- United States

- /

- Oil and Gas

- /

- NYSE:BTU

Could Peabody Energy’s (BTU) New Governance Rules Reveal a Shift in Boardroom Priorities?

Reviewed by Sasha Jovanovic

- On October 14, 2025, Peabody Energy’s Board of Directors implemented changes to the company’s bylaws, enhancing director nomination procedures, stockholder meeting organization, and disclosure requirements, while adding a severability clause.

- These largely procedural amendments reflect an ongoing effort to strengthen Peabody Energy’s corporate governance framework rather than signaling any shifts in operational strategy or business fundamentals.

- Now, we’ll examine how investor activity ahead of Peabody's earnings release, combined with updated governance procedures, informs its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Peabody Energy Investment Narrative Recap

Peabody Energy’s investment case rests on the outlook for global and U.S. coal demand, its ability to manage regulatory and environmental pressures, and continued policy support for domestic production. The recent bylaw changes are procedural and unlikely to influence the upcoming earnings release, which remains the major catalyst. The biggest risk continues to be the threat posed by decarbonization efforts and regulatory changes, which could impact long-term revenues much more than near-term governance tweaks.

Among recent announcements, Peabody’s decision to maintain its quarterly dividend at US$0.075 per share stands out, underlining the company’s focus on capital returns amid recent financial volatility. This dividend action may appeal to investors who view stable payouts favorably, though it should be weighed in the context of earnings variability and policy risks that could affect profitability and distributions over time.

However, investors should also be mindful of how tightening regulations and long-term decarbonization policies could...

Read the full narrative on Peabody Energy (it's free!)

Peabody Energy's narrative projects $4.9 billion in revenue and $468.2 million in earnings by 2028. This requires 6.4% yearly revenue growth and a $327.3 million increase in earnings from $140.9 million today.

Uncover how Peabody Energy's forecasts yield a $32.45 fair value, a 12% upside to its current price.

Exploring Other Perspectives

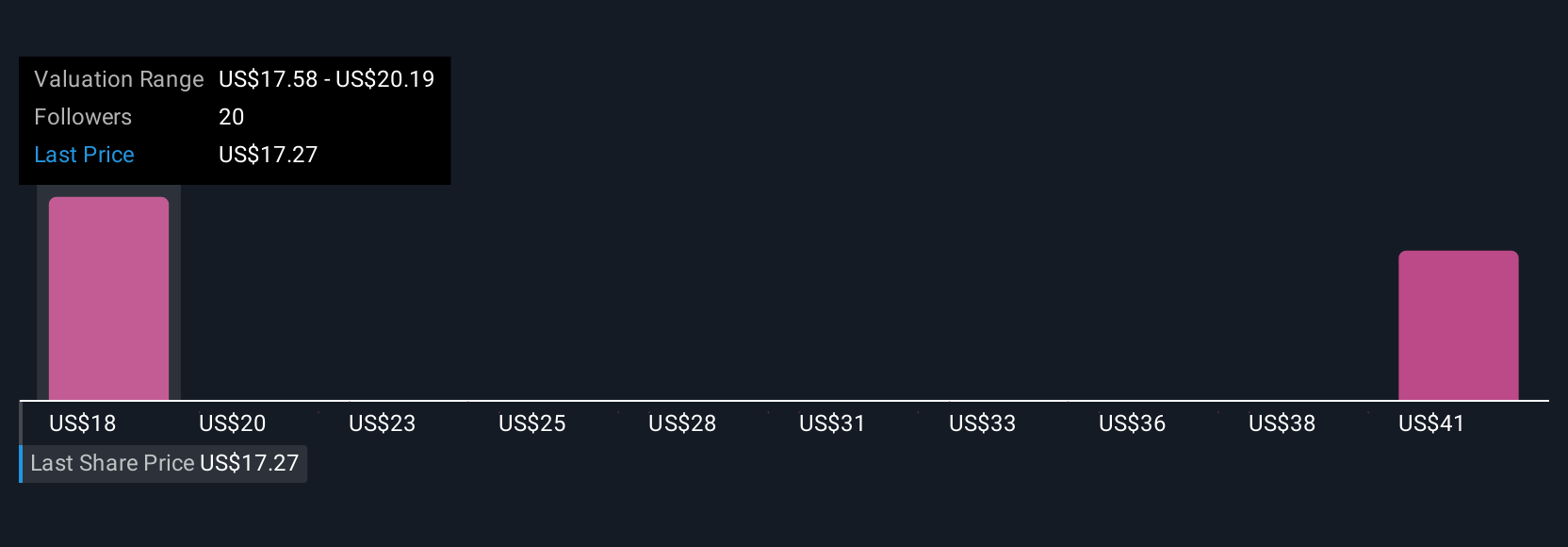

Five community estimates value Peabody between US$24 and US$45.61 per share, revealing a wide range of outlooks. While many see upside, tightening environmental regulations remain a factor that could reshape the company’s future and are worth considering as you review these diverse viewpoints.

Explore 5 other fair value estimates on Peabody Energy - why the stock might be worth 17% less than the current price!

Build Your Own Peabody Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peabody Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Peabody Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peabody Energy's overall financial health at a glance.

No Opportunity In Peabody Energy?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BTU

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives