- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

National Energy Services Reunited (NESR) Is Up 11.1% After Securing Saudi Aramco Deal and Margin Gains – What's Changed

Reviewed by Sasha Jovanovic

- On November 13, 2025, National Energy Services Reunited Corp. announced its third quarter earnings, reporting revenue of US$295.32 million and net income of US$17.74 million, reflecting reduced revenue but improved margins driven by cost controls and efficiency gains.

- The company also secured a major hydraulic fracturing contract with Saudi Aramco in the Jafurah field, positioning NESR for expanded growth opportunities in the Middle East and North Africa region.

- We'll examine how the strengthened profitability and new Saudi Aramco contract influence NESR’s investment narrative and future growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

National Energy Services Reunited Investment Narrative Recap

To be a shareholder in National Energy Services Reunited (NESR), you need to believe in the resilience of long-term energy demand across emerging markets and NESR’s ability to win and execute large-scale contracts in the Middle East and North Africa. The latest quarterly results highlighted ongoing margin improvement despite pressure on revenue, but near-term contract execution and exposure to concentrated NOC clients remain the most important catalyst and risk. The new Jafurah contract supports growth, though customer concentration risk is still material.

Among recent announcements, NESR’s award of the large Saudi Aramco hydraulic fracturing contract is particularly relevant. This secures the company’s presence in the Jafurah field, which could underpin both future revenue visibility and margin stability, tying directly into the growth catalyst most important for the next stage of the company’s journey.

However, beneath these headline wins, investors should be aware that reliance on a few NOC customers and regional stability could...

Read the full narrative on National Energy Services Reunited (it's free!)

National Energy Services Reunited's outlook anticipates $1.5 billion in revenue and $168.6 million in earnings by 2028. This scenario requires 4.0% annual revenue growth and a $95.6 million increase in earnings from the current $73.0 million.

Uncover how National Energy Services Reunited's forecasts yield a $15.40 fair value, a 12% upside to its current price.

Exploring Other Perspectives

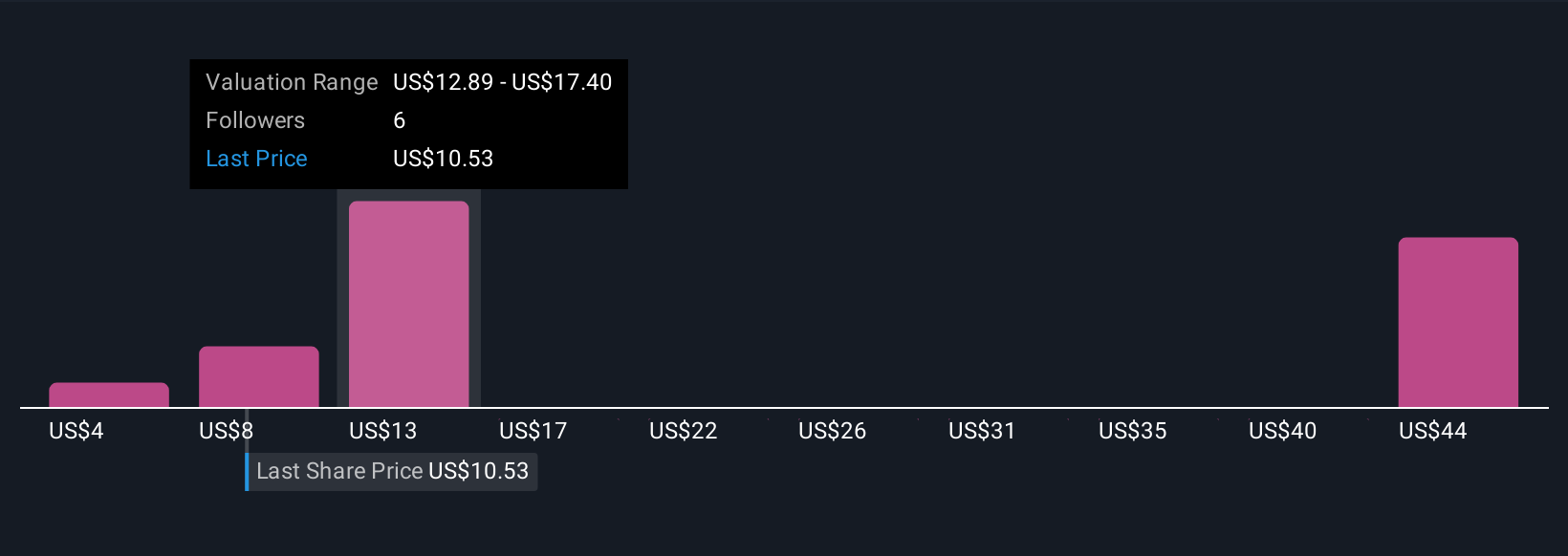

Fair value estimates from seven Simply Wall St Community members range from US$3.87 to US$57.77 per share. While strong contract wins may fuel optimism, the concentrated customer risk remains a clear consideration affecting future performance. Explore several viewpoints for a broader perspective.

Explore 7 other fair value estimates on National Energy Services Reunited - why the stock might be worth less than half the current price!

Build Your Own National Energy Services Reunited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Energy Services Reunited research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free National Energy Services Reunited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Energy Services Reunited's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives