- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

Strategic LNG Partnerships With Industry Leaders Could Be a Game Changer for NextDecade (NEXT)

Reviewed by Sasha Jovanovic

- In recent developments, major players including TotalEnergies, Baker Hughes, and ConocoPhillips announced significant agreements and contracts with NextDecade for the Rio Grande LNG project in Texas, positioning the company as a central partner in expanding US LNG export capacity.

- This collaboration marks a turning point for NextDecade, highlighting the increasing interest of established energy giants in the US LNG sector as global demand evolves.

- We will now explore how these fresh partnerships and technology contracts could reshape NextDecade's investment narrative, especially with LNG export growth in focus.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is NextDecade's Investment Narrative?

To own shares in NextDecade today, you would need conviction not just in the future of US LNG exports, but also in the company’s ability to bring the Rio Grande LNG project online, despite ongoing losses and a deep need for outside capital. The recent news of TotalEnergies, Baker Hughes, and ConocoPhillips forging fresh partnerships and supply deals with NextDecade is meaningful, as it adds heavyweight partners, potential operational expertise, and financial support, signaling greater confidence in moving Trains 4 and 5 toward final investment decisions. This might help address the company’s most critical short-term catalyst: securing enough commercial and financial backing for the next phases. At the same time, key risks still loom large, including a limited cash runway, a “going concern” warning from auditors, and legal challenges around construction and permitting. While the new agreements could ease some doubts, they don’t instantly erase uncertainties about financing, execution, or future profitability, especially given recent volatility and heavy share price declines. However, it’s the limited cash runway and “going concern” note that many investors might overlook.

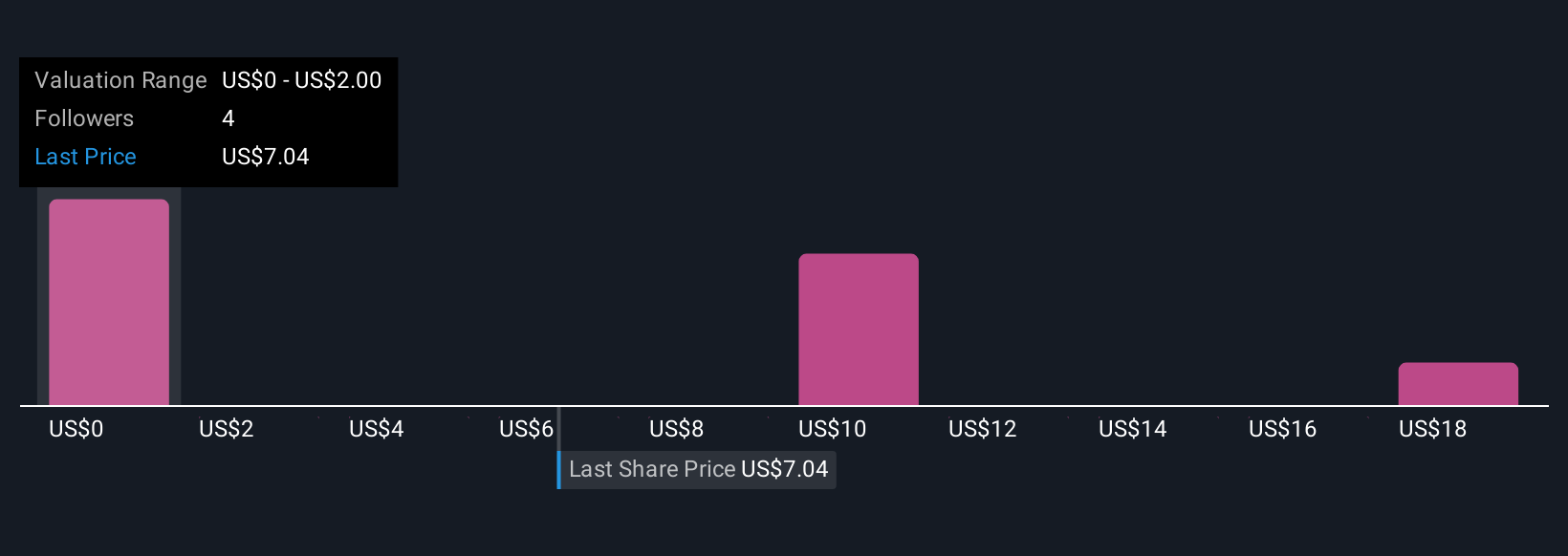

NextDecade's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 4 other fair value estimates on NextDecade - why the stock might be worth over 3x more than the current price!

Build Your Own NextDecade Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NextDecade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextDecade's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives