- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

A Fresh Look at NESR (NasdaqCM:NESR) Valuation Following Q3 2025 Earnings Decline

Reviewed by Simply Wall St

National Energy Services Reunited (NESR) just released its Q3 2025 earnings, drawing investor attention as both sales and net income fell compared to last year. This update comes at a time of heightened interest in its financial performance.

See our latest analysis for National Energy Services Reunited.

Despite this earnings dip, National Energy Services Reunited’s share price has surged 100.72% over the past 90 days, highlighting a dramatic shift in investor sentiment and momentum. The stock’s 1-year total shareholder return sits at 57.85%, suggesting some real staying power despite short-term headwinds.

If this kind of sharp turnaround has you thinking about new opportunities, now is the time to discover fast growing stocks with high insider ownership

With the share price already doubling even as earnings contract, investors are left to wonder if National Energy Services Reunited is undervalued or if the market has already factored in all its future growth potential. Is there still a buying opportunity here?

Most Popular Narrative: 9.3% Undervalued

With National Energy Services Reunited trading at $13.97 and the most popular narrative setting fair value at $15.40, the market is eyeing further upside if future projections materialize. The discount rate of 7.54% has shaped this view as investors weigh current momentum against forward-looking fundamentals.

“Secured multi-year (3, 9 year) contract durations, growing contract awards, and a backlog that extends to 2030+ give NESR a high degree of earnings visibility and reduce volatility. This supports more stable cash flow and profitability.”

Curious what bold forecasts are packed into this narrative? There is a dramatic shift from modest margins and revenue today to a future profit profile you might expect from market darlings. Want to see what kind of growth is required to support this value? Peek inside for the full playbook that analysts are using to value the shares.

Result: Fair Value of $15.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the company’s reliance on long-term MENA contracts and the potential impact of shifting global energy policies on demand.

Find out about the key risks to this National Energy Services Reunited narrative.

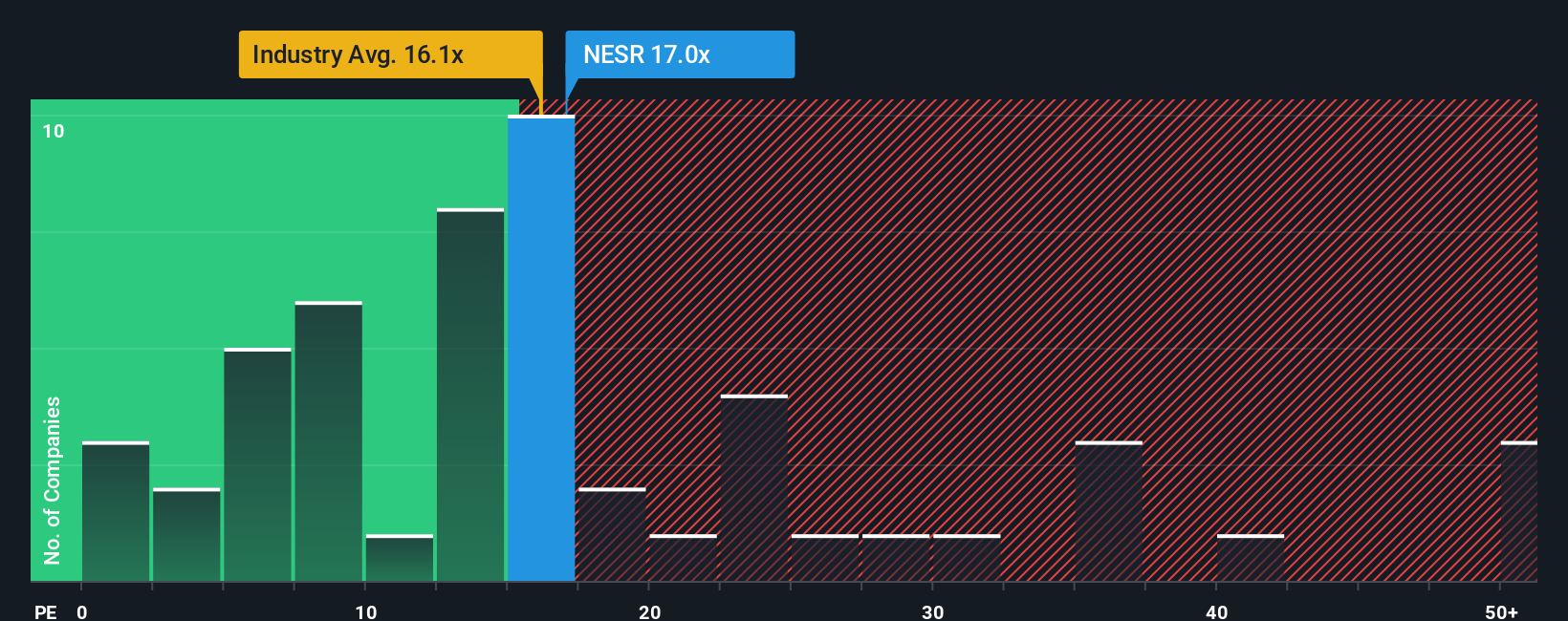

Another View: How Do Market Multiples Stack Up?

While narrative and fair value methods suggest National Energy Services Reunited is undervalued, a look at its price-to-earnings ratio adds complexity. At 19.1x, NESR trades above both its peer average of 16.1x and the broader US Energy Services industry at 16.9x. The fair ratio for NESR is estimated at 23.9x, suggesting there could still be room for upside if the market moves in that direction. Does this premium signal confidence in NESR’s growth story, or does it point toward heightened valuation risk if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Energy Services Reunited Narrative

If you have a different perspective or want to dig into the numbers yourself, it only takes a few minutes to shape your own view, so why not Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding National Energy Services Reunited.

Looking for More Investment Opportunities?

Why settle for mainstream picks when you could be first to spot the next breakout? Let Simply Wall Street’s tools show you where the action is heading now.

- Unlock steady income streams by reviewing these 15 dividend stocks with yields > 3% with yields above 3% and a record of proven resilience through volatile markets.

- Amplify your portfolio’s potential by targeting these 27 AI penny stocks leading innovation in artificial intelligence and driving tomorrow’s major breakthroughs.

- Capitalize on market mispricing by scanning these 870 undervalued stocks based on cash flows identified by rigorous, cash flow-based screening and ready for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives