- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

New Fortress Energy (NFE): Valuation Insights Following Major LNG Supply Deal With Puerto Rico

Reviewed by Kshitija Bhandaru

If you hold shares of New Fortress Energy (NFE), this week’s announcement may have you recalibrating your outlook. The company has reached terms for a long-term contract to supply liquefied natural gas to Puerto Rico, supporting the island’s shift away from costlier, high-emission fuels. Although the deal still needs final approval from the Financial Oversight and Management Board, it secures revenue for NFE over the next seven years and strengthens its strategic partnership in a region eager for affordable, cleaner energy.

This development follows a turbulent period for NFE investors. Over the past year, the stock price has dropped 75%, even as recent quarterly results showed a nearly 20% rise in revenue and a surge in annual net income growth. While shares have rebounded about 15% in the past three months on renewed momentum, the broader picture remains challenging. With the company expanding into new markets and securing contracts like this, the key question is whether this operational progress will result in sustainable value for shareholders.

After last year’s steep decline and the renewed optimism around the Puerto Rico contract, is New Fortress Energy now trading at a discount, or is the market already reflecting expectations for future growth?

Most Popular Narrative: 54.1% Undervalued

The most widely followed narrative suggests that New Fortress Energy may be trading well below its estimated fair value, based on a blend of anticipated earnings growth, margin improvement, and discounted future cash flows. This narrative frames NFE as substantially undervalued, with a current fair value assessed at $5.10 per share. This implies strong upside if company targets are met.

The FLNG asset coming online is expected to significantly contribute to future earnings as it allows optimization of the portfolio, leading to increased future returns and positively impacting revenue and earnings.

Curious how New Fortress Energy could go from heavy losses to unprecedented cash generation? The foundation of this narrative rests on ambitious growth, bold future profit assumptions, and a valuation formula that defies the present mood. Want to see which key metrics analysts are betting on for this turnaround story and how they reach a price target more than double today’s level? Don’t miss the full narrative, where the biggest drivers behind this dramatic upside are finally revealed.

Result: Fair Value of $5.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reliance on key markets and the significant execution challenges tied to expansion could quickly undermine even the most optimistic projections.

Find out about the key risks to this New Fortress Energy narrative.Another View: Discounted Cash Flow Says Otherwise

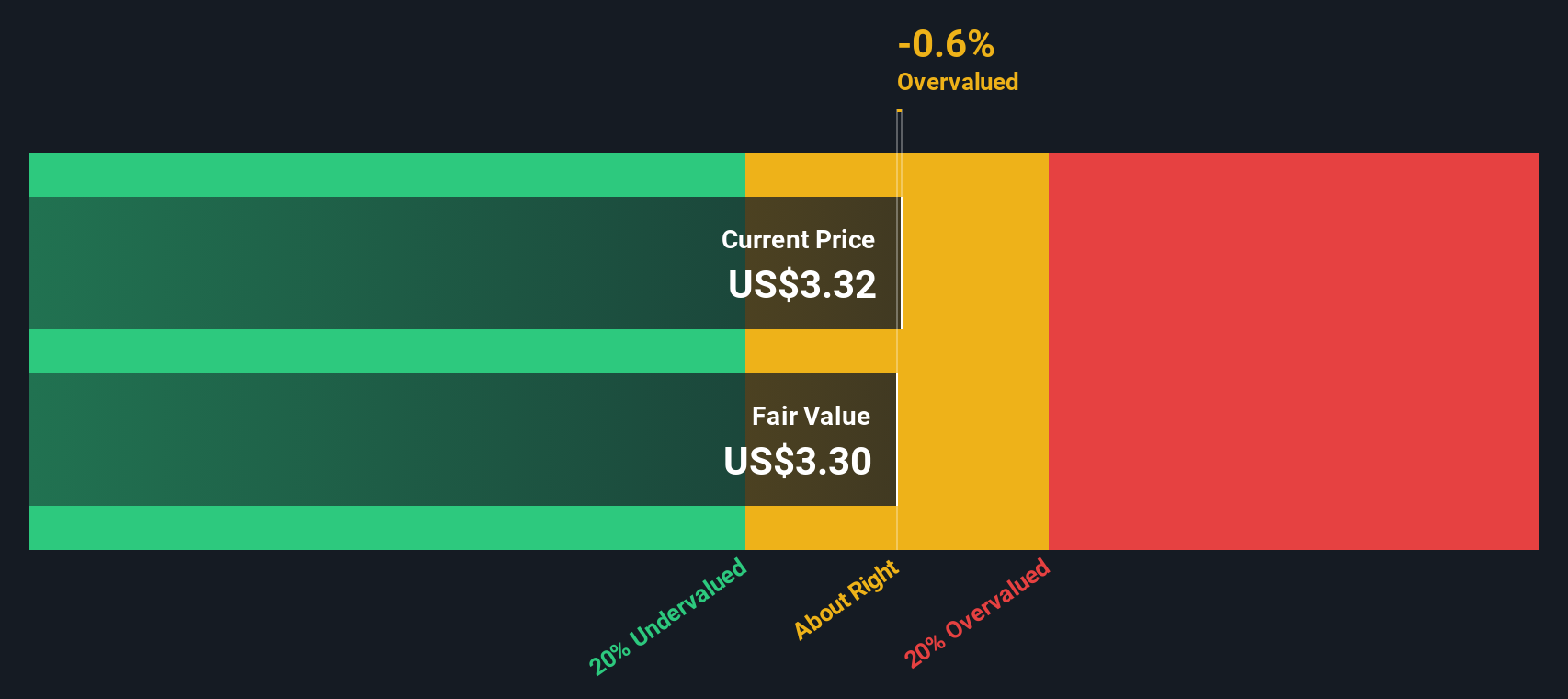

While the market is buzzing about upside based on future growth projections, our SWS DCF model offers a different perspective and suggests New Fortress Energy may actually be overvalued today if you focus on underlying cash flows. So, which lens tells the real story here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out New Fortress Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own New Fortress Energy Narrative

If you see things differently or want to dig deeper into the numbers, take a few moments to shape your own narrative from the ground up: Do it your way.

A great starting point for your New Fortress Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t watch great opportunities pass you by. Use the Simply Wall Street Screener to pinpoint tomorrow’s leaders and strengthen your investment strategy with actionable ideas right now.

- Uncover stocks showing strong financials among the small-cap space by checking out a handpicked collection of penny stocks with strong financials.

- Tap into the world of AI breakthroughs driving change in multiple sectors by exploring a smart selection of AI penny stocks.

- Boost your income with potential high-yield picks and find companies offering compelling payouts through our targeted dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives