day share price return of 5.8% suggests the news of increased financial flexibility is resonating with investors. However, the stock’s year-to-date share price return stands at -42.7%, and one-year total shareholder return remains firmly in the red. Momentum may be picking up as a result of these capital improvements, but there is still ground to recover compared to previous highs.

If you’re evaluating new ideas as the energy sector evolves, it’s a good time to branch out and discover fast growing stocks with high insider ownership

With shares still down sharply for the year but trading at a notable discount to analyst targets, is Crescent Energy an overlooked value play poised for a rebound, or is the market already reflecting this improved outlook?

Most Popular Narrative: 42.3% Undervalued

With the most widely followed narrative setting a fair value of $14.78, which is 42% above the last closing price of $8.53, there is a clear divide between the market and analyst expectations. This creates a distinct contrast for investors weighing current momentum against the narrative’s more optimistic outlook.

Persistent growth in global energy demand, alongside heightened energy security concerns among major economies, is likely to support stable or higher commodity prices and underpin ongoing demand for Crescent Energy's oil and gas production, providing a tailwind to future revenue and cash flow.

Eager to uncover the bold projection that justifies such a big gap? The narrative’s formula hinges on robust revenue growth, rising margins, and a dramatic profit swing. Curious about what sets Crescent’s fair value apart? You’ll want to see which ambitious assumptions drive this standout number.

Result: Fair Value of $14.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on acquisitions and exposure to regional regulatory changes could undermine Crescent Energy’s profitability and could hamper long-term valuation gains.

Find out about the key risks to this Crescent Energy narrative.

Another View: What Do Earnings Ratios Say?

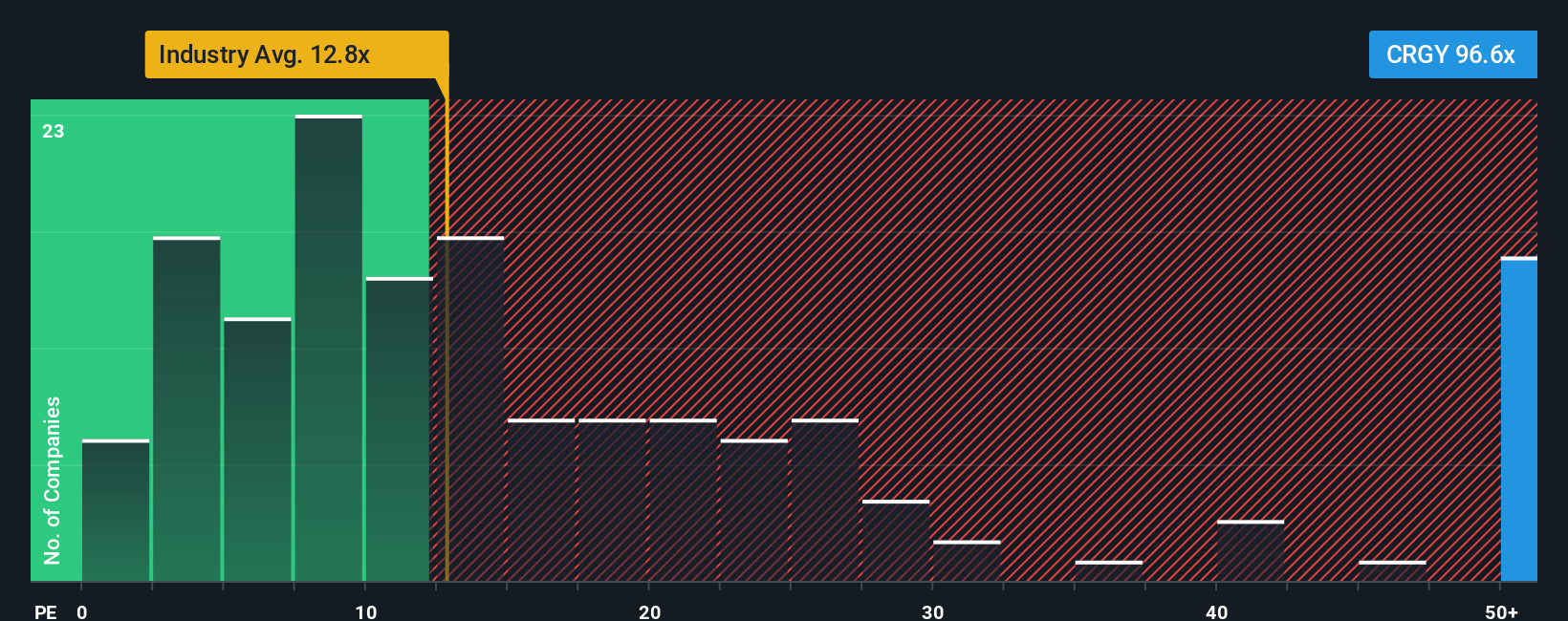

Looking through the lens of earnings ratios, Crescent Energy’s price-to-earnings sits at 94.1x, which is much higher than its industry peers at 12.9x and well above the fair ratio of 20.4x. This signals that, despite recent optimism, the market may be pricing in significant future growth or could be overvaluing the company for its current performance. Is the premium justified, or is this a warning sign for valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crescent Energy Narrative

If you’d rather dig into the numbers yourself or believe there’s another angle on Crescent Energy’s outlook, you’re invited to craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Crescent Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. The market is moving fast, so give yourself the edge by searching smartly for strong stocks with big potential gains.

- Target higher returns with these 876 undervalued stocks based on cash flows, where you’ll spot stocks trading below their fair value and positioned for a turnaround.

- Capitalize on innovation by checking out these 27 AI penny stocks, which are pushing boundaries in artificial intelligence and revolutionizing entire industries.

- Start building passive income streams by browsing these 17 dividend stocks with yields > 3%, offering consistent yields above 3% for long-term financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives