- CNX is well-positioned to benefit from the natural gas reclassification

- The company has an attractive value relative to its peers

- A strong buyback campaign should offer support if needed

With growing geopolitical tension, and the recent reclassification of natural gas as a green energy source, midstream companies have been taking the spotlight on the energy market. For that reason, we'll look into CNX Resources Corporation ( NYSE:CNX ), a company that has a strong growth perspective in that sector.

CNX Company Profile

CNX Resources Corporation is an independent natural gas and midstream company, operating primarily in the Appalachian Basin. The company designs, builds, and operates natural gas gathering systems, operating about 2,600 miles of pipelines as well as natural gas processing facilities – but it is not a pure midstream play. It owns rights to extract natural gas in several states, including lucrative locations like Utica Shale and Marcellus Shale. These fields, dubbed Saudia Arabia of natural gas, are considered among the richest in the world.

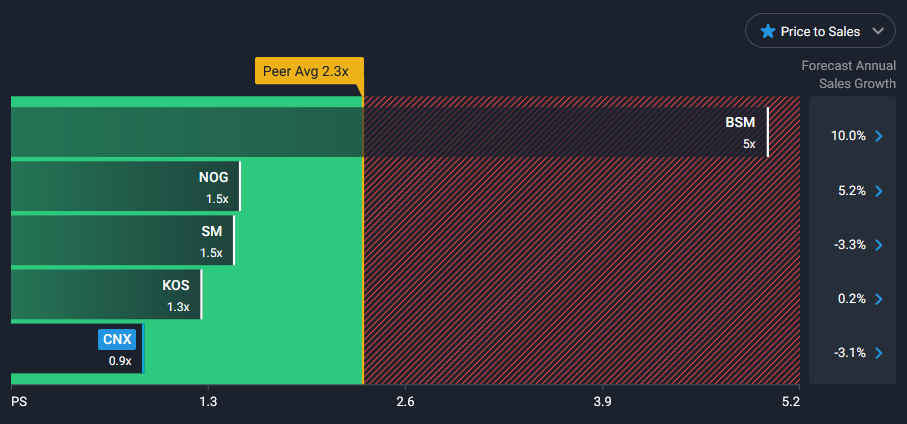

CNX Value vs. Peers

Compared to its peers, CNX has a favorable P/S ratio (0.9x vs 2.3x average) and P/B ratio (1.3x vs 5.5x average), and a forward P/E ratio of 5.9.

With shares trading around $17 and roughly $4 per share in free cash flow in 2022, at a shares float of 185.5m, this gives roughly $740m in free cash flow. Since the management prefers share buybacks to dividends (repurchased 18.7 million shares in 2021), we can expect substantial repurchases in the future (likely over 15% of the float per year).

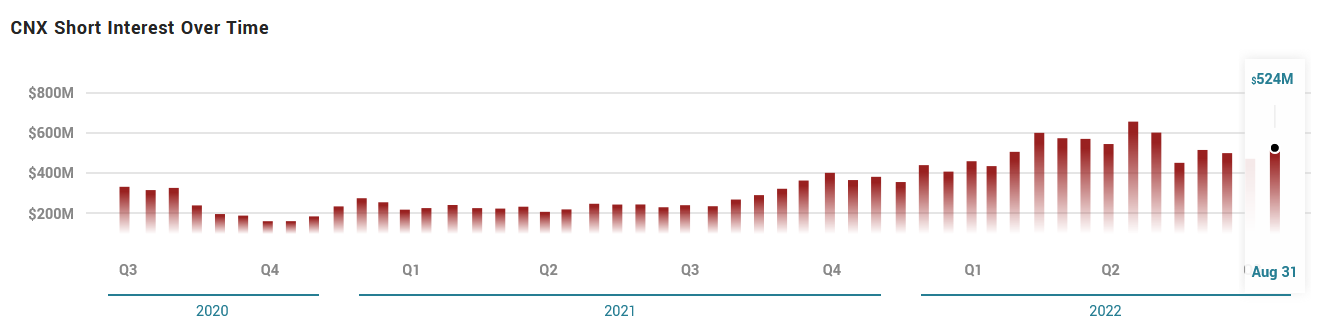

CNX has a High Short Interest

Short interest remains rather high at over 15%.

With 9 days to cover given the average volume, this increases the probability of a short squeeze in case of a positive news catalyst.

CNX has Quality Earnings

In equity analysis, it is important to measure how well a company converts reported profits into free cash flow (FCF). A key ratio that measures it is called the accrual ratio using the following formula:

Accrual Ratio = (Net Income – Free Cash Flow) / Total Assets

During the 1990s, professor Richard Sloan documented the "accrual anomaly“, suggesting that companies with small or negative accruals vastly outperform those of companies with large ones.

Thus, we're pleased to see that CNX Resources had a negative accrual ratio (-0.30) for the first half of 2022. Despite the negative profits in the last year, it reported an FCF of US$523m. If you're interested in further analyst forecasts, you can check that by clicking here. You could get a better understanding of CNX Resources' growth by checking out this more detailed historical graph of earnings, revenue, and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives