- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAGP

How Investors Are Reacting To Plains GP Holdings (PAGP) After Upward Earnings Estimate Revisions and Growth Forecasts

Reviewed by Simply Wall St

- Recent news highlighted Plains GP Holdings as a value stock, with analyst earnings estimates revised upward and expectations for very large year-over-year earnings growth in 2025.

- This recognition is drawing attention to Plains GP Holdings' valuation and growth prospects, especially given the focus on its EV-to-EBITDA ratio as a key metric.

- We'll examine how the significant upward revision to earnings forecasts could impact Plains GP Holdings' broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Plains GP Holdings Investment Narrative Recap

To be a shareholder in Plains GP Holdings, you need to believe in the potential for continued cash flow generation from its core crude oil midstream business, despite secular headwinds from the global energy transition and recent revenue declines. While the news of sharply higher earnings estimates and rapid expected profit growth has brought renewed interest, the most important near-term catalyst remains the successful redeployment of NGL sale proceeds, while the biggest risk is persistent margin compression from legacy contract roll-offs, neither of which is likely to be materially changed by the latest analyst revisions alone. Among recent developments, Plains GP Holdings’ January dividend increase stands out, with the payout rising to $0.38 per Class A share and annualizing at $1.52. This announcement is highly relevant given the current focus on earnings growth and value metrics, as rising dividends often signal confidence in the underlying strength of cash flows and support the company’s investment narrative amid volatility. On the other hand, investors should be mindful that a higher payout may not fully offset the risk associated with...

Read the full narrative on Plains GP Holdings (it's free!)

Plains GP Holdings is projected to reach $49.7 billion in revenue and $428.0 million in earnings by 2028. This outlook assumes a 1.3% annual revenue growth rate and an earnings increase of $456 million from current earnings of -$28.0 million.

Uncover how Plains GP Holdings' forecasts yield a $21.46 fair value, a 12% upside to its current price.

Exploring Other Perspectives

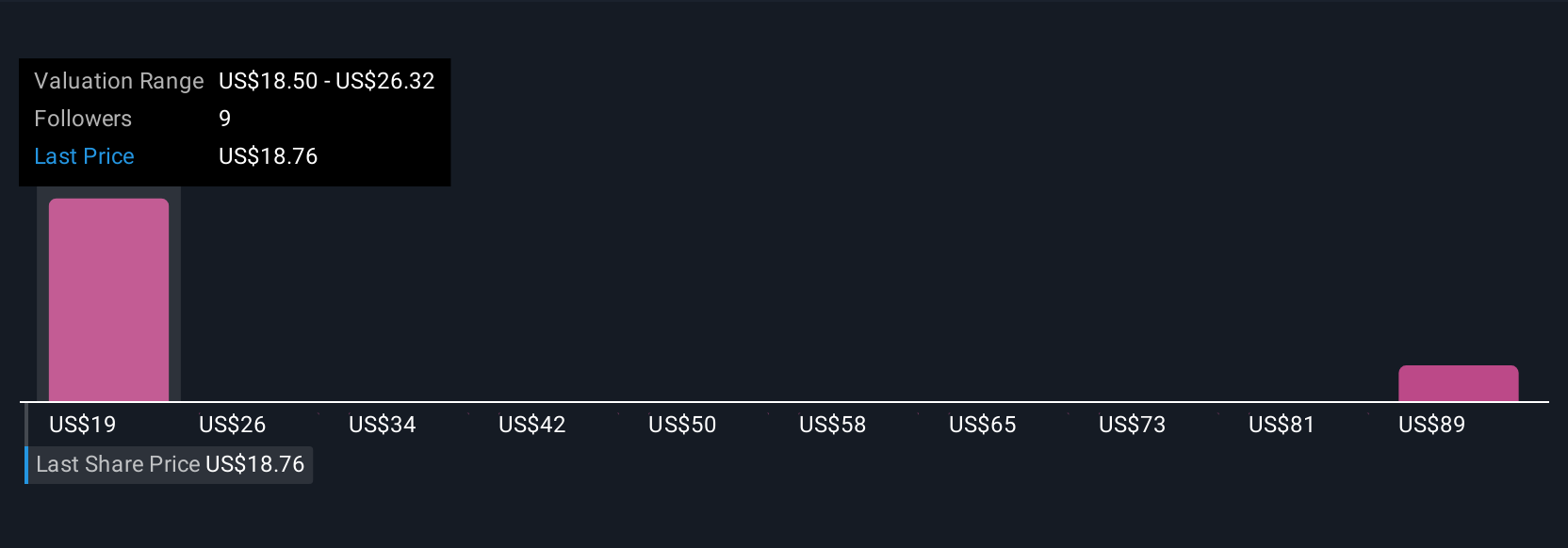

Five estimates from the Simply Wall St Community put Plains GP Holdings’ fair value between US$18.50 and US$96.92 per share, showing a wide spread in views. The community’s range highlights how differing expectations about persistent margin compression can shape each investor’s outlook on returns and resilience in the sector.

Explore 5 other fair value estimates on Plains GP Holdings - why the stock might be worth over 5x more than the current price!

Build Your Own Plains GP Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plains GP Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Plains GP Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plains GP Holdings' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAGP

Plains GP Holdings

Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives