- United States

- /

- Oil and Gas

- /

- NYSE:AM

A Fresh Look at Antero Midstream’s Valuation Following Share Buybacks and Dividend Confirmation

Reviewed by Kshitija Bhandaru

Antero Midstream, a U.S.-based energy infrastructure company, has caught investors’ attention after completing another round of share repurchases and reaffirming its quarterly dividend. These moves signal the firm's ongoing focus on shareholder value and financial health.

See our latest analysis for Antero Midstream.

After these shareholder-focused moves, Antero Midstream’s stock has shown solid momentum, as the company has posted a year-to-date share price return of 25% and a remarkable 1-year total shareholder return of 31%. Over longer stretches, returns have been even more impressive, with a 141% total return in three years and nearly 368% over five. Investors are clearly responding to the company’s mix of financial discipline and steady distributions, supporting optimism about its growth prospects and risk profile heading into upcoming results.

If you’re looking for more opportunities with similar momentum, now is a great time to discover fast growing stocks with high insider ownership.

But with such robust returns and shareholder-focused actions, are investors getting in at fair value? Alternatively, could Antero Midstream’s recent momentum mean that future growth is already reflected in the current share price?

Most Popular Narrative: Fairly Valued

At $19.35, the latest close for Antero Midstream is almost perfectly aligned with the most popular narrative's fair value estimate of $18.07. This indicates little room for major mispricing according to analysts tracking the stock. This close alignment suggests that the market is closely following earnings projections and current business developments.

Long-term, exclusive contracts with Antero Resources, combined with over 20 years of high-quality, dedicated natural gas inventory, ensure stable minimum volume commitments. This supports strong earnings visibility and reduces risk for future net margins.

Wondering what powers this tight fair value? The real intrigue lies in the projected profit margins and the magnitude of future earnings growth built into analyst models. Dive in to discover which assumptions could make all the difference for Antero Midstream’s next chapter.

Result: Fair Value of $18.07 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on Antero Resources and evolving energy transition trends could pose challenges for Antero Midstream’s stable earnings and future growth.

Find out about the key risks to this Antero Midstream narrative.

Another View: Discounted Cash Flow Perspective

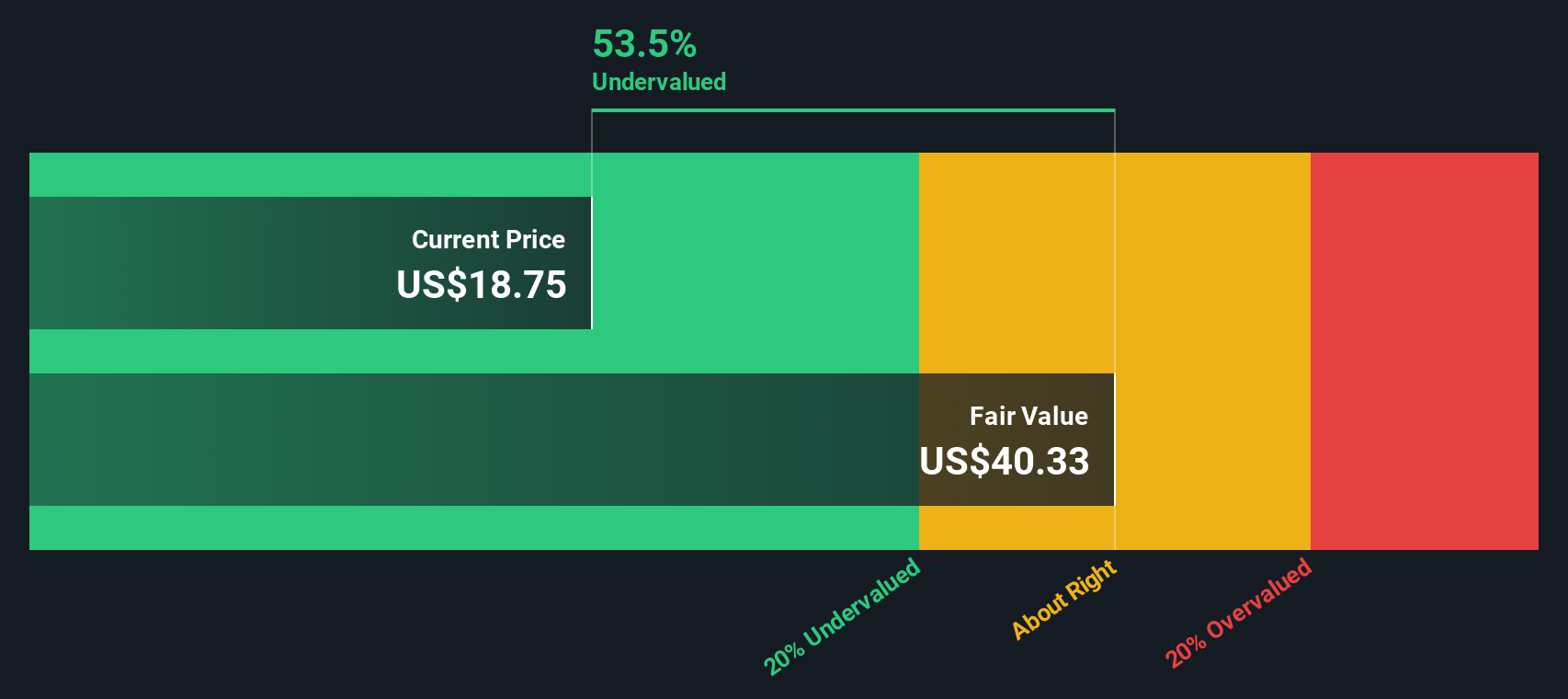

Looking through the SWS DCF model, Antero Midstream appears deeply undervalued, trading at a 54% discount to its estimated fair value of $42.31. This stark difference from the price targets suggested by the analyst consensus raises questions. Could the market be overlooking long-term cash flow strength, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Antero Midstream Narrative

If the consensus view doesn’t quite fit your perspective, you can dive into the numbers and craft your own unique thesis in just minutes. Do it your way.

A great starting point for your Antero Midstream research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next brilliant investment slip by unnoticed. Unlock unique market opportunities by targeting strategies and sectors most investors overlook using these hand-picked screens:

- Spot growth before the crowd by scanning for potential in these 3573 penny stocks with strong financials, where overlooked stocks may be gearing up for breakout moments.

- Ride the future of medicine and innovation by tracking medical breakthroughs within these 32 healthcare AI stocks, featuring companies pioneering healthcare with artificial intelligence.

- Boost your passive income strategy when you target consistent payers through these 19 dividend stocks with yields > 3%, focusing on stocks providing yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AM

Antero Midstream

Owns, operates, and develops midstream energy assets in the Appalachian Basin.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives