- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAA

Plains All American Pipeline (PAA): Assessing Current Valuation and Future Potential for Investors

Reviewed by Kshitija Bhandaru

Plains All American Pipeline (PAA) recently closed at $16.82, drawing attention as investors weigh the company’s long-term performance in light of recent share price fluctuations. Its year-over-year returns and growth metrics offer a few points worth considering.

See our latest analysis for Plains All American Pipeline.

While Plains All American Pipeline’s share price has seen some minor dips in recent sessions, what stands out is its steady long-term momentum. The stock’s 1-year total shareholder return is modest, but its 3-year figure of over 90% underscores solid compounding for investors willing to ride out the noise.

If you’re looking to expand your radar beyond midstream energy, now’s an ideal time to discover fast growing stocks with high insider ownership.

With shares still trading well below analyst price targets and recent growth outpacing revenue, the question now is whether Plains All American Pipeline is an undervalued opportunity or if the market has already factored in all future gains.

Most Popular Narrative: 18.9% Undervalued

Plains All American Pipeline’s latest price sits well below the most widely-followed fair value estimate, setting the stage for a debate about how much future growth is already priced in. With the narrative’s valuation showing a significant gap to today’s share price, the details behind that figure demand a closer look.

Strong strategic positioning in the Permian Basin and the ability to acquire further interests in key pipelines (such as BridgeTex), paired with ongoing population and economic growth in North America, provide a resilient volume foundation and upward revenue trajectory.

Want to see why analysts are betting on this company’s long-term earnings expansion? The narrative is built around rising profits and a bold forecast for margins and cash flows. Find out what is driving the consensus price target and which financial levers could push shares higher than expected.

Result: Fair Value of $20.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including long-term energy transition pressures and industry overcapacity. Both of these factors could challenge Plains All American Pipeline's earnings and outlook.

Find out about the key risks to this Plains All American Pipeline narrative.

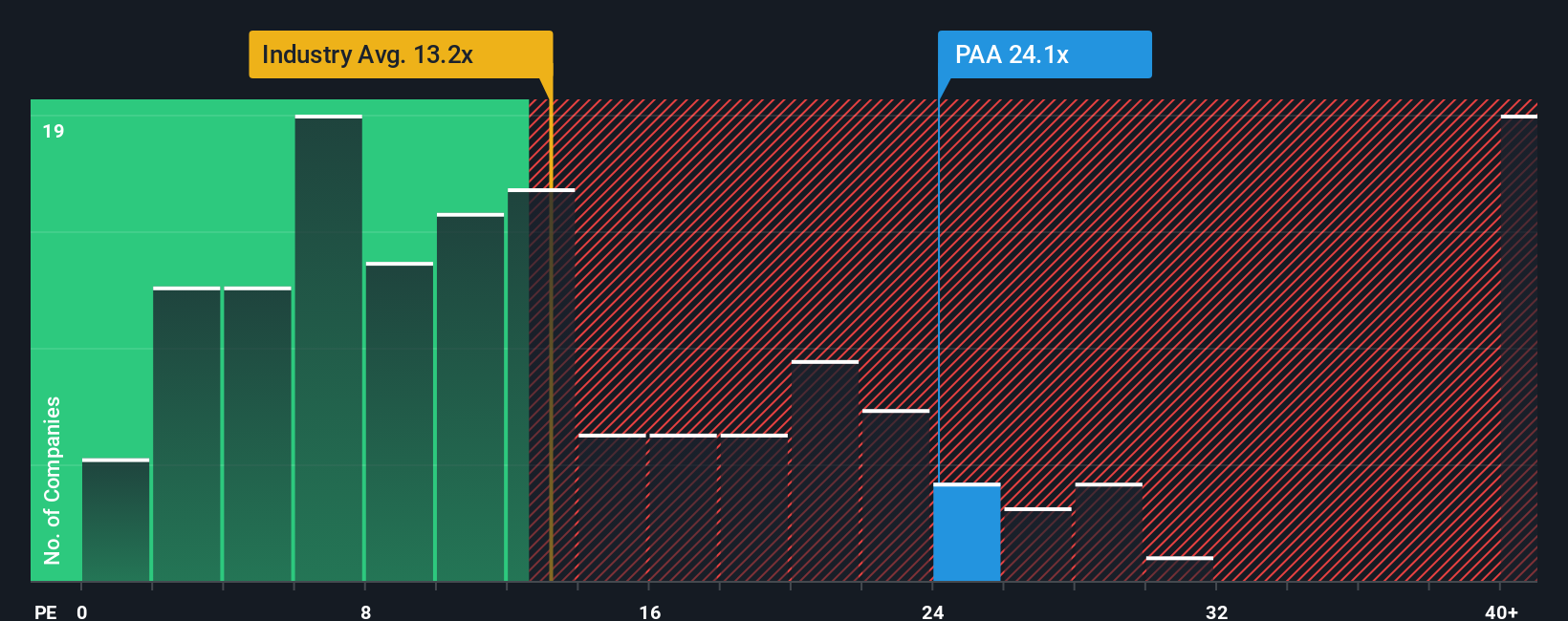

Another View: A Look at Market Multiples

While the discounted cash flow approach signals Plains All American Pipeline is undervalued, using the market’s standard price-to-earnings ratio tells a different story. Currently, its P/E of 25.6x is notably higher than the industry average of 13.4x and even above the peer average of 19.6x. This premium suggests investors are paying a lot for future earnings, and the gap to the fair ratio of 21.6x highlights some valuation risk. Is the market too optimistic, or is there upside others have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plains All American Pipeline Narrative

If you have a different perspective or prefer hands-on analysis, you can easily craft your own data-driven story in just a few minutes. Do it your way.

A great starting point for your Plains All American Pipeline research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t settle for just one play. Now is your chance to tap into fresh ideas that could put your portfolio ahead of the crowd. Sharpen your edge with these proven picks:

- Unlock powerful growth potential when you check out these 896 undervalued stocks based on cash flows, targeting companies whose cash flows signal genuine value the market may be missing.

- Boost your income streams by finding these 19 dividend stocks with yields > 3%, offering attractive yields above 3% and the stability long-term investors rely on.

- Get ahead of emerging trends as you gain access to these 24 AI penny stocks, set to disrupt industries with innovative artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAA

Plains All American Pipeline

Through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives