- United States

- /

- Oil and Gas

- /

- NYSE:CNR

Does CNR's Mix of Buybacks and New Dividend Point to Shifting Capital Priorities?

Reviewed by Sasha Jovanovic

- Earlier this month, Core Natural Resources reported third-quarter earnings and a new sales guidance, announced a US$0.10 per share quarterly dividend, and provided an update on its buyback program, while State Street Corp increased its ownership by nearly 270,000 shares.

- Despite higher year-over-year sales, the company's quarterly net income and earnings per share declined significantly, but continued capital management efforts and growing institutional investment contributed to heightened market attention.

- We’ll explore how the combination of rising institutional ownership and recent earnings developments influences Core Natural Resources' investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Core Natural Resources Investment Narrative Recap

To be a shareholder in Core Natural Resources right now, you need conviction in the ongoing demand for coal, especially driven by industrial and power needs in both established and emerging markets. The latest earnings results, despite stronger sales, did not materially shift short-term catalysts nor dramatically impact the fundamental risk around the company’s dependence on export markets and the long-term transition away from fossil fuels.

Among recent announcements, the updated sales guidance stands out as most relevant. Management now expects 2025 sales volumes between 83.4 million and 87.8 million tons, reflecting steady demand, which ties directly to the company’s near-term ability to offset earnings volatility and reinforce confidence in its ability to deliver on volume-based market catalysts, even as profitability remains challenged.

In contrast, investors should also be aware of ongoing export market risks and what it could mean for...

Read the full narrative on Core Natural Resources (it's free!)

Core Natural Resources' outlook anticipates $5.1 billion in revenue and $920.4 million in earnings by 2028. Achieving these estimates would require annual revenue growth of 15.9% and an increase in earnings of about $899.8 million from the current $20.6 million.

Uncover how Core Natural Resources' forecasts yield a $113.62 fair value, a 46% upside to its current price.

Exploring Other Perspectives

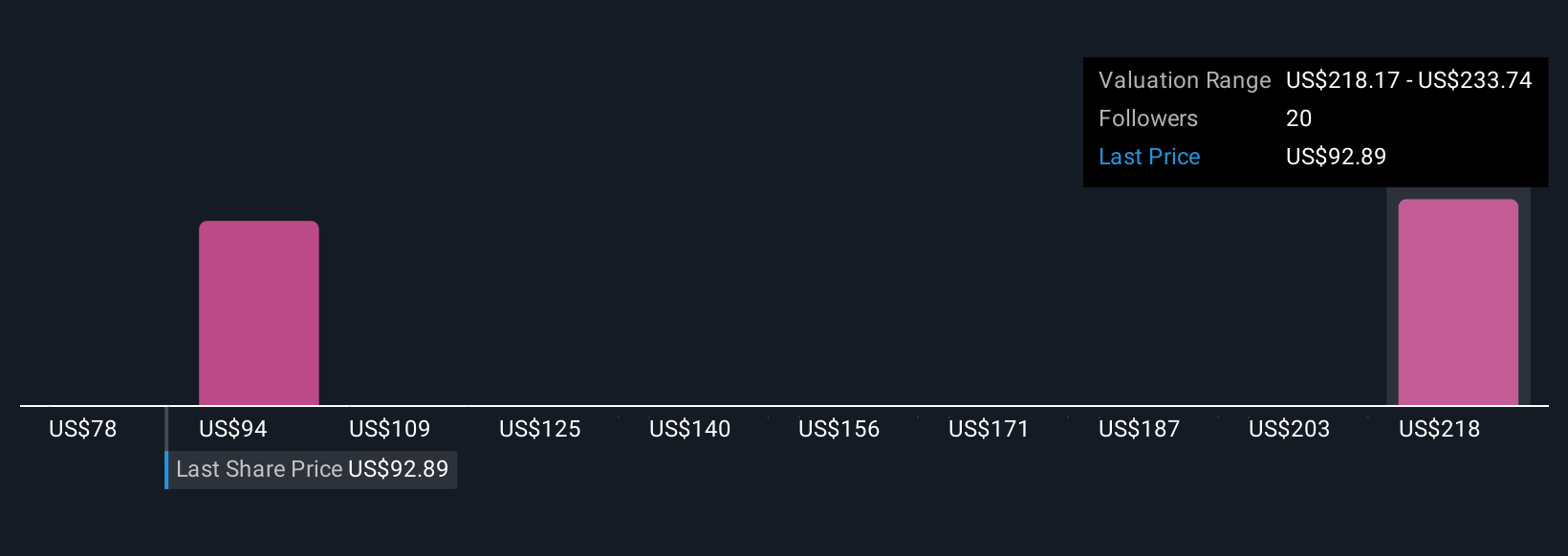

Three recent fair value estimates from the Simply Wall St Community range widely from US$110 to US$284.89 per share. As you assess these viewpoints, keep the company’s sensitivity to export market volatility and regulatory change firmly in mind.

Explore 3 other fair value estimates on Core Natural Resources - why the stock might be worth just $110.00!

Build Your Own Core Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core Natural Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Core Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core Natural Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNR

Core Natural Resources

Produces, sells, and exports metallurgical and thermal coals in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives