- United States

- /

- Oil and Gas

- /

- NYSE:COP

Could ConocoPhillips' (COP) Anadarko Sale Reveal a New Direction for Growth Investments?

Reviewed by Simply Wall St

- In July 2025, ConocoPhillips entered advanced discussions to sell its Oklahoma assets in the Anadarko basin, covering 300,000 net acres and producing 39,000 barrels of oil equivalent per day, to Stone Ridge Energy for around US$1.3 billion, though no final agreement has been reached.

- This potential divestment follows ConocoPhillips' Marathon Oil acquisition, illustrating the company's focus on optimizing its portfolio and raising capital for major LNG growth initiatives.

- We will explore how asset sales, such as the possible Anadarko basin divestment, could influence ConocoPhillips' future project funding and investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ConocoPhillips Investment Narrative Recap

The ConocoPhillips investment story is centered on portfolio optimization, capital discipline, and exposure to global LNG growth. The recent discussions over the US$1.3 billion Anadarko basin asset sale highlight efforts to streamline the business and free up capital after acquiring Marathon Oil. This news may not significantly alter the main near-term catalyst: successful integration of Marathon Oil’s assets, while commodity price volatility remains the most immediate risk to ConocoPhillips's cash flows and earnings.

Among recent announcements, ConocoPhillips confirmed its commitment to returning US$10 billion to shareholders in 2025 through dividends and buybacks. This shareholder return plan is especially relevant as asset sales like the Anadarko deal can provide additional capital to support these payouts and help maintain financial strength during periods of price swings.

However, even if capital is raised as planned, investors should consider the possibility of...

Read the full narrative on ConocoPhillips (it's free!)

ConocoPhillips is projected to reach $61.7 billion in revenue and $10.4 billion in earnings by 2028. This scenario assumes annual revenue growth of 1.5% and a $0.9 billion increase in earnings from the current $9.5 billion.

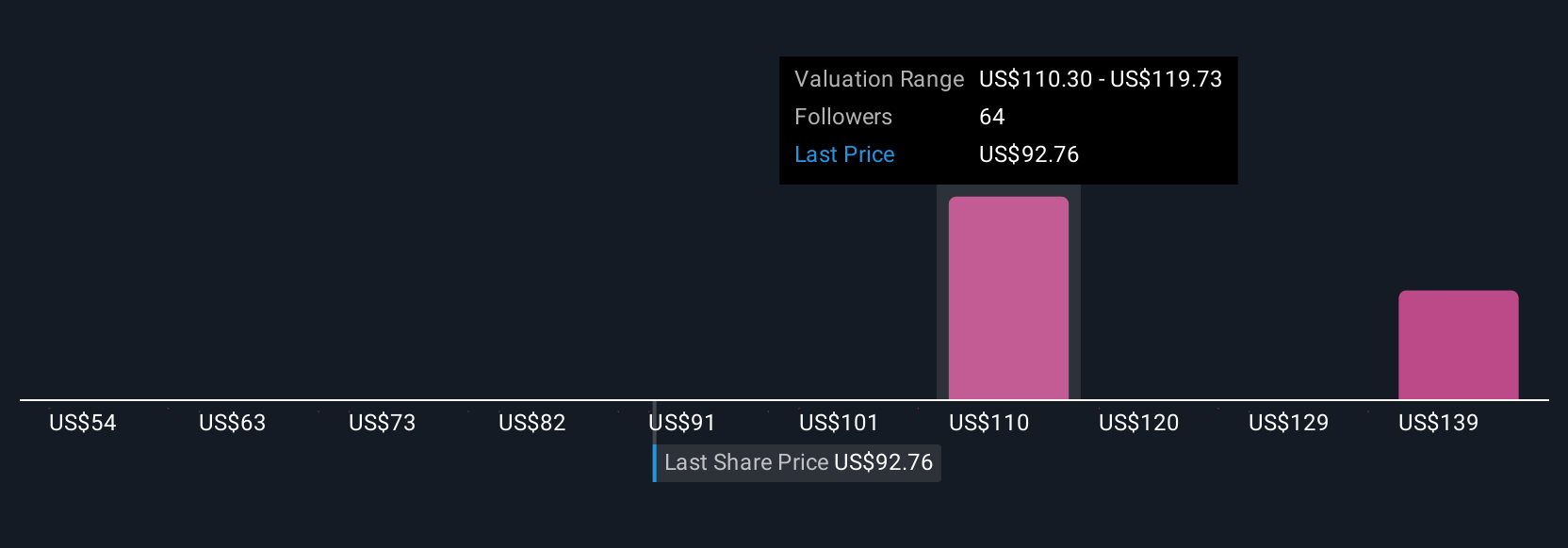

Uncover how ConocoPhillips' forecasts yield a $117.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate ConocoPhillips’s fair value between US$53.72 and US$147.82 across 5 perspectives. While these views differ widely, integration of Marathon Oil’s assets is a recurring theme influencing sentiment and expectations for future performance.

Explore 5 other fair value estimates on ConocoPhillips - why the stock might be worth 45% less than the current price!

Build Your Own ConocoPhillips Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ConocoPhillips research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ConocoPhillips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ConocoPhillips' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives