- United States

- /

- Oil and Gas

- /

- NasdaqGS:FANG

Is Diamondback Energy’s Recent 5.5% Rally Signaling a Shift in Valuation for 2025?

Reviewed by Bailey Pemberton

Trying to figure out whether Diamondback Energy stock deserves a place in your portfolio right now? You are certainly not alone. Investors have been keeping a close eye on the energy sector, and Diamondback has just posted some intriguing numbers. After a recent 7-day gain of 5.5%, with a 3.5% uptick over the last month, it is tempting to wonder: is this a short-lived bounce or a sign of stronger momentum building?

Of course, if you zoom out just a bit, the year-to-date and one-year returns tell a slightly different story. The stock is down 11.8% so far this year and off 16.5% over the past twelve months. However, those longer-term figures are remarkable. Diamondback has delivered a staggering 615.2% return over the last five years, decisively outpacing many industry peers. Recent market optimism has been fueled partly by shifts in oil supply policy and strategic moves by Diamondback itself, as the company continues to strengthen its position in core Permian Basin assets and demonstrate financial discipline.

Plenty of investors are asking, does this recent swing create an undervaluation opportunity? According to our valuation framework, which scores companies across six key metrics, Diamondback Energy earns a perfect 6 out of 6. Not all valuation approaches are created equal, so let's break down the methods behind this score, and later, I'll share an even more compelling way to put these numbers in perspective.

Why Diamondback Energy is lagging behind its peers

Approach 1: Diamondback Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them to today's dollars. This method helps investors determine whether a stock is trading at an attractive price based on expected performance rather than on short-term market sentiment.

For Diamondback Energy, the DCF model uses a two-stage Free Cash Flow to Equity approach. The company's latest reported Free Cash Flow stands at $301.3 Million. Analyst projections estimate that annual Free Cash Flow will reach roughly $4.8 Billion by 2029, with tighter model-driven extrapolations pointing to continued growth over the next decade. These projections are developed by combining several years of analyst forecasts and then extending the outlook using carefully selected growth assumptions to capture the company's core business fundamentals.

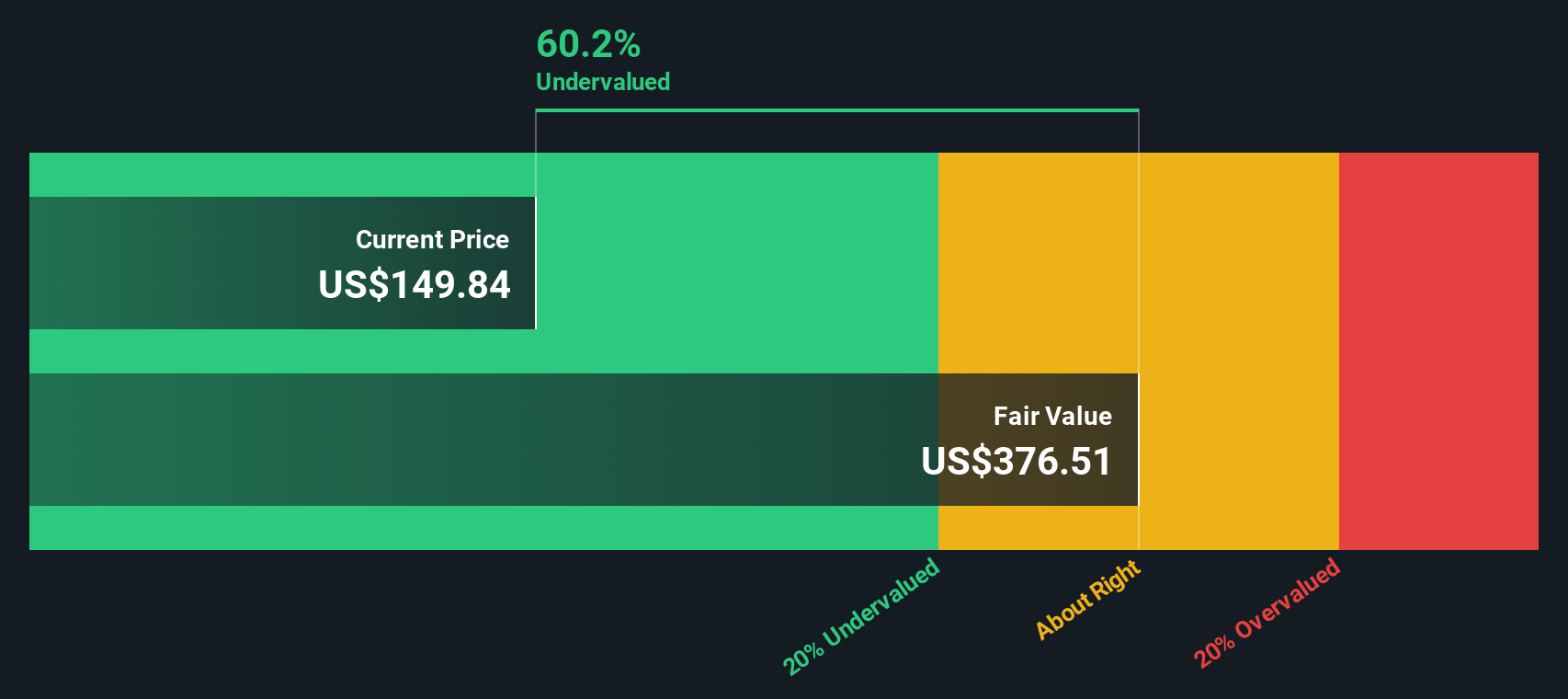

Based on these inputs, the DCF model calculates the intrinsic value of Diamondback Energy stock to be $345.23 per share, using cash flow projections in dollars and discounting them back to present value. This is approximately 57.4% higher than the current share price, suggesting the stock is significantly undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Diamondback Energy is undervalued by 57.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Diamondback Energy Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most popular methods for evaluating profitable companies because it compares the company's stock price to its earnings, giving a direct sense of how much investors are willing to pay for each dollar of profit. It is especially relevant when a business has consistent earnings growth and operates within a mature, profit-generating sector like energy.

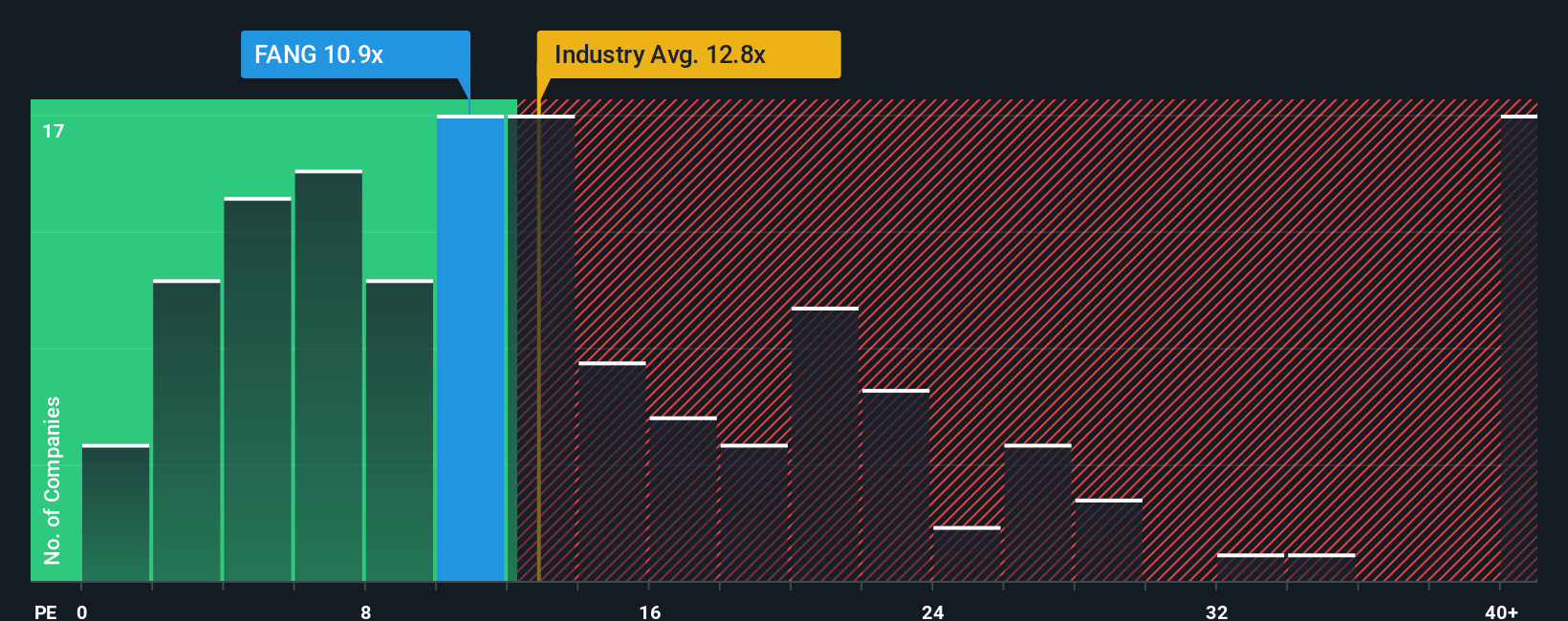

Growth prospects and risk profile significantly influence what is considered a "fair" PE ratio. Higher, more reliable earnings growth will usually justify a higher PE multiple, while increased risk and uncertain profits tend to bring it down. Right now, Diamondback Energy trades at a PE of 11.2x. For context, the average for the oil and gas industry is 12.9x, and key peers are averaging around 20.6x. On the surface, this suggests Diamondback is trading at a discount relative to its sector and peers.

Yet, it is even more insightful to consider the proprietary "Fair Ratio" developed by Simply Wall St. This figure, based on a blend of Diamondback’s expected earnings growth, profit margins, market cap, sector, and company-specific risk, is currently 17.1x for Diamondback. Unlike raw comparisons, the Fair Ratio synthesizes qualitative factors unique to Diamondback that market averages or peer comparisons may overlook.

Comparing Diamondback’s current 11.2x PE with the Fair Ratio of 17.1x, it appears the stock is undervalued on this basis as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Diamondback Energy Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you combine your personal view of a company’s story with your own forecasts for metrics like future revenue, earnings, and profit margins, turning those expectations into a fair value you can compare to the market price. Narratives help you weave real business events, strategies, and risks into a clear financial outlook, making them much more meaningful than basic ratios alone.

On Simply Wall St’s Community page, used by millions of investors, you can explore or create Narratives for Diamondback Energy in minutes. Narratives make it easy to review the logic and numbers behind different views, instantly see if the stock looks overvalued or undervalued versus its fair value, and react as new data arrives, since Narratives update dynamically with each news or earnings release.

For example, some investors are optimistic, forecasting Diamondback’s earnings will reach $5.8 billion with a bullish price target of $222, while others are more cautious, eying earnings of $2.9 billion and a price target of $143. No matter which perspective fits your view, Narratives let you test your convictions, see where you differ from consensus, and make buy or sell decisions with real conviction.

Do you think there's more to the story for Diamondback Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FANG

Diamondback Energy

An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives