- United States

- /

- Oil and Gas

- /

- NYSE:CNX

Earnings Working Against CNX Resources Corporation's (NYSE:CNX) Share Price

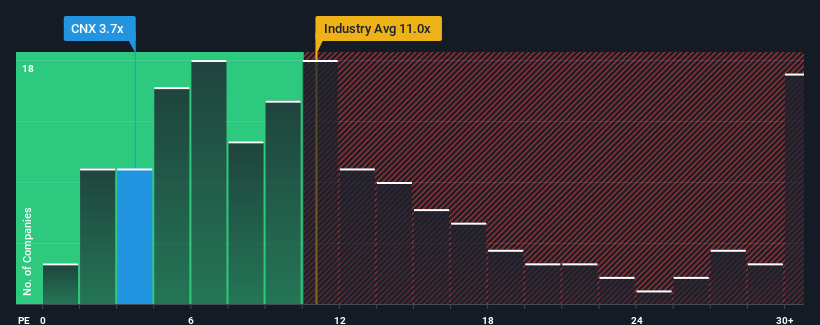

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider CNX Resources Corporation (NYSE:CNX) as a highly attractive investment with its 3.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

CNX Resources has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for CNX Resources

How Is CNX Resources' Growth Trending?

In order to justify its P/E ratio, CNX Resources would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 27% each year over the next three years. That's not great when the rest of the market is expected to grow by 10% each year.

With this information, we are not surprised that CNX Resources is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From CNX Resources' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that CNX Resources maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for CNX Resources (1 is a bit unpleasant) you should be aware of.

If these risks are making you reconsider your opinion on CNX Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives