- United States

- /

- Oil and Gas

- /

- NasdaqGS:GPRE

Green Plains (GPRE): Forecasts Signal 77.45% Annual Earnings Growth Ahead of Profitability Target

Reviewed by Simply Wall St

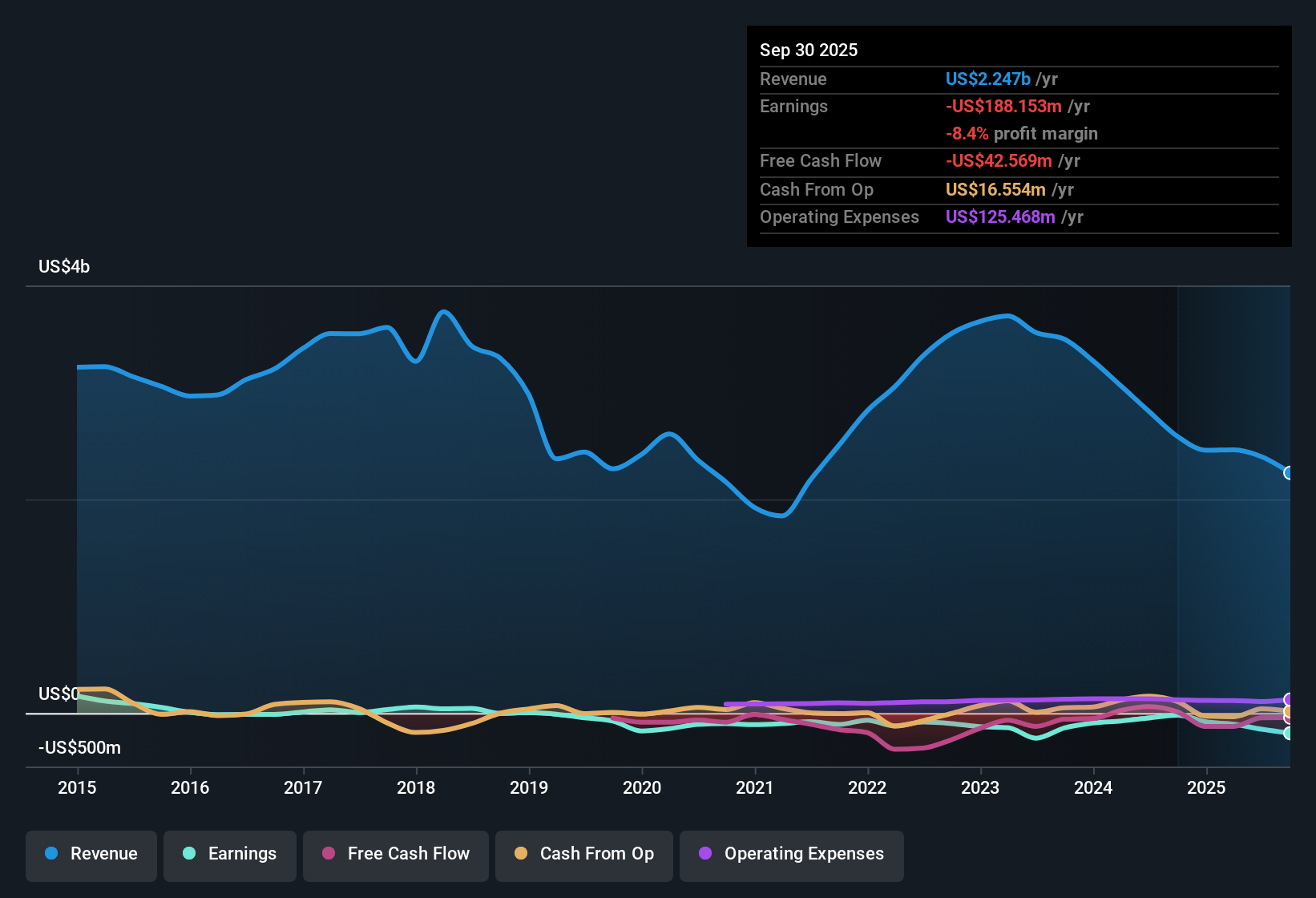

Green Plains (GPRE) is currently unprofitable but is on a bright trajectory, with forecasts calling for a 77.45% jump in earnings per year and a return to profitability within three years. Revenue is projected to rise at 12.3% annually, outpacing the US market. The company has cut its losses at a rate of 0.6% each year over the past five years. Investors are likely to see the combination of discounted valuation, improving fundamentals, and a price-to-sales ratio of just 0.3x as signals of potential upside. However, recent share price volatility remains something to watch.

See our full analysis for Green Plains.Next, we will see how these results compare to the dominant market narratives and whether the numbers back up the story investors are telling themselves.

See what the community is saying about Green Plains

Margins Move from Losses to Profits

- Analysts project profit margins rising from -6.3% currently to 3.4% in three years, reflecting expectations that Green Plains can shift from ongoing losses into solid earnings territory over a relatively short timeframe.

- Consensus narrative emphasizes the catalysts behind these margin improvements, including:

- Government policies such as the expanded 45Z clean fuel production tax credit through 2029 are expected to drive more recurring revenue and allow EBITDA to rise from both greater plant qualification and premium pricing on low-carbon ethanol.

- Ongoing cost reductions, including achieving and surpassing their $50 million savings goal and targeting further SG&A compression, add operating leverage. This amplifies the impact of revenue on actual profits and supports the margin recovery story.

- Consensus narrative analysts note that exposure to regulatory risk remains high. Any future reduction or elimination of key credits or export policies could delay or derail these anticipated margin gains.

Policy Catalyst: Tax Credit Upside

- The extension and expansion of clean fuel incentives, especially the 45Z tax credit, are set to boost Green Plains' recurring annualized EBITDA to over $150 million from the company’s three qualifying plants, with expectations that all nine plants will benefit by 2026.

- Consensus narrative points to these policy-driven catalysts as giving Green Plains a significant advantage:

- Removal of indirect land use change penalties and broadening of low-carbon fuel mandates are set to increase demand for Green Plains' products, resulting in stronger pricing and improved utilization across their assets.

- Despite the upside, the consensus highlights dependency on policy continuity and sustained export demand as key risks. Changing government support or trade friction could undermine the strong forecasted outcomes.

DCF Fair Value and Analyst Target Signal Discount

- At a current share price of $11.28, Green Plains trades dramatically below its DCF fair value estimate of $94.87, as well as below the analyst consensus price target of $10.89. This indicates that valuation models and market expectations point to substantial upside if fundamentals deliver as forecasted.

- Consensus narrative underscores the deep value case, but notes the importance of future milestones:

- Green Plains’ price-to-sales ratio of 0.3x is well below its industry and peer averages (1.5x and 0.8x, respectively). This suggests market caution about execution or durability of growth, especially as recent share price volatility remains elevated.

- To justify analyst expectations, Green Plains must achieve major milestones. These include $3.4 billion in revenue and $116.3 million in earnings by 2028, while maintaining favorable policies and margin expansion. Investors are advised to sense-check these targets against their own outlook before relying solely on consensus valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Green Plains on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your view and craft a personalized narrative in just a few minutes with Do it your way.

A great starting point for your Green Plains research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Green Plains offers turnaround potential, its recent history of losses and continued earnings volatility reflect the risks of relying on policy-driven catalysts.

If dependable, year-in-year-out performance is your priority, use our stable growth stocks screener (2074 results) to zero in on companies delivering consistent growth with fewer surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GPRE

Green Plains

Produces low-carbon fuels in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives