- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

Taking Stock of NextDecade’s (NEXT) Valuation After Hanwha Boosts Stake Above 9%

Reviewed by Simply Wall St

Hanwha Aerospace just scooped up nearly 0.9 million shares of NextDecade (NEXT) in open market buys, lifting its stake above 9% and sparking fresh attention on the beaten down LNG developer.

See our latest analysis for NextDecade.

The 1 day share price return of 1.76% to 5.19 only slightly dents what has been a tough stretch for NEXT, with a year to date share price return of negative 37.47% but a still impressive 5 year total shareholder return of 133.78%, suggesting long term believers are watching this pullback as momentum cools rather than disappears.

If Hanwha’s move has you thinking about where else committed capital is lining up behind future growth stories, it could be a good moment to explore fast growing stocks with high insider ownership.

With the stock down sharply this year yet still trading at a steep discount to analyst targets, is NextDecade now quietly undervalued, or are markets already correctly pricing in its long dated LNG and CCS growth story?

Price to Book of 8.9x, Is it justified?

NextDecade is trading on a rich 8.9x price to book multiple versus Friday’s 5.19 close, placing it well above typical oil and gas peers.

The price to book ratio compares the market value of the company’s equity to its accounting book value, a common yardstick for capital intensive energy developers. For a pre revenue, loss making LNG and CCS platform, such a premium usually implies investors are paying up for future project optionality rather than current fundamentals.

Here, the contrast with benchmarks is stark, with the broader US oil and gas group on roughly 1.4x price to book and a similar 1.5x average across direct peers. That gap suggests the market is assigning NextDecade a sizeable scarcity and growth premium, even as our DCF work and profitability forecasts remain cautious about near term returns.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 8.9x (OVERVALUED)

However, persistent losses and execution risk around its Rio Grande LNG and CCS projects could quickly erode that perceived scarcity premium if timelines slip.

Find out about the key risks to this NextDecade narrative.

Another View Using Our DCF Model

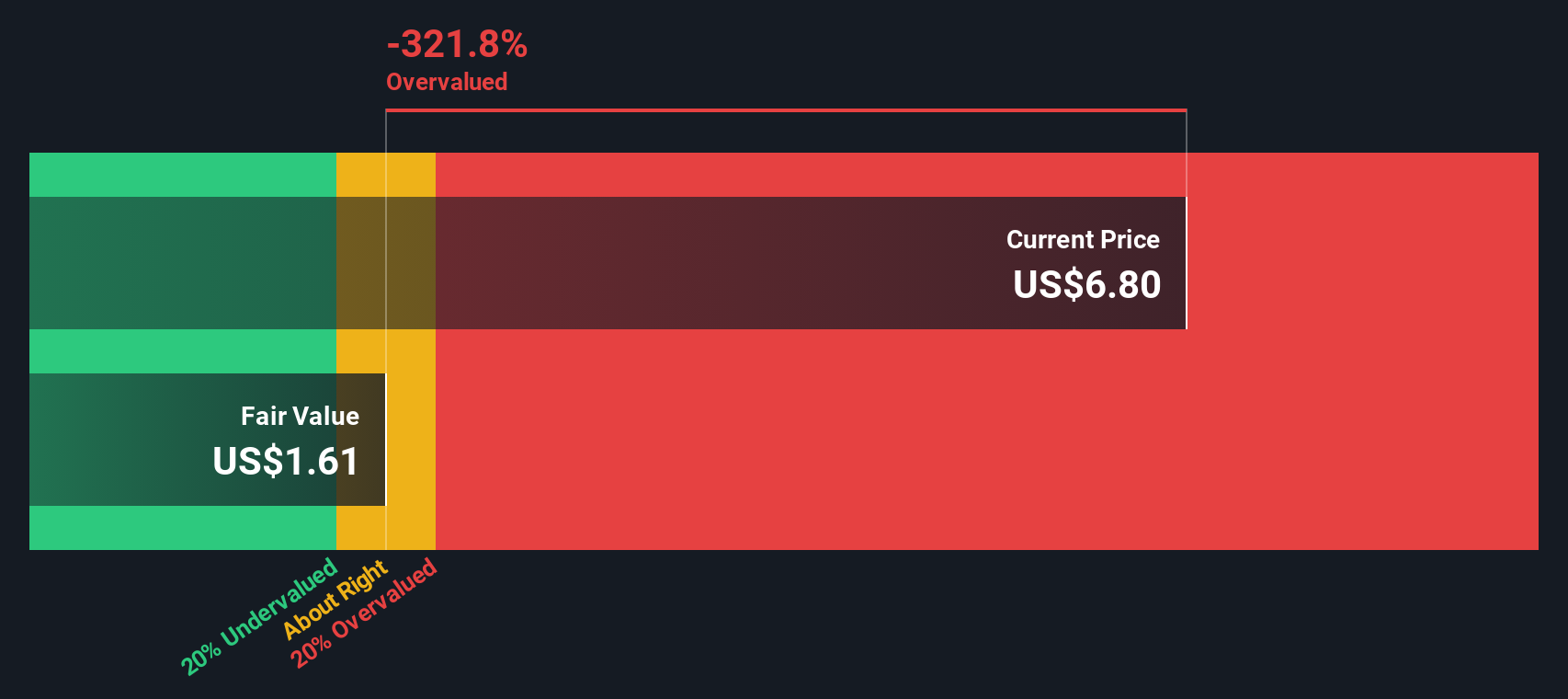

Our DCF model paints a very different picture to the rich 8.9x price to book, suggesting fair value of about 1.62 per share versus the current 5.19. That points to NEXT looking overvalued on cash flow assumptions, not just on assets. This raises the question of which signal investors should consider more closely.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextDecade for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextDecade Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next watchlist upgrade with focused stock shortlists built from real fundamentals, momentum shifts, and long term return potential.

- Capture early stage growth potential by scanning these 3642 penny stocks with strong financials that already back strong balance sheets and improving business quality.

- Harness structural tailwinds in automation and data by targeting these 26 AI penny stocks positioned at the heart of real world AI adoption.

- Strengthen your core portfolio with these 912 undervalued stocks based on cash flows that our models flag as trading below their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)