- United States

- /

- Oil and Gas

- /

- NYSE:AR

How Investors May Respond To Antero Resources (AR) Analyst Optimism and Enhanced Gas Price Risk Management

Reviewed by Sasha Jovanovic

- In the past week, Antero Resources attracted considerable attention from analysts, with recent Buy and Hold ratings coinciding with risk management developments and a focus on long-term prospects for the U.S. natural gas market.

- Amid these updates, the company’s efforts to hedge against gas price swings and a continued consensus of analyst optimism reveal shifting expectations in a complex energy sector landscape.

- Let's explore how this renewed analyst focus and commentary on risk management may influence Antero Resources' investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Antero Resources Investment Narrative Recap

To be a shareholder in Antero Resources, you’d likely need conviction in the U.S. natural gas export trend and confidence that recent risk management, such as enhanced hedging, can soften short-term price swings. The recent analyst updates, including new Hold and Buy ratings alongside price target revisions, seem unlikely to significantly move the needle on Antero’s short-term catalyst: growing LNG export demand. The biggest near-term risk, ongoing regional price volatility due to pipeline constraints, remains largely unchanged by these developments.

Among the recent news, Antero’s continued hedging against gas price volatility stands out as the most relevant. By adding additional collars, the company has taken a step to limit downside risk from sharp commodity price moves, an important factor for those watching how pipeline bottlenecks and local oversupply affect near-term performance. This risk management remains closely tied to the outlook for higher realized revenues on export-linked volumes, which is a leading near-term catalyst.

By contrast, one area that investors should not overlook is how pipeline constraints and regional oversupply expose Antero to...

Read the full narrative on Antero Resources (it's free!)

Antero Resources' outlook anticipates $6.1 billion in revenue and $745.2 million in earnings by 2028. This implies a 7.9% annual revenue growth rate and a $266.3 million increase in earnings from the current $478.9 million.

Uncover how Antero Resources' forecasts yield a $43.14 fair value, a 40% upside to its current price.

Exploring Other Perspectives

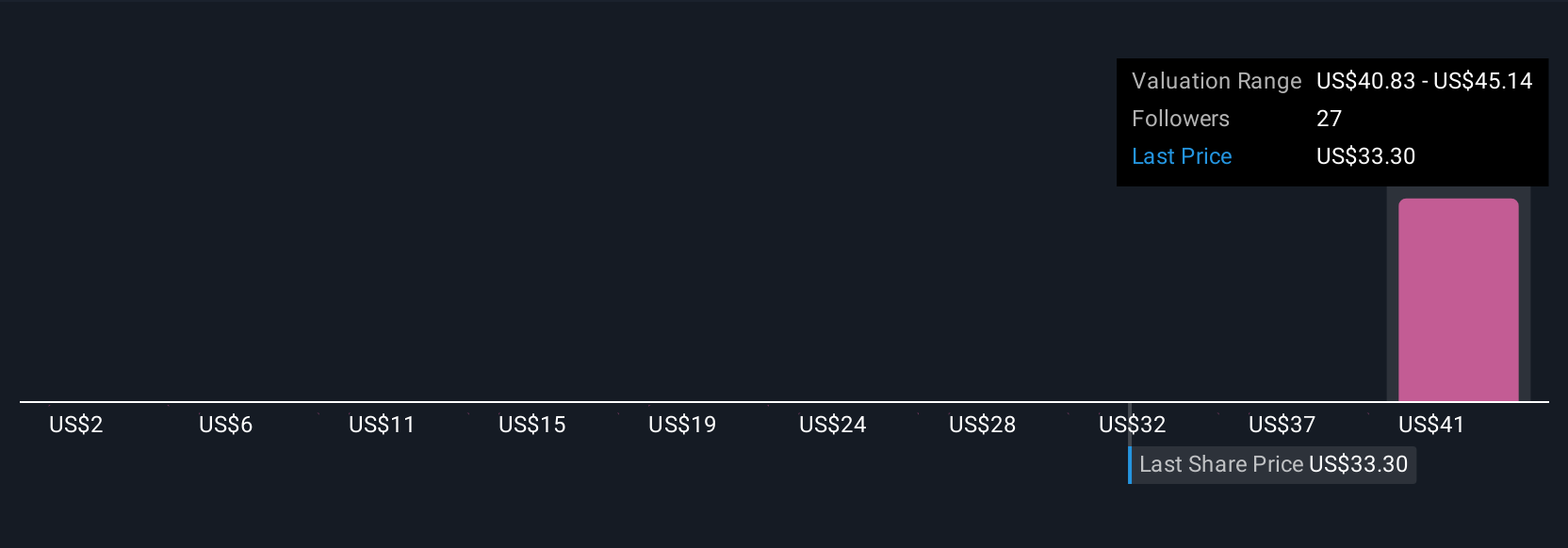

Five fair value estimates from the Simply Wall St Community range from US$2 to US$43.14 per share. Shifting expectations around export-linked pricing and persistent local price risk keep market views wide open, review several viewpoints before deciding.

Explore 5 other fair value estimates on Antero Resources - why the stock might be worth less than half the current price!

Build Your Own Antero Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Antero Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Antero Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Antero Resources' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AR

Antero Resources

An independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives