- United States

- /

- Oil and Gas

- /

- NasdaqGS:GLNG

Is Golar LNG’s Surge Justified After Recent Shipping Agreements and Price Drop in 2025?

Reviewed by Bailey Pemberton

If you're thinking about what to do with Golar LNG stock right now, you’re not alone. Plenty of investors are weighing their options, and with good reason: this is a company that’s made some serious long-term waves. Over the past five years, Golar has soared an impressive 456.4%, and even the three-year gain stands strong at 52.3%. Still, the ride hasn't been smooth lately, as shares are down 13.1% year-to-date and have slipped 2.5% just in the last week. It’s easy to wonder if this is a short-term stumble or the sign of something more.

Part of the uncertainty comes from shifting industry dynamics and ongoing global discussions about energy transition. News about Golar's latest moves in the LNG market and updated shipping agreements has kept traders on their toes. While these didn’t send shockwaves through the stock, they provide valuable context for anyone trying to make sense of recent share price trends.

Numbers alone don't always tell the whole story, but if you’re looking at valuation, Golar currently scores a 1 out of 6 on our value checks. It’s undeniably undervalued in one key area, while falling short in others. But what does that really mean for your portfolio? We’ll break down the different ways analysts assess valuation, and stick around because the best way to judge value might just surprise you.

Golar LNG scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Golar LNG Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) values a company by projecting future dividend payments and discounting them back to today’s dollars. This approach is especially useful for businesses like Golar LNG, given their history of significant dividend payouts.

According to the most recent data, Golar LNG pays an annual dividend per share of $1, with a return on equity of 5.77% and a payout ratio of 74.41%. This model projects dividend growth of about 1.48%, derived from the company's retained earnings reinvested at that rate of return. The growth rate comes directly from calculating the retained portion of earnings multiplied by the return on equity.

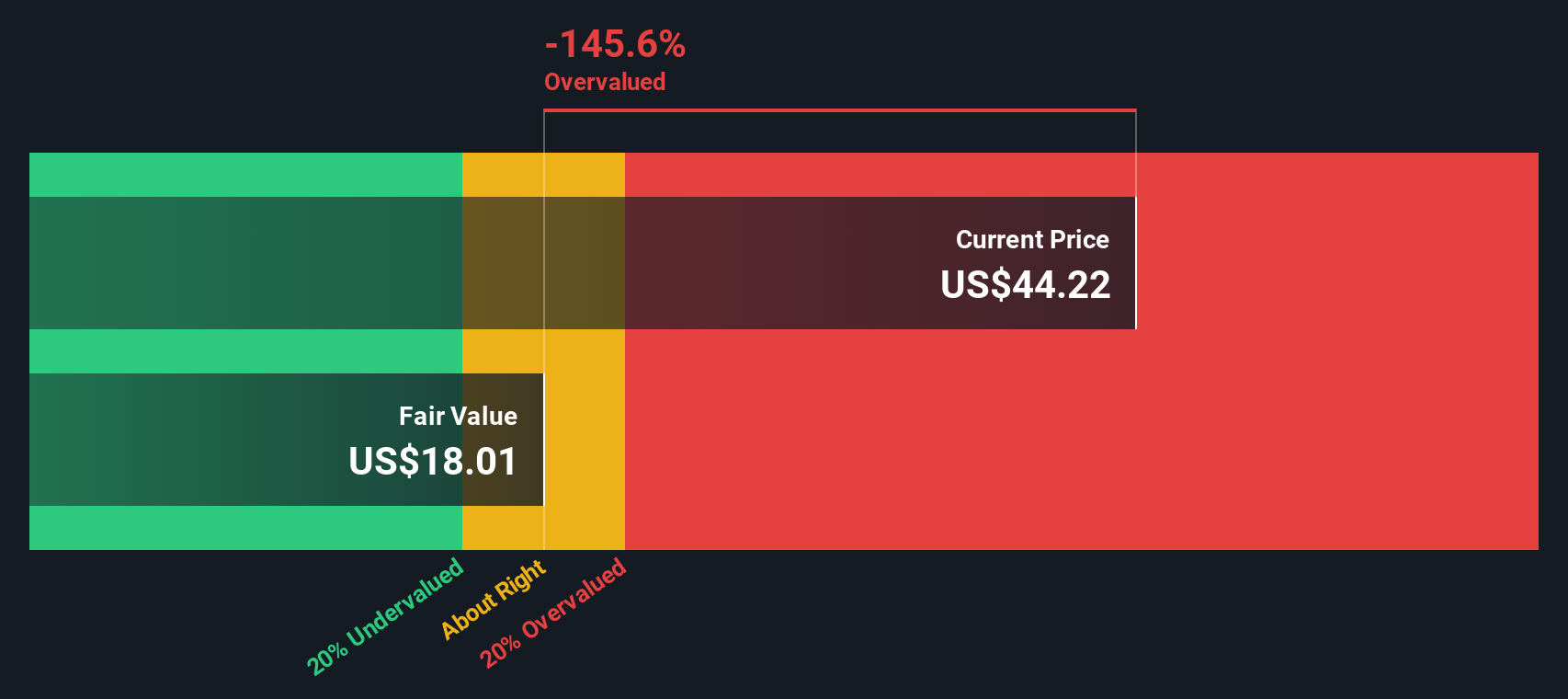

The DDM estimate pegs Golar LNG’s intrinsic fair value at $18.87 per share. Compared to the current share price, this suggests the stock is trading at a premium of approximately 101.9%. In this analysis, the shares appear significantly overvalued relative to the discounted value of expected dividends.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Golar LNG may be overvalued by 101.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Golar LNG Price vs Sales

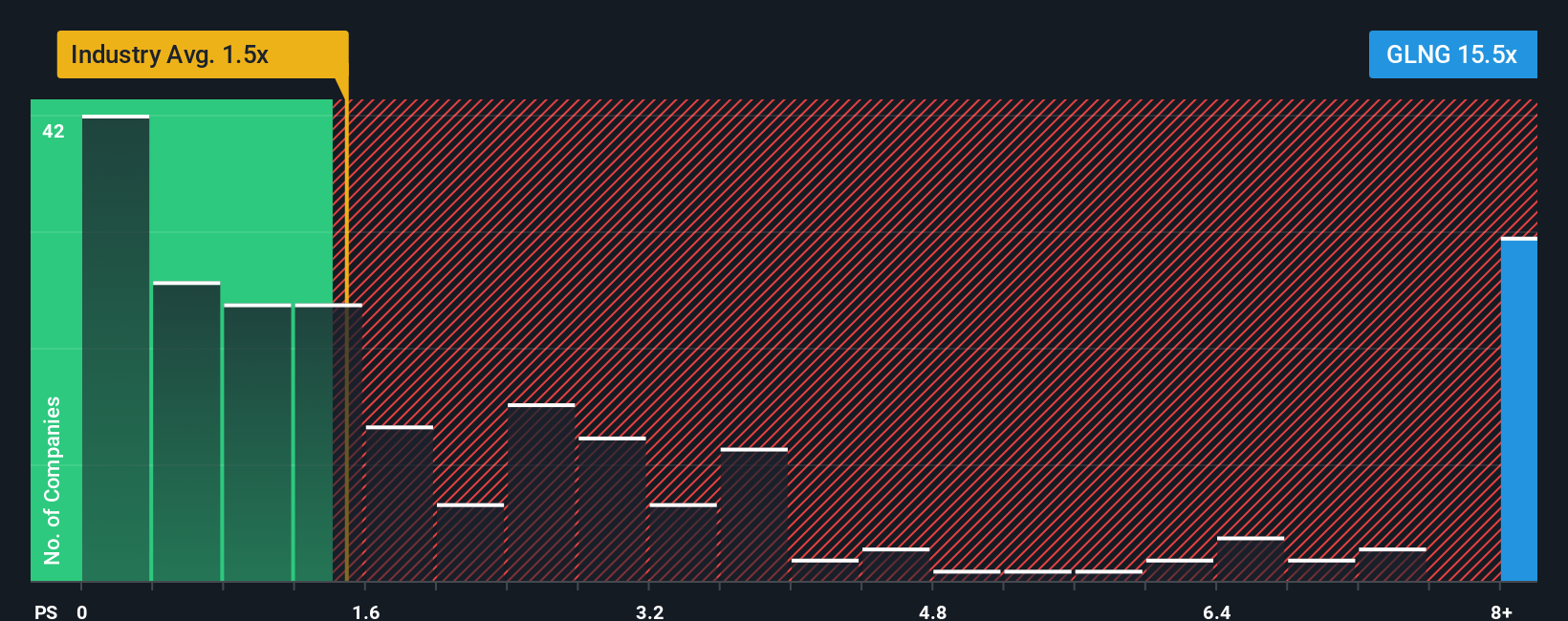

When valuing a company, the Price-to-Sales (P/S) multiple is often used for firms that may have uneven earnings but possess consistent revenue streams, such as Golar LNG. This metric helps investors assess how much they are paying for each dollar of sales, which can be especially insightful when profits fluctuate due to capital investments or industry cycles.

Growth potential and risk factors typically drive what a "normal" or "fair" P/S ratio should be. High-growth and low-risk businesses usually trade at a premium, while riskier or slower-growing firms command lower multiples. Comparing multiples in context is crucial to avoid overpaying or overlooking a bargain.

Currently, Golar LNG trades at a P/S multiple of 14.49x. This stands far above the oil and gas industry average of 1.48x and its peer group average of 2.13x. On the surface, this could raise eyebrows, but context is key. That is where Simply Wall St's "Fair Ratio" comes in. The proprietary Fair Ratio for Golar LNG lands at 1.76x, which factors in the company’s growth outlook, profit margins, risk, market cap, and industry trends, offering a more tailored benchmark than generic industry or peer comparisons.

By using the Fair Ratio instead of broad averages, investors get a nuanced perspective. For Golar LNG, with its actual P/S multiple vastly exceeding its Fair Ratio, the stock appears significantly overvalued on this basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Golar LNG Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives pair the company's story, your perspective on Golar’s future, with the numbers that matter most: estimates of revenue growth, margins, and fair value, all combined into a clear financial forecast. This bridges the qualitative and quantitative by linking the latest business developments, such as long-term FLNG contracts or shifts in LNG demand, directly to a dynamic fair value estimate.

Millions of investors on Simply Wall St’s Community page use Narratives because they make it easy and accessible to stress-test your investment thesis, then compare your Narrative’s Fair Value to today’s price to inform buy or sell decisions. Best of all, Narratives update automatically when news or earnings reports are released, so your view always reflects fresh information.

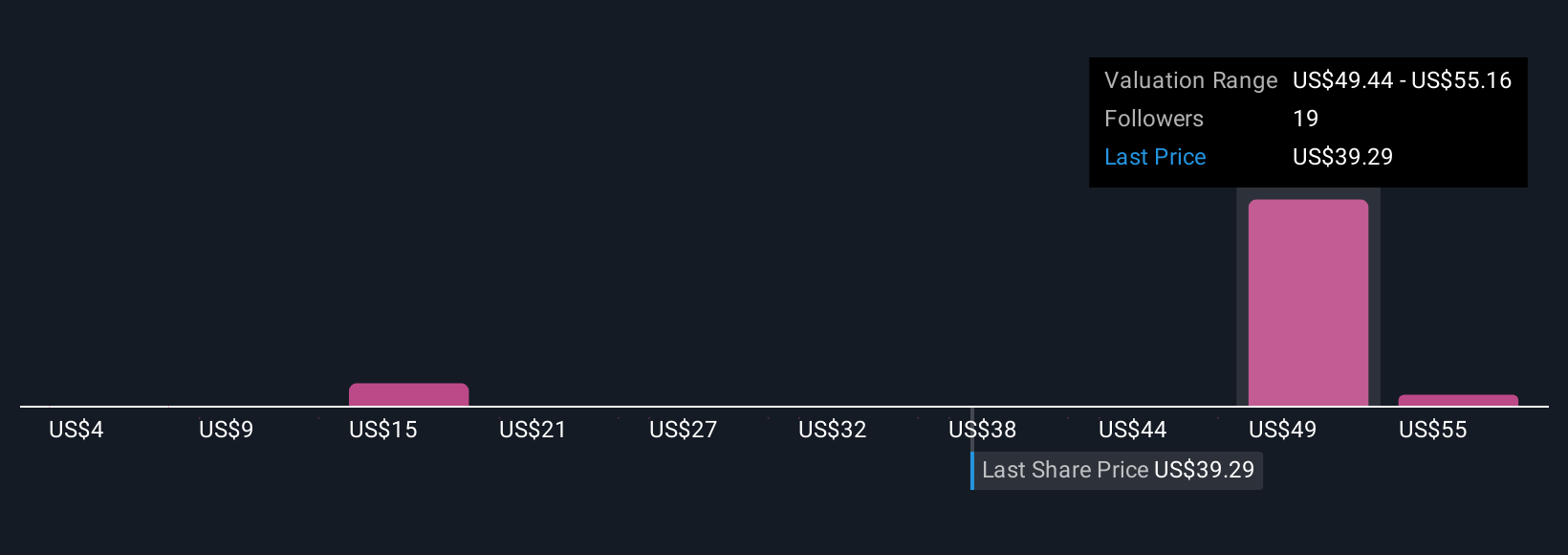

For example, some Golar LNG investors use a bullish Narrative based on 20-year FLNG charters and robust revenue projections, believing the fair value is as high as $55 per share. The most cautious investors see key risks and cap future earnings, setting their fair value closer to $44.50. Narratives help you decide where you stand and act with conviction.

Do you think there's more to the story for Golar LNG? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLNG

Golar LNG

Designs, converts, owns, and operates marine infrastructure for the liquefaction of natural gas.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives