- United States

- /

- Energy Services

- /

- NasdaqGS:SND

The Smart Sand, Inc. (NASDAQ:SND) Analyst Just Boosted Their Forecasts By A Captivating Amount

Smart Sand, Inc. (NASDAQ:SND) shareholders will have a reason to smile today, with the covering analyst making substantial upgrades to this year's forecasts. The analyst greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Investor sentiment seems to be improving too, with the share price up 4.7% to US$3.59 over the past 7 days. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

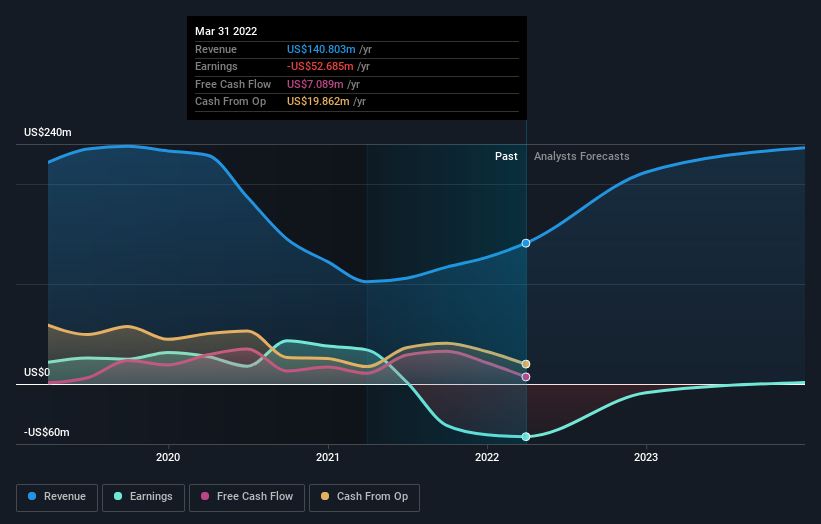

Following the upgrade, the latest consensus from Smart Sand's solo analyst is for revenues of US$212m in 2022, which would reflect a huge 50% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 82% to US$0.21. However, before this estimates update, the consensus had been expecting revenues of US$182m and US$0.32 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analyst making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

View our latest analysis for Smart Sand

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. For example, we noticed that Smart Sand's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 72% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 0.7% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 9.7% annually. So it looks like Smart Sand is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting Smart Sand is moving incrementally towards profitability. Fortunately, the analyst also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. More bullish expectations could be a signal for investors to take a closer look at Smart Sand.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SND

Smart Sand

Provides mine to wellsite proppant supply and logistics solutions to frac sand customers.

Excellent balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives