- United States

- /

- Energy Services

- /

- NasdaqGS:WFRD

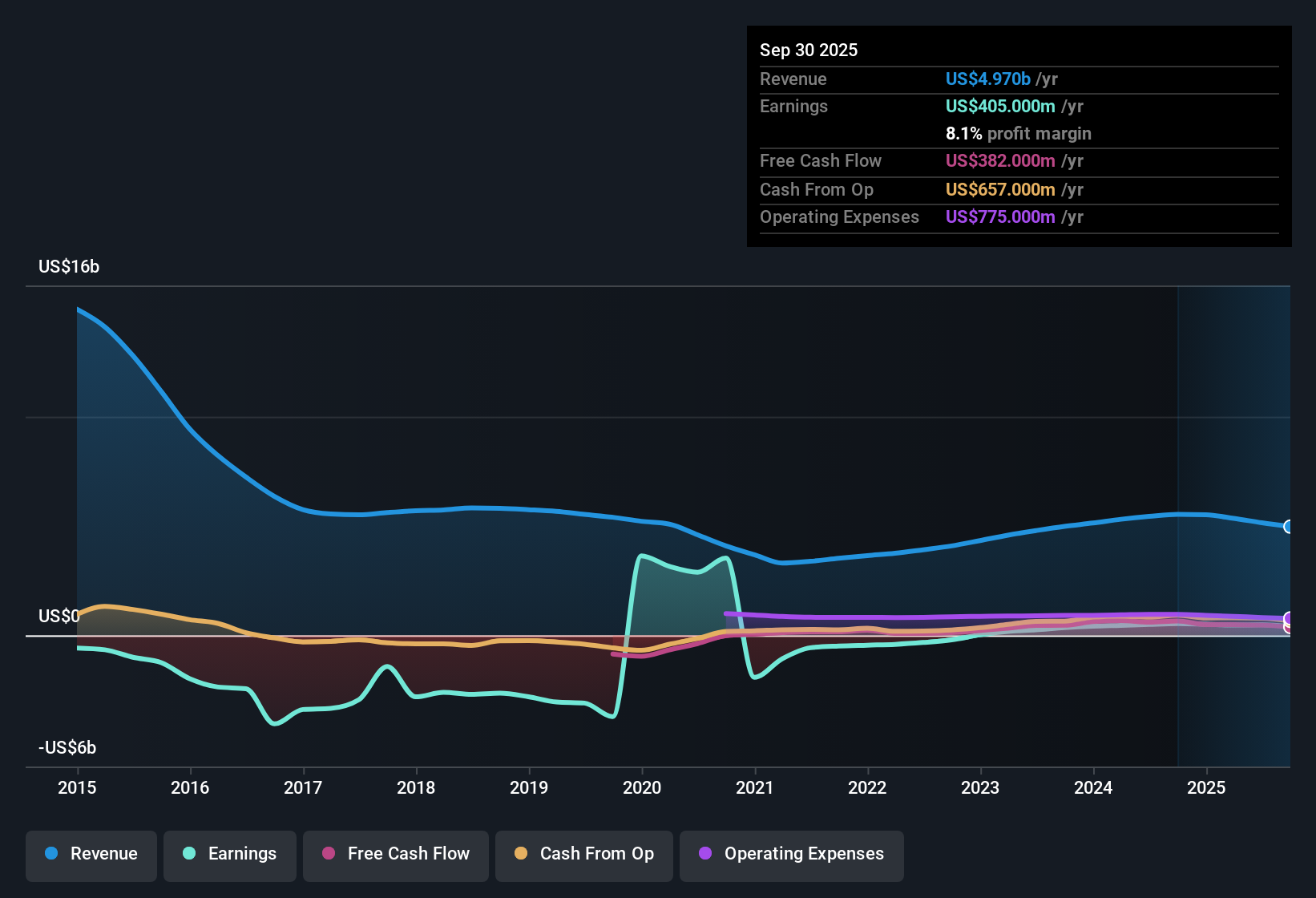

Weatherford (WFRD) Margin Drop to 8.1% Challenges Profitability Recovery Narrative

Reviewed by Simply Wall St

Weatherford International (WFRD) reported that its earnings are forecast to rise 9.05% annually, while revenue growth is expected at 2.6% per year. The net profit margin came in at 8.1%, a step down from last year’s 9.6%. Despite negative earnings growth in the most recent year, the company has achieved a 22.6% annual earnings growth rate over the past five years and is now profitable, with reported earnings classified as high quality. With these results, investors are likely to see Weatherford’s value credentials and growth outlook as placing the shares in a favorable position, especially given its discounted valuation relative to peers and the broader industry.

See our full analysis for Weatherford International.Next up, we will put these headline results head-to-head with some widely followed narratives to see where the numbers support market expectations and where the story takes an unexpected turn.

See what the community is saying about Weatherford International

Margin Expansion Targeted as Profit Mix Shifts

- Analysts expect profit margins to advance from 9.3% now to 10.1% over the next three years, underpinned by Weatherford’s push toward more technology-driven, higher-margin services.

- The analysts' consensus view highlights that advanced technology solutions are positioning Weatherford to capture higher margins as global oilfield projects become more complex.

- Expanding offerings like managed pressure drilling and digitalized project solutions are intended to support long-term earnings resilience.

- Analysts believe this shift, combined with disciplined capital allocation, may yield more stable and attractive returns even if top-line growth remains modest.

- See what’s driving analyst confidence in Weatherford’s strategy in the full consensus narrative. 📊 Read the full Weatherford International Consensus Narrative.

Share Reduction Supports Per-Share Growth

- The company is projected to reduce its share count by 1.12% per year over the next three years, a move set to enhance earnings per share growth despite relatively flat topline performance.

- The analysts' consensus view contends that Weatherford’s strong balance sheet and active capital management, such as buybacks and debt reduction, boost its ability to invest in innovation while delivering shareholder value.

- Disciplined buybacks not only support per-share profitability, but also help offset any weakness in organic revenue growth if market activity remains subdued.

- This strategy is designed to strengthen long-term returns, with consensus seeing capacity for further investment in both core and emerging markets.

Valuation Discount Remains Wide to Peers

- Weatherford’s shares trade at a Price-To-Earnings ratio of 12.5x, considerably below the peer group average of 42.4x and the U.S. Energy Services industry median of 15.3x.

- The analysts' consensus perspective points out that, while market risks persist, Weatherford’s continued profitability turnaround, discounted valuation, and robust risk controls make it an appealing pick for value-focused investors.

- This deep valuation gap means the shares appear attractively priced compared to both the sector and the broader market, especially given the company’s high-quality reported earnings.

- Consensus also notes potential catalysts for rerating if margin expansion and free cash flow improvements materialize as planned.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Weatherford International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot opportunities others might miss? You can quickly shape your own interpretation of Weatherford’s prospects in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Weatherford International.

See What Else Is Out There

While Weatherford is regaining profitability, its revenue growth outlook and profit margins remain subdued compared to industry standards.

If you want consistency through cycles, check out stable growth stocks screener (2089 results) to spot companies with stable revenue and earnings expansion that might better suit your investment approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weatherford International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WFRD

Weatherford International

An energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives