- United States

- /

- Oil and Gas

- /

- NYSE:COP

Will Willow Project Cost Increases and Dividend Hike Redefine ConocoPhillips’ (COP) Capital Discipline?

Reviewed by Sasha Jovanovic

- ConocoPhillips recently increased its total spending plan for the Willow oil and natural gas project in Alaska to as much as US$9 billion due to inflation and higher costs, while affirming that first oil production remains on track for early 2029.

- An important insight is that despite the higher capital expenditures, ConocoPhillips has maintained its project timeline, received affirmation of its credit ratings, and announced an 8% dividend increase, signaling continued financial stability and commitment to shareholder returns.

- Next, we’ll examine how the Willow project’s cost escalation impacts ConocoPhillips’ long-term earnings outlook and efficiency improvements.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

ConocoPhillips Investment Narrative Recap

To be a shareholder in ConocoPhillips, you generally need to believe in the company's ability to execute large, capital-intensive oil and gas projects like Willow, manage cost inflation, and benefit from continued demand for traditional energy sources. The latest news of rising Willow project costs is significant, but with the timeline and credit ratings unchanged, the most important near-term catalyst, consistent cash flow from production expansion, remains intact. For now, the increased capital spend does not materially alter the biggest present risk, which is execution and cost control on major projects.

The announced 8% dividend increase in the fourth quarter of 2025 stands out as the most relevant recent development in light of cost pressures. This highlights ConocoPhillips’ clear commitment to maintaining shareholder returns and signals confidence in the company’s financial position, despite elevated investment in Willow and other growth projects. Ongoing dividend growth is closely linked to the company’s ability to deliver on large-scale developments and manage free cash flow across market cycles.

However, while the timetable and ratings remain stable, investors should be aware that if project execution risk rises or Willow faces further overruns...

Read the full narrative on ConocoPhillips (it's free!)

ConocoPhillips is projected to achieve $57.6 billion in revenue and $10.4 billion in earnings by 2028. This outlook assumes a −1.0% annual revenue decline and a $1.2 billion increase in earnings from the current level of $9.2 billion.

Uncover how ConocoPhillips' forecasts yield a $112.91 fair value, a 30% upside to its current price.

Exploring Other Perspectives

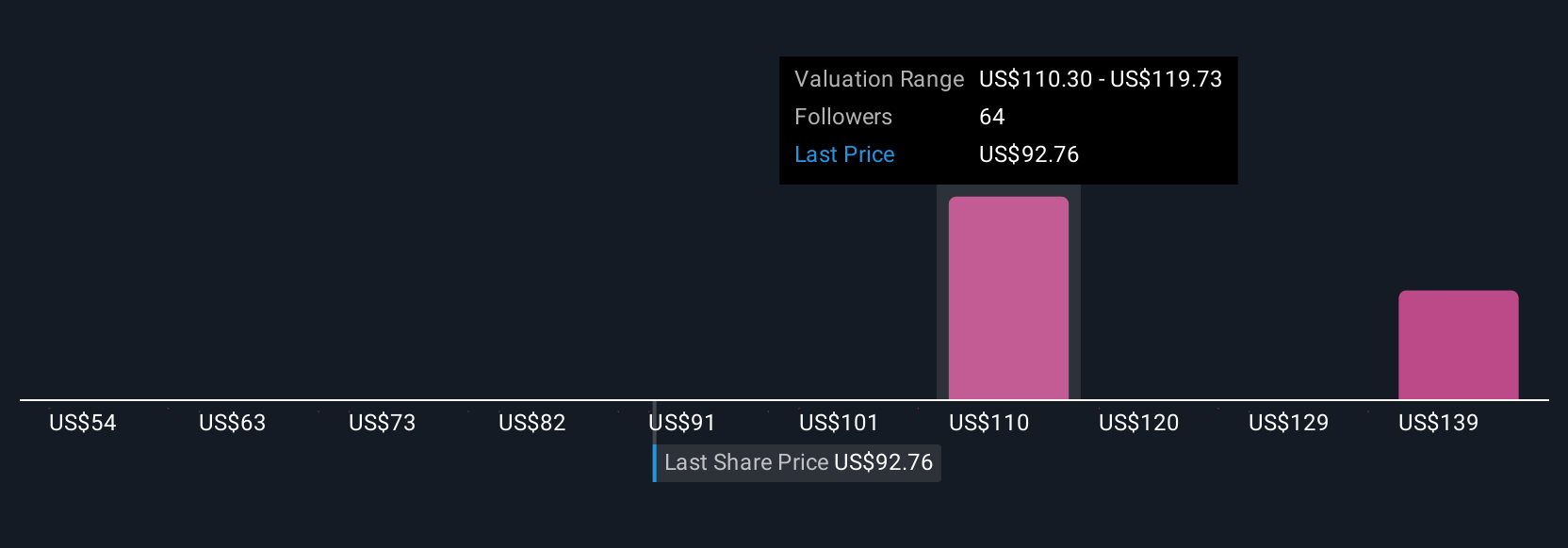

Five members of the Simply Wall St Community estimate ConocoPhillips’ fair value between US$110 and US$210 per share, showing a wide range of expectations. With execution risk high on multi-billion dollar projects like Willow, these diverging opinions reflect how your outlook on cost control and earnings potential can shape your approach to the stock.

Explore 5 other fair value estimates on ConocoPhillips - why the stock might be worth just $110.00!

Build Your Own ConocoPhillips Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ConocoPhillips research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ConocoPhillips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ConocoPhillips' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success