- United States

- /

- Energy Services

- /

- NasdaqGS:PTEN

Patterson-UTI (PTEN): Shares Trade at Discount as Losses Persist and Revenue Set to Decline 1%

Reviewed by Simply Wall St

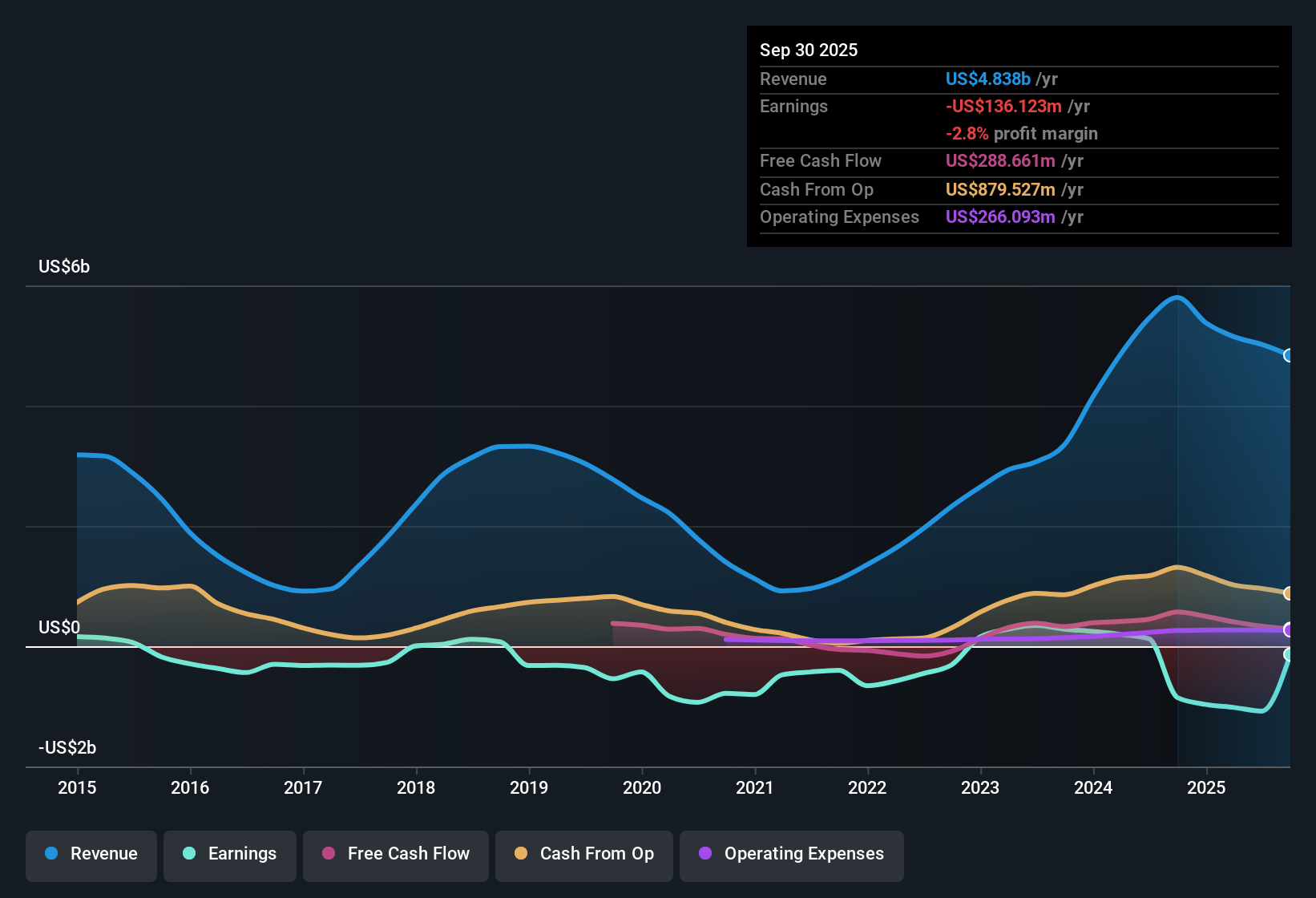

Patterson-UTI Energy (PTEN) remains unprofitable, as revenue is projected to decline at a rate of 1% per year over the next three years. Despite the ongoing losses, the company has managed to reduce its losses over the past five years at an annual rate of 3.7%. Investors will be weighing these persistent profit and revenue challenges against the company’s notable valuation discount versus sector and peer benchmarks. The current focus is on Patterson-UTI's progress in managing losses and questions about future sustainability.

See our full analysis for Patterson-UTI Energy.Now let’s see how Patterson-UTI’s latest numbers stack up against the prevailing market narratives. We will find out where consensus holds and where expectations might get challenged.

See what the community is saying about Patterson-UTI Energy

Automation Drives Margin Upside

- Patterson-UTI's advanced technology offerings, including digital drilling and emissions-reduction systems, enable the company to command premium pricing and aim for structurally higher EBITDA margins, even as sector-wide drilling demand remains mixed.

- Analysts' consensus view points to specialized automation and clean technology as key catalysts for improved profitability in the coming years.

- By focusing on digital solutions like the Cortex automation suite, the company is set to capture higher-margin contracts and reinforce its competitive moat among oilfield service peers.

- Consensus expects these differentiated services to translate into more stable margins, helping offset cyclical softness in broader drilling activity.

Share Decline and Revenue Headwinds

- Revenue is projected to fall by 1% per year through 2026, reflecting continued moderation in drilling activity and persistent volatility in customer spending.

- Analysts' consensus narrative underscores the challenge of declining topline sales given the softness in drilling and completion activity.

- Pressure on revenue growth creates uncertainty about the pace of recovery and raises questions about management’s assumptions for a quick rebound.

- Consensus also highlights risks from high capital spending needs, which could weigh down net margins if commodity prices do not recover.

Trading at a Discount to Peers

- Patterson-UTI shares trade at a notable discount to both the US Energy Services sector and close peer group when measured by price-to-sales ratio. This makes the $6.63 share price particularly attractive compared to sector averages.

- Analysts' consensus view finds this valuation gap compelling but flags lingering risks around persistent unprofitability and dividend sustainability.

- While peers tend to command higher multiples, the company’s discounted price leaves room for upside if profit margins improve and ongoing losses narrow in line with expectations.

- This gap against the sector average could close if management delivers on promises of operational synergy and sustained margin gains from recent acquisitions.

For a balanced perspective on how Patterson-UTI’s valuation and technology roadmap fit into the wider industry narrative, check out the full consensus analysis.📊 Read the full Patterson-UTI Energy Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Patterson-UTI Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Put your perspective into action and craft your personal narrative in just a few minutes. Do it your way

A great starting point for your Patterson-UTI Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Patterson-UTI faces ongoing losses, shrinking topline sales, and lingering risks to dividend sustainability as revenue and profit remain under pressure.

If you want steadier performers, use our stable growth stocks screener (2098 results) to discover companies demonstrating reliable growth and consistent earnings, even when market conditions turn challenging.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTEN

Patterson-UTI Energy

Through its subsidiaries, provides drilling and completion services to oil and natural gas exploration and production companies in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives