- United States

- /

- Oil and Gas

- /

- NasdaqGS:FANG

Diamondback Energy (NasdaqGS:FANG) Reports Strong Q1 Earnings and Declares US$1.00 Dividend

Reviewed by Simply Wall St

Diamondback Energy (NasdaqGS:FANG) recently announced strong first-quarter 2025 earnings, reporting a revenue increase to $4,048 million from a year prior. The company also declared a $1.00 per share dividend for Q1 2025. Over the past month, Diamondback's stock price increased by 8%, a movement aligned with the broader market, which saw energy stocks gaining ground amidst rising oil prices. While the S&P 500 experienced a moderate decline due to recent tariff uncertainties and Federal Reserve developments, Diamondback’s performance provided a solid foundation, reflecting investor confidence bolstered by robust earnings and consistent dividend policies.

Diamondback Energy's recent earnings announcement, reporting a revenue increase to US$4.05 billion, alongside a US$1.00 per share dividend declaration, reinforces its financial stability and commitment to shareholder returns. This bolstered investor confidence, as reflected in the 8% rise in share price over the past month, despite broader market challenges. This price movement is also noteworthy in the context of Diamondback's longer-term performance, where the total shareholder return reached an impressive 305.58% over the past five years. This result, notably outpacing the US Oil and Gas industry's -10.5% return over the past year, signifies Diamondback's relative strength and effective operational strategies.

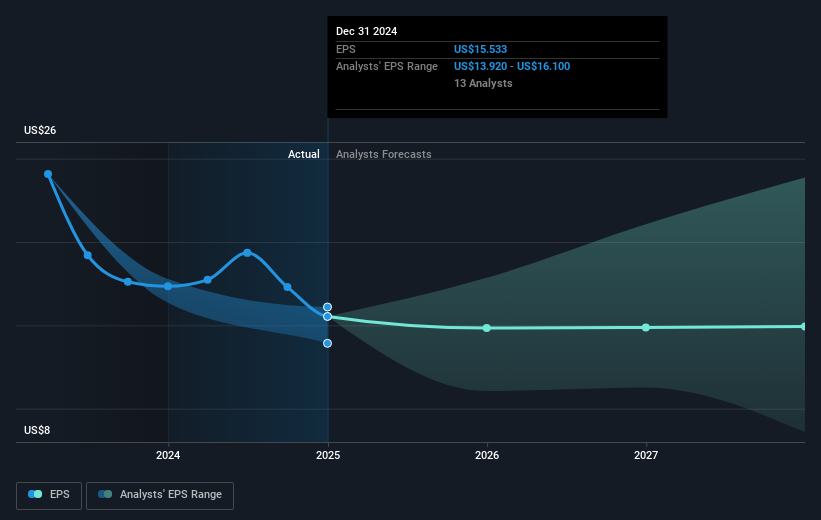

The company's involvement in mergers and acquisitions and the strategy to streamline operations by divesting non-core assets is likely to sustain this upward momentum. These moves are expected to enhance operational efficiency and improve net margins through cost reductions, potentially boosting future revenue and earnings forecasts. Analysts are anticipating a 11.9% annual revenue growth over the next three years, supported by Diamondback's innovative practices and leverage of DUC inventory. The positive shift in share price also sits within context to the consensus analyst price target of US$188.28, suggesting a potential upside, as the current share price hovers at US$136.65. However, analysts underscore that reliance on oil prices and high debt levels could pose risks to these favorable forecasts.

Assess Diamondback Energy's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FANG

Diamondback Energy

An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives