- United States

- /

- Energy Services

- /

- NYSE:AROC

Archrock (AROC): Evaluating Valuation After Strong Q3 Results, Upgraded Guidance, and Expanded Buyback

Reviewed by Simply Wall St

Archrock (AROC) just posted a surge in third-quarter revenue and profit, raised its earnings outlook for the year, and expanded its share buyback authorization. These moves are catching investors’ eyes for several reasons.

See our latest analysis for Archrock.

Archrock’s string of upbeat announcements this quarter, including upgraded earnings guidance, higher dividends, and additional share buybacks, has supported the momentum behind its stock. The latest share price sits at $25.41, and while short-term price movement has been mixed, the company’s total shareholder return over the past year is up 31%, with an impressive 262% over three years. Momentum from operational gains and investor optimism is clearly building, rewarding both recent and longtime shareholders.

If you’re interested in uncovering opportunities beyond energy infrastructure, now is a good moment to broaden your search and discover fast growing stocks with high insider ownership

The company’s recent string of upgrades and positive analyst sentiment has fueled strong momentum. However, with the stock already up 31% this year, investors have to ask whether there is still room to buy, or if future growth is already priced in.

Most Popular Narrative: 17.7% Undervalued

With Archrock closing at $25.41 and the narrative’s fair value set at $30.89, there is a significant gap that has analysts optimistic. That gap arises from bold expectations on growth, contracts, and the U.S. energy infrastructure boom.

Sustained investments in domestic energy production and infrastructure, bolstered by energy security priorities and manufacturing onshoring, are generating broad-based demand across major shale basins. This enables Archrock to expand geographically and diversify its customer base, reducing revenue volatility and supporting stable earnings.

Want to uncover the story behind this aggressive fair value? Growth assumptions, margin gains, and a shift in contract lengths quietly drive this bold estimate. The full narrative dives into projections that could surprise even seasoned investors.

Result: Fair Value of $30.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Archrock’s growth depends heavily on U.S. natural gas demand, and limited diversification makes it vulnerable if energy regulations or market conditions shift.

Find out about the key risks to this Archrock narrative.

Another View: What Do Earnings Ratios Tell Us?

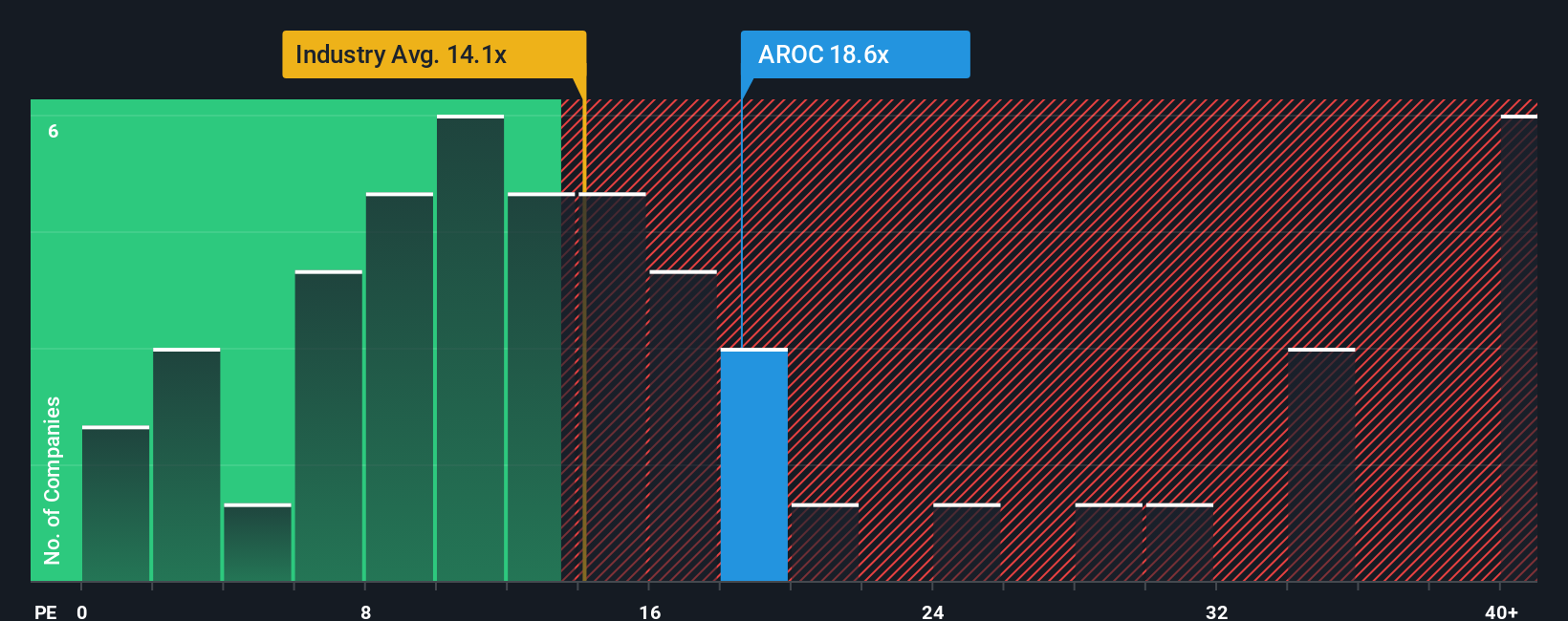

While the consensus valuation expects more upside, a look at Archrock’s current earnings ratio offers a reality check. Its 17x earnings ratio is nearly identical to its fair ratio of 16.6x. However, it is higher than the U.S. Energy Services industry average of 16.5x. This narrows the margin of safety and indicates the market might already recognize much of the growth story. Does this mean upside is limited, or could a re-rating still lie ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Archrock Narrative

Feel like taking a different view or testing your own ideas? It only takes a few minutes to build a narrative using your own insights. Do it your way

A great starting point for your Archrock research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

The stock market offers a wide range of opportunities beyond what you’ve seen here. Savvy investors frequently branch out, using our unique screeners to identify tomorrow's standouts before others. Give yourself an edge and don’t let these insights pass you by.

- Tap into rapid innovation and shape your portfolio with AI-powered companies when you check out these 26 AI penny stocks.

- Unlock market-beating yields and dependable income streams by starting with these 24 dividend stocks with yields > 3%.

- Follow major advances in digital assets and blockchain technology when you access these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AROC

Archrock

Operates as an energy infrastructure company in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion