- United States

- /

- Oil and Gas

- /

- NasdaqGS:VNOM

Why Viper Energy (VNOM) Is Down 6.4% After Announcing $8 Billion Shelf Registration And What's Next

Reviewed by Simply Wall St

- On August 26, 2025, Viper Energy, Inc. filed a shelf registration allowing it to offer up to US$8.02 billion in Class A Common Stock, totaling 203,172,011 shares.

- This unusually large registration amount signals potential major capital-raising plans or significant corporate actions, drawing heightened attention across financial circles.

- We’ll explore how this large potential equity issuance could shift the company’s investment narrative and affect future earnings expectations.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Viper Energy Investment Narrative Recap

For shareholders of Viper Energy, the core investment story centers around the company’s ability to leverage its royalty interests in the Permian Basin while capitalizing on long-term U.S. energy trends. The recent shelf registration to potentially issue up to US$8.02 billion in stock is significant but may not change the most immediate short-term catalyst: successful integration of the Sitio Royalties acquisition. The biggest risk right now is still the company’s exposure to third-party operator decisions, which could affect production and cash flows. Among recent company announcements, the revision of production guidance on August 19, 2025, is most relevant to this context. Updated forecast ranges for oil and total production reaffirm management’s emphasis on near-term operational delivery, even as the possibility of major equity issuance looms in the background. Investors must weigh how any large capital raise could interact with these updated targets and impact near-term earnings per share, especially if operational risks materialize. But in contrast, a lesser-known risk that could affect even the best execution is...

Read the full narrative on Viper Energy (it's free!)

Viper Energy's narrative projects $2.3 billion revenue and $293.3 million earnings by 2028. This requires 35.1% yearly revenue growth and a $77.9 million earnings decrease from the current $371.2 million.

Uncover how Viper Energy's forecasts yield a $53.44 fair value, a 43% upside to its current price.

Exploring Other Perspectives

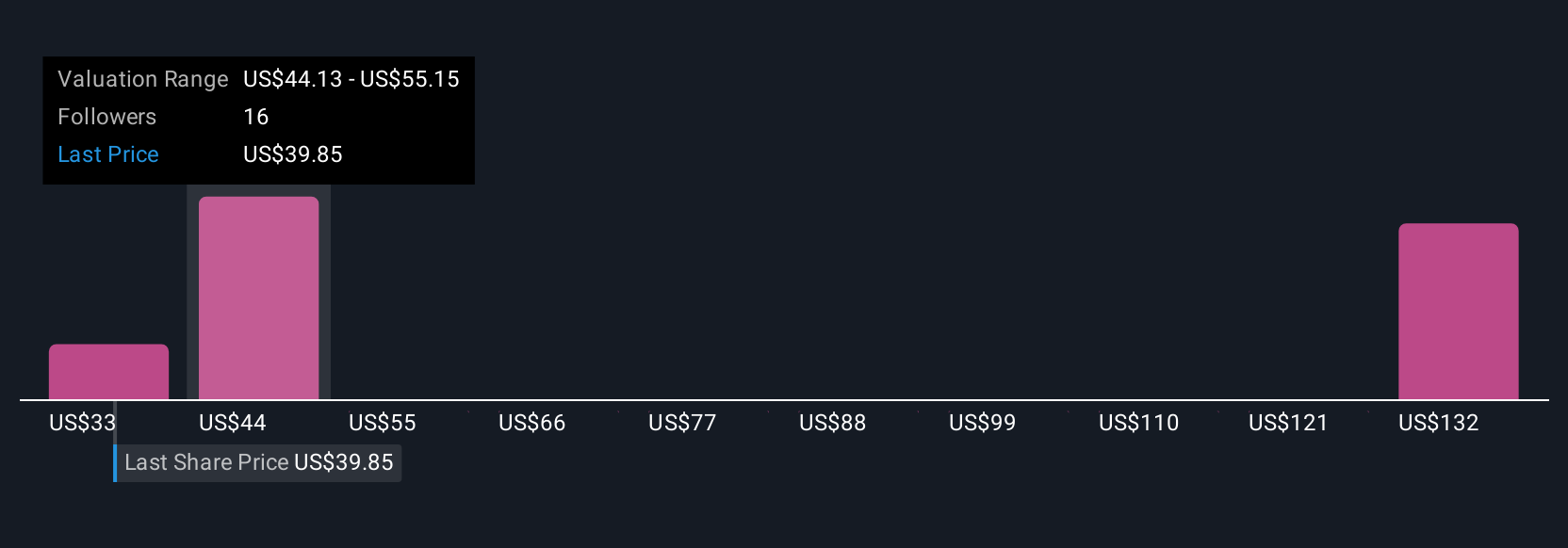

Six private fair value estimates from the Simply Wall St Community range from just US$33.10 to US$140.65 per share. While many anticipate growth, consensus highlights the company’s dependence on third-party operators, so it pays to look at a variety of viewpoints.

Explore 6 other fair value estimates on Viper Energy - why the stock might be worth 11% less than the current price!

Build Your Own Viper Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viper Energy research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Viper Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viper Energy's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNOM

Viper Energy

Owns, acquires, and exploits oil and natural gas properties in North America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives