- United States

- /

- Oil and Gas

- /

- NYSE:COP

How Investors Are Reacting To ConocoPhillips (COP) Beating Q2 Guidance and Accelerating Marathon Oil Synergies

Reviewed by Simply Wall St

- ConocoPhillips reported strong second quarter 2025 results, surpassing production guidance, finalizing the Marathon Oil integration, realizing over US$1 billion in synergies, and raising its asset sales target to US$5 billion by 2026.

- This combination of robust operational execution, accelerated non-core asset sales, and successful merger integration positions the company for improved cash flow and shareholder returns despite broader macroeconomic pressures.

- Let's explore how these developments, particularly the early achievement of cost synergies, reshape ConocoPhillips's current investment narrative and future outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

ConocoPhillips Investment Narrative Recap

For investors considering ConocoPhillips, the central belief is in the company’s ability to drive long-term value through operational efficiency, disciplined capital allocation, and continued portfolio optimization, even as oil prices and geopolitical risks remain unpredictable. The recent beat on production guidance, rapid Marathon Oil integration, and realization of over US$1 billion in synergies reinforces confidence around the biggest near-term catalyst: achieving meaningful cost reductions from the merger. However, the main risk, commodity price volatility, remains largely unchanged, as lower realized prices continue to pressure near-term cash flows; recent news does not materially alter this risk.

Among recent developments, ConocoPhillips’ reaffirmed full-year production guidance, despite ongoing asset sales and integration activities, stands out as especially relevant. This consistency signals to shareholders that the company is maintaining operational momentum through its transformation, supporting the narrative that execution on volume and efficiency catalysts is on track, even as external uncertainties persist.

But on the flip side, with oil prices still unpredictable and margins under pressure, investors should pay close attention to...

Read the full narrative on ConocoPhillips (it's free!)

ConocoPhillips is projected to reach $62.1 billion in revenue and $10.2 billion in earnings by 2028. This outlook is based on analysts' assumptions of a 1.6% annual revenue growth rate and a $0.7 billion increase in earnings from the current level of $9.5 billion.

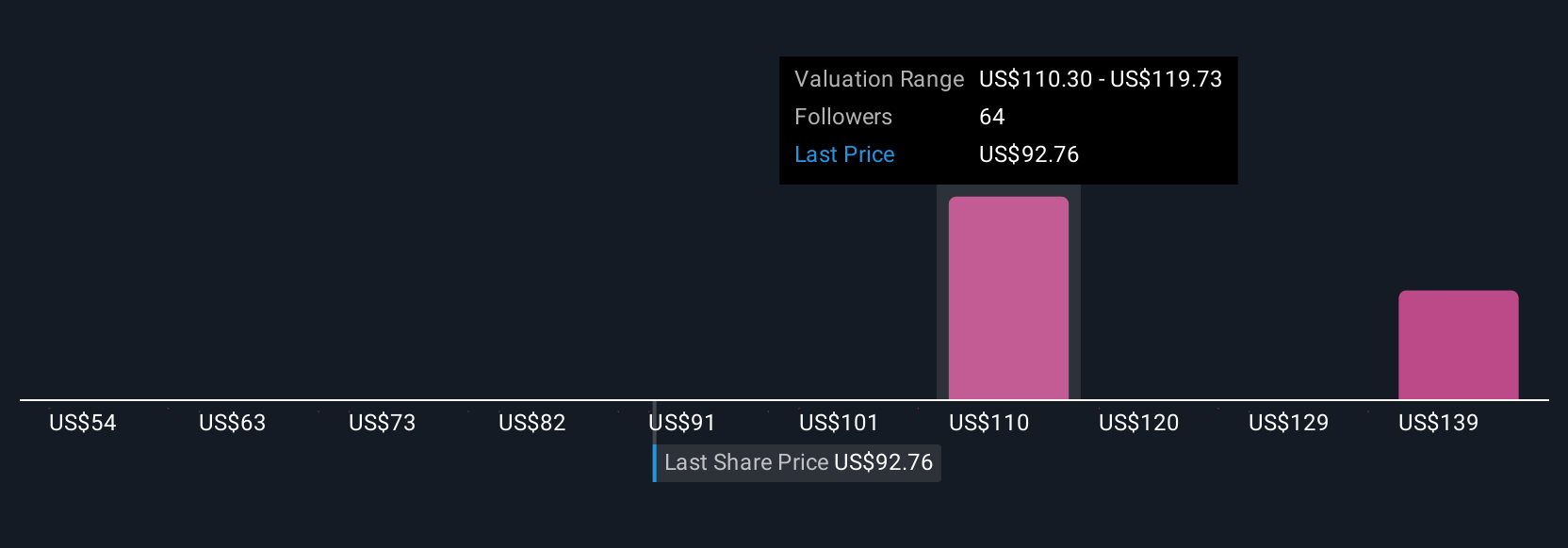

Uncover how ConocoPhillips' forecasts yield a $116.74 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span US$53.72 to US$193.64 per share. While some see substantial upside, the ongoing risk from commodity price volatility means your outlook may shift as energy markets change.

Explore 5 other fair value estimates on ConocoPhillips - why the stock might be worth over 2x more than the current price!

Build Your Own ConocoPhillips Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ConocoPhillips research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ConocoPhillips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ConocoPhillips' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives