- United States

- /

- Oil and Gas

- /

- NYSE:CRC

California Resources (CRC) Engages In M&A Discussions With Berry Corporation

Reviewed by Simply Wall St

California Resources (CRC) recently held discussions regarding potential mergers and acquisitions with Berry Corporation, hinting at potential growth in the energy sector. This development, along with a robust earnings report showing significant revenue and net income growth, likely supported CRC's solid 13% stock price increase over the last quarter. Coupled with a substantial stock buyback, which could enhance shareholder value, these factors added positive weight to CRC's performance. Amid a market where major indices like the Nasdaq and S&P 500 are reaching record highs, CRC's performance aligns with broader market trends, further supported by favorable corporate guidance and consistent dividend payouts.

We've identified 1 warning sign for California Resources that you should be aware of.

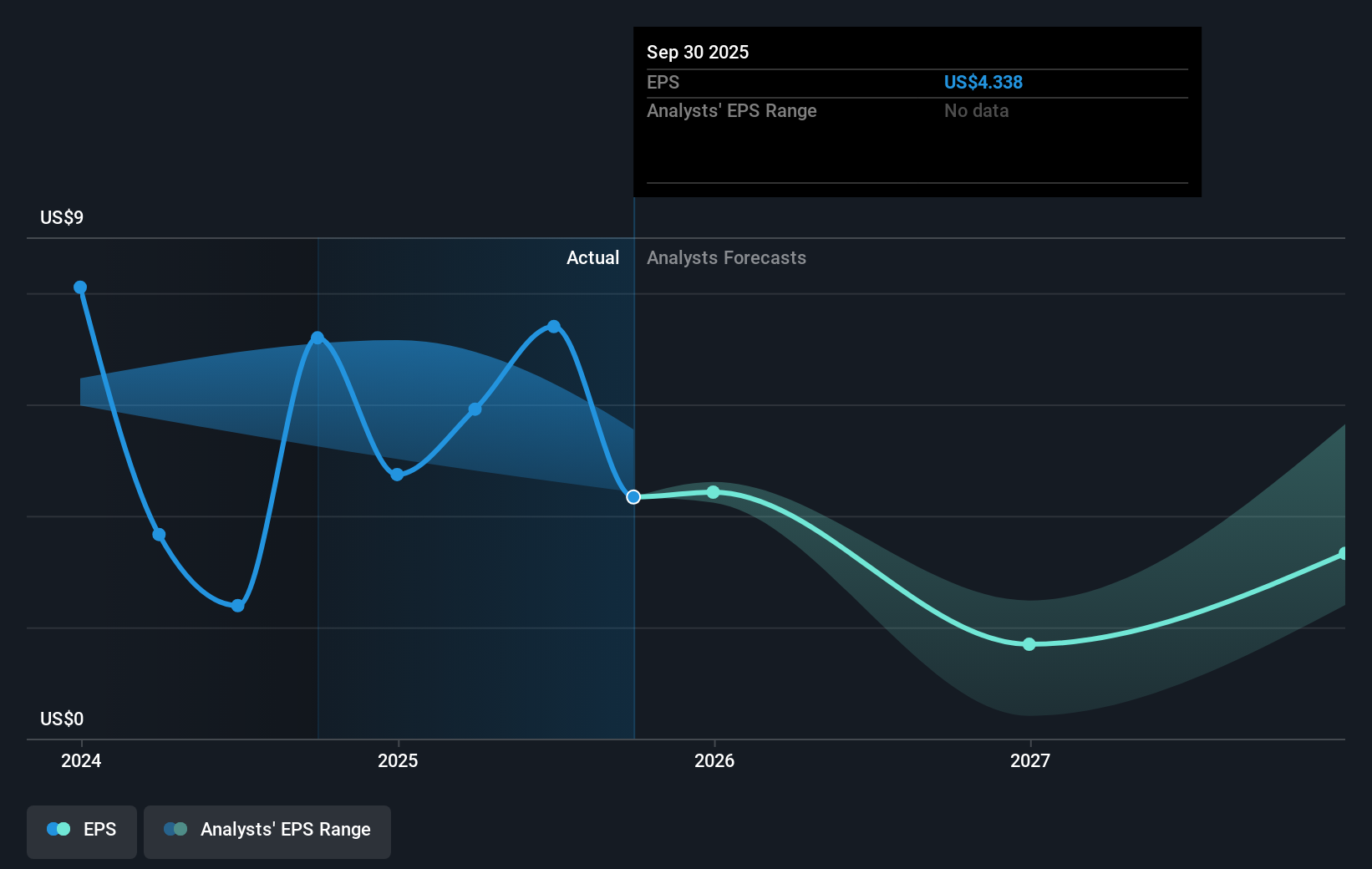

The recent merger discussions between California Resources (CRC) and Berry Corporation signal potential strategic directions that could enhance CRC's foothold in the energy sector. This aligns with CRC's efforts to capitalize on regulatory changes and carbon capture initiatives, potentially driving revenue growth and stabilizing pricing power. However, analysts project a 5.9% annual revenue decline over the next 3 years, with earnings expected to decrease significantly. The advance in carbon capture and cost management remain pivotal in countering these declines.

Over the past three years, CRC's total return, including share price and dividends, was 33.25%, signaling a favorable long-term outcome for its investors. However, in the context of the broader market, CRC's annual return matched the US Oil and Gas industry standard of 4.7%, yet it underperformed against the US market's return of 18.7% over the past year. This performance needs consideration when evaluating its standing against both sector and market metrics.

The current share price of US$53.01 reflects a 15.39% discount to the consensus price target of US$61.17, suggesting potential room for growth if CRC successfully leverages its strategic initiatives. Analysts' projections assume the company will trade at a higher P/E ratio, implying optimism for future valuation, despite expected earnings declines. These developments underscore the need for CRC to execute its expansion plans while closely managing regulatory and operational risks to meet or exceed future earnings forecasts.

Evaluate California Resources' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRC

California Resources

Operates as an independent energy and carbon management company in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success