- United States

- /

- Oil and Gas

- /

- NasdaqGM:HPK

Why Investors Shouldn't Be Surprised By HighPeak Energy, Inc.'s (NASDAQ:HPK) 27% Share Price Plunge

Unfortunately for some shareholders, the HighPeak Energy, Inc. (NASDAQ:HPK) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

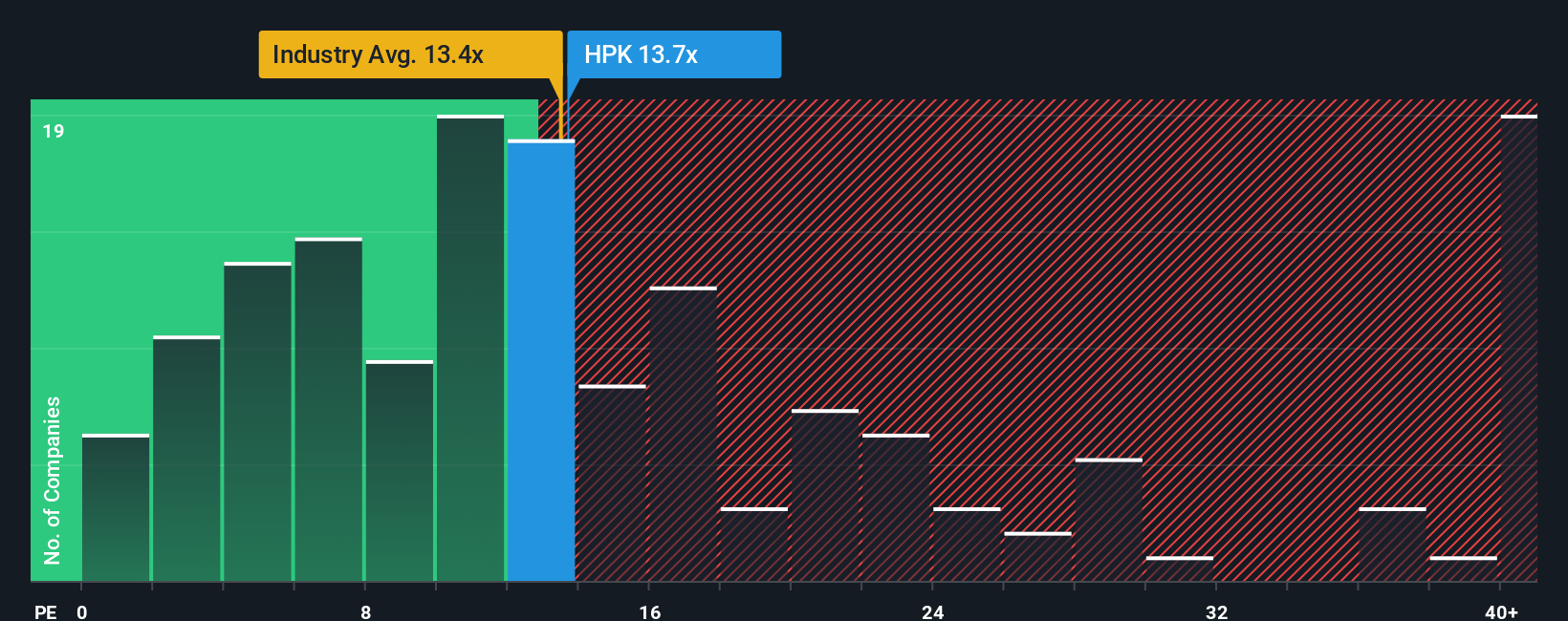

Since its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider HighPeak Energy as an attractive investment with its 13.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, HighPeak Energy's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for HighPeak Energy

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like HighPeak Energy's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 70% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 79% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 14% during the coming year according to the three analysts following the company. With the market predicted to deliver 16% growth , that's a disappointing outcome.

With this information, we are not surprised that HighPeak Energy is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On HighPeak Energy's P/E

HighPeak Energy's recently weak share price has pulled its P/E below most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of HighPeak Energy's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 5 warning signs for HighPeak Energy (2 are a bit concerning!) that you need to be mindful of.

If you're unsure about the strength of HighPeak Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HighPeak Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HPK

HighPeak Energy

Operates as an independent crude oil and natural gas exploration and production company.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives