- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

NextDecade (NEXT): Assessing Valuation After Securing Full Funding and FID for Rio Grande LNG Train 5

Reviewed by Simply Wall St

NextDecade (NEXT) has advanced its Rio Grande LNG project with a positive final investment decision on Train 5. The company has fully funded the expansion and instructed Bechtel to start construction. This move significantly boosts the company’s future LNG production capacity.

See our latest analysis for NextDecade.

NextDecade’s recent green light for Train 5 comes at a pivotal time, as the company has weathered significant market swings. Despite a tough 90-day share price return of -46.8%, longer-term total shareholder return is still up an impressive 134.5% over five years. The latest string of updates, including a new interim CFO and major progress at Rio Grande LNG, suggests both a strengthening commitment to future growth and shifting investor sentiment as momentum builds behind their expansion.

If this new phase of growth sparks your interest, it’s a great moment to expand your investing search and discover fast growing stocks with high insider ownership

The big question now, with shares near 33% below analyst price targets and a major project underway, is whether NextDecade is trading at a discount or if the market has already factored in all this future growth.

Price-to-Book of 6x: Is it justified?

NextDecade currently trades on a price-to-book ratio of 6x, placing its valuation well above both peer and industry averages at the last close of $5.98 per share.

The price-to-book ratio reflects how much investors are willing to pay for each dollar of net assets. For a company like NextDecade, which remains in the pre-profit phase, this metric becomes even more important as investors attempt to value growth prospects relative to tangible book value.

With peers averaging 1.8x and the US Oil and Gas industry at 1.3x, NextDecade’s 6x ratio stands out as highly expensive in its sector. The market appears to be pricing in much of the future upside already, so caution may be warranted when comparing value against its rivals.

See what the numbers say about this price — find out in our valuation breakdown.

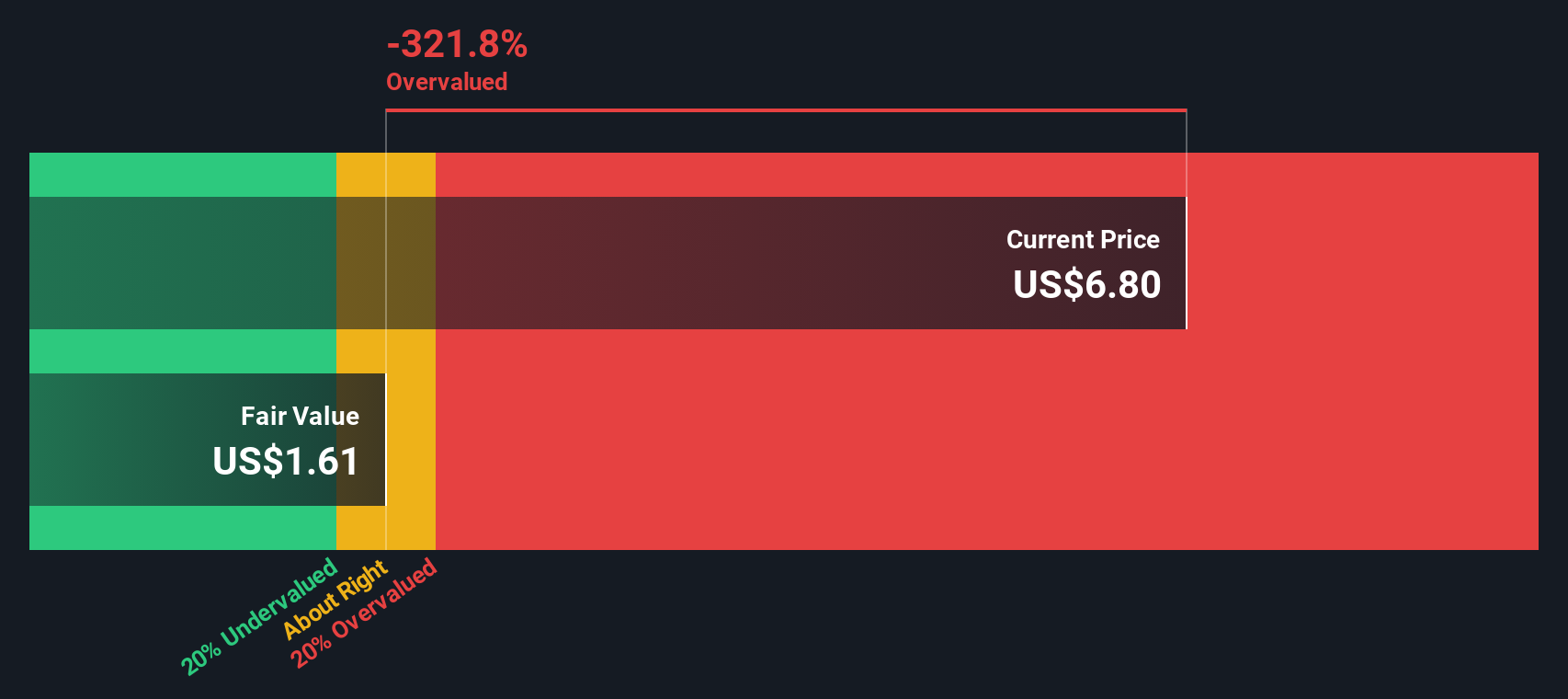

Result: Price-to-Book of 6x (OVERVALUED)

However, ongoing negative earnings and the company’s lack of current revenue highlight real risks, which could quickly shift investor sentiment and valuation.

Find out about the key risks to this NextDecade narrative.

Another View: What Does the SWS DCF Model Say?

To challenge the high price-to-book valuation, the SWS DCF model provides another angle. According to our DCF, NextDecade shares are currently trading well above their estimated fair value, which signals the stock could be overvalued by this measure as well. So, are investors being overly optimistic, or is future growth still being underestimated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextDecade for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextDecade Narrative

If our analysis does not align with your perspective, or you would rather trust your own research, you can quickly build and test your own view: Do it your way.

A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not stop at just one opportunity. Expand your horizons and uncover your next win with these handpicked tools tailored to fast-moving markets.

- Target growth potential by tapping into these 25 AI penny stocks, offering exposure to AI-driven innovation that could transform entire industries.

- Capture value opportunities now with these 879 undervalued stocks based on cash flows, based on cash flows and find stocks that the market may be overlooking.

- Lock in consistent income by reviewing these 17 dividend stocks with yields > 3%, with yield rates over 3% and proven financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives