- United States

- /

- Oil and Gas

- /

- NYSE:BSM

Assessing Black Stone Minerals’s Valuation Following Executive Succession Plan and Steady Q3 Performance

Reviewed by Simply Wall St

Black Stone Minerals (BSM) has revealed a sweeping leadership succession plan set for January 2026, introducing new executive and board appointments. These changes came as the company reported steady Q3 revenue and net income year-over-year.

See our latest analysis for Black Stone Minerals.

The leadership shake-up and stable earnings appear to be stirring fresh interest in Black Stone Minerals, with the share price rebounding 6.4% over the past month after a tough start to the year. Looking further out, total shareholder return is essentially flat for one and three years. However, the five-year total return remains impressive at more than 200%, hinting at long-term rewards even as short-term sentiment fluctuates.

If the recent changes at Black Stone have you thinking about what else is out there, now's a great time to broaden your search and discover fast growing stocks with high insider ownership

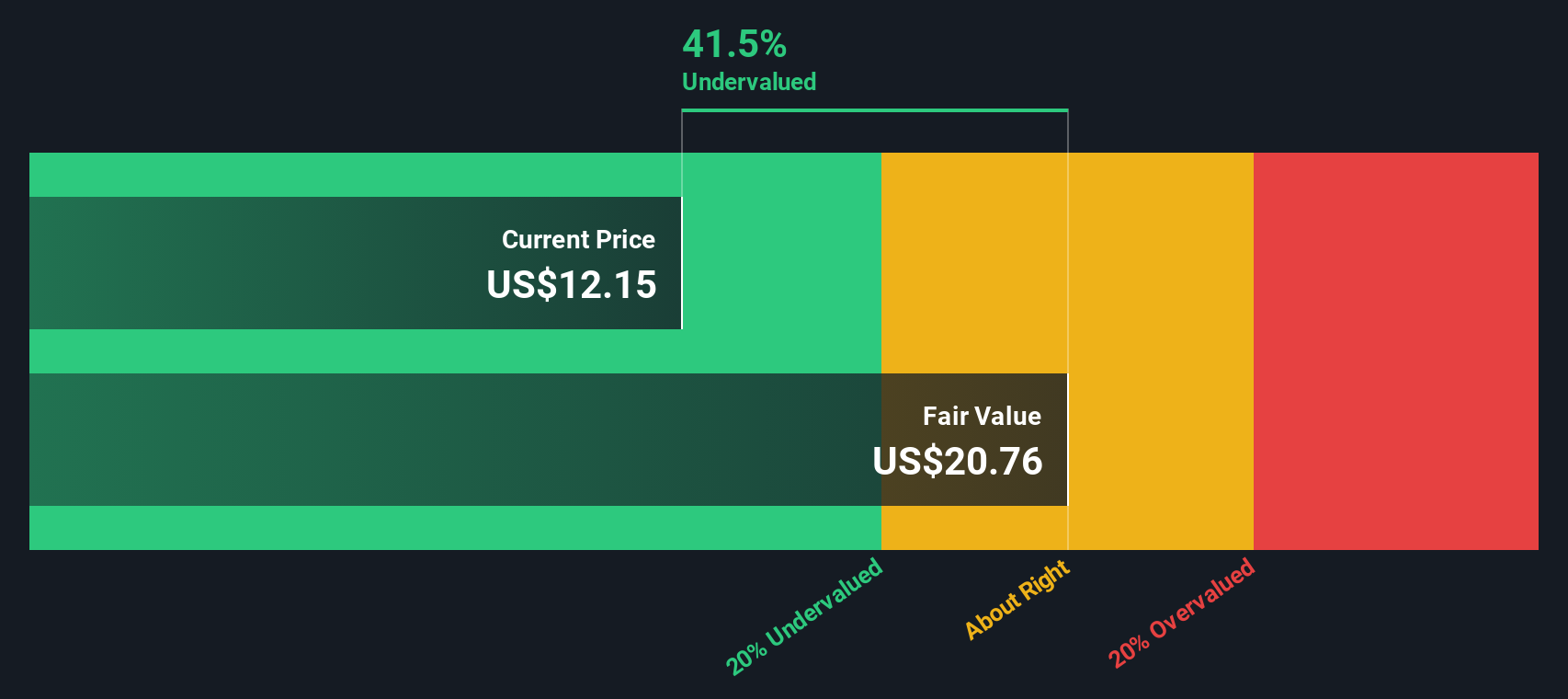

With management changes underway and consistent earnings growth, is Black Stone Minerals trading below its true value, or have investors already priced in the company’s upcoming transformation and future growth prospects?

Most Popular Narrative: 3.8% Overvalued

With the most popular narrative putting fair value at $13.00, just below the recent close of $13.50, the latest outlook suggests investors are weighing modest upside against current risks. This razor-thin valuation margin sets the stage for a closer look at the underlying drivers behind analyst thinking.

The expansion of the Shelby Trough and new development agreements (notably with Revenant) are expected to more than double drilling obligations over the next five years. This should drive significant growth in natural gas volumes as global LNG demand rises, positively impacting future revenues and distributable cash flows.

Want to see what’s powering this tight pricing call? The narrative includes ambitious operational milestones, future cash flow leaps, and a bold industry outlook. The financial forecast behind this price point might surprise you. Unlock the full rationale to discover what numbers and strategic moves keep this target in play.

Result: Fair Value of $13.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected production in key regions and ongoing reliance on third-party operators could undermine these optimistic long-term forecasts.

Find out about the key risks to this Black Stone Minerals narrative.

Another View: DCF Suggests Value Overlooked?

While market multiples put Black Stone Minerals near fair value, our SWS DCF model tells a different story. DCF analysis estimates the company is trading at an impressive 63% discount to its calculated fair value. This hints at possible upside that current market sentiment might be missing.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Black Stone Minerals Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to shape your own perspective, so why not Do it your way

A great starting point for your Black Stone Minerals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big opportunity slip past you. Equip yourself with fresh investing angles and spot tomorrow’s winners using these tailored screeners today.

- Capitalize on stocks trading below their cash flow value by tapping into these 865 undervalued stocks based on cash flows. Get ahead of the crowd hunting for bargains.

- Catch the momentum of technology shifts and be among the first to pinpoint future trends by scanning these 24 AI penny stocks with AI potential.

- Secure a stream of passive income when you browse these 16 dividend stocks with yields > 3% featuring companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSM

Black Stone Minerals

Owns and manages oil and natural gas mineral interests.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives