- United States

- /

- Oil and Gas

- /

- NasdaqGS:FANG

Diamondback Energy (FANG): Updated Valuation After Raising Near-Term Production Guidance

Reviewed by Simply Wall St

Most Popular Narrative: 19.4% Undervalued

According to community narrative, Diamondback Energy is currently trading below what analysts believe to be its fair value. There is a strong case for future potential based on earnings growth and efficiency-driven expansion. The consensus view is that the company is undervalued, with robust operational improvements and industry-leading cost management cited as major catalysts for price appreciation.

Ongoing consolidation in the Permian Basin positions Diamondback as the "consolidator of choice" because of its industry-best integration, low cost structure, and demonstrated ability to deliver synergies from recent large acquisitions (for example, Double Eagle and Endeavor). This supports expectations for future growth in scale, cost savings, and higher EBITDA margins.

The factors fueling this discount include strategic acquisitions, significant operational upgrades, and a clear plan for higher margins. If you are interested in projections for profits or in which milestone numbers may impact this valuation, the full report explores the forecasts and key targets that support this analyst consensus.

Result: Fair Value of $182.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising operating costs in the Permian and declines in premium drilling inventory could pressure Diamondback’s margins and create challenges for its long-term growth outlook.

Find out about the key risks to this Diamondback Energy narrative.Another View

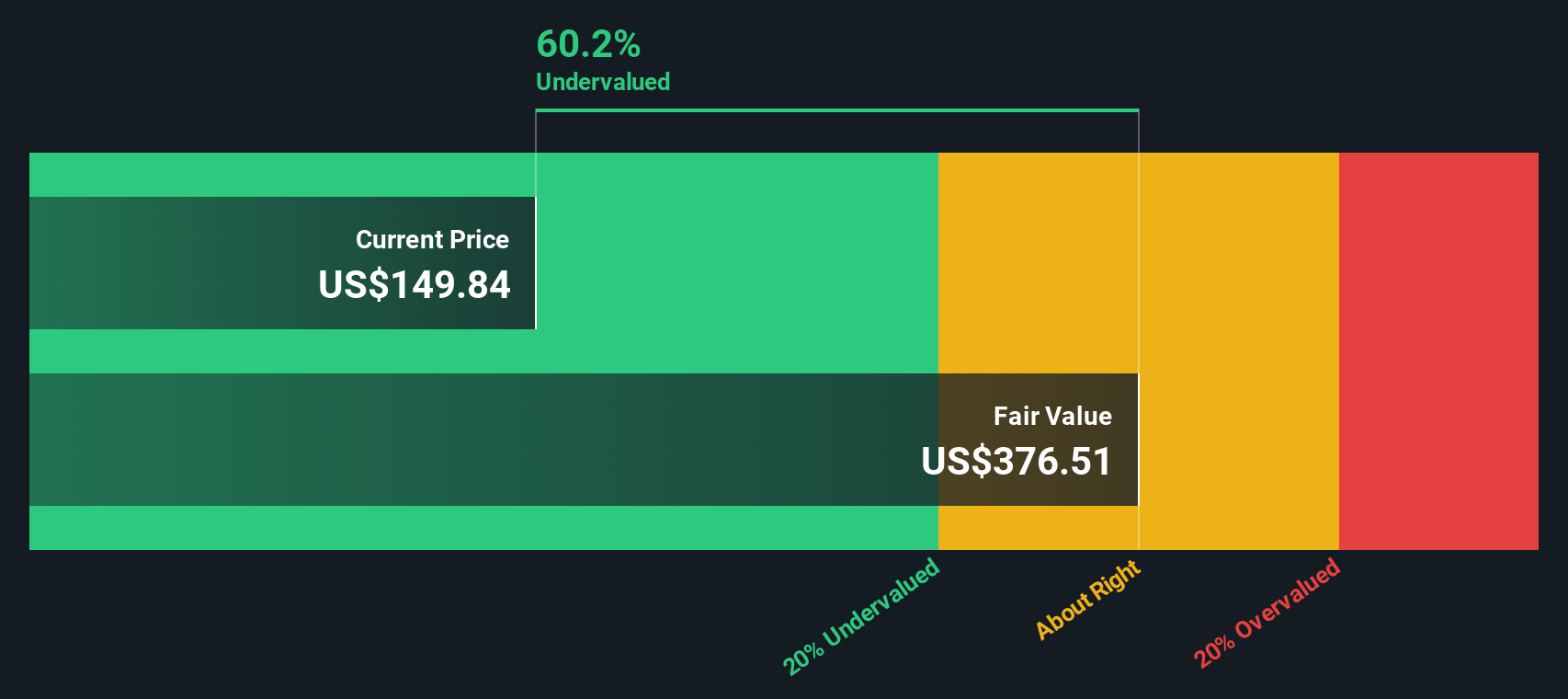

Our SWS DCF model tells a similar story, suggesting Diamondback is also undervalued when you look at its future cash flows, rather than just market multiples. Does this alignment boost your confidence or deepen your curiosity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diamondback Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diamondback Energy Narrative

If you would rather reach your own conclusions or take a different perspective, the tools are here for you to investigate and shape your own in just a few minutes. Do it your way

A great starting point for your Diamondback Energy research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not let your next big opportunity slip by. The Simply Wall Street Screener is designed to help you identify stocks with the potential to outperform your expectations. Give yourself an advantage and review these handpicked themes tailored for forward-thinking investors:

- Uncover hidden value by targeting companies that are likely undervalued based on future cash flows with undervalued stocks based on cash flows locked in.

- Generate recurring income with a focus on top performers yielding over 3%. Check out dividend stocks with yields > 3% and see how the strongest dividend payers compare.

- Jump ahead of the curve in artificial intelligence disruption with AI penny stocks at the forefront of innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:FANG

Diamondback Energy

An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives