- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

Upcoming Earnings and AI Focus Might Change the Case for Investing in Expand Energy (EXE)

Reviewed by Sasha Jovanovic

- Expand Energy Corporation announced it would release its 2025 third quarter operational and financial results after market close on October 28, 2025, followed by a conference call on October 29 for further discussion and Q&A.

- Analyst coverage has recently highlighted Expand Energy's position as the largest U.S. natural gas producer and its ability to quickly scale operations using AI and machine learning for added efficiencies.

- We'll explore how increased analyst optimism around operational efficiency and demand growth is reshaping Expand Energy's investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Expand Energy Investment Narrative Recap

To be a shareholder in Expand Energy today, you need to believe in the company’s ability to sustain operational gains and capitalize on rising natural gas demand, while managing exposure to commodity cycles and regulatory changes. The recent earnings announcement and upcoming Q3 results are important, but do not materially shift the main near-term catalyst: the pace at which operational efficiencies from AI and scale can drive margin improvement. The most immediate risk, potential cost pressure from mature basin concentration, remains largely unchanged by this news.

Of the recent company updates, the September expansion of Expand Energy’s unsecured revolving credit facility to US$3.5 billion stands out for its relevance. This enhanced liquidity provides the flexibility to invest in technology, fund operational improvements, or buffer against cost swings, tying directly into the company’s ability to realize the operational catalysts that seem central to its narrative.

In contrast, investors should not overlook the risk that reliance on mature basins like Haynesville could create unexpected cost or productivity headwinds...

Read the full narrative on Expand Energy (it's free!)

Expand Energy's outlook expects $13.2 billion in revenue and $4.0 billion in earnings by 2028. This is based on an annual revenue growth rate of 14.3% and a dramatic earnings increase of $3.8 billion from the current $206 million.

Uncover how Expand Energy's forecasts yield a $128.78 fair value, a 28% upside to its current price.

Exploring Other Perspectives

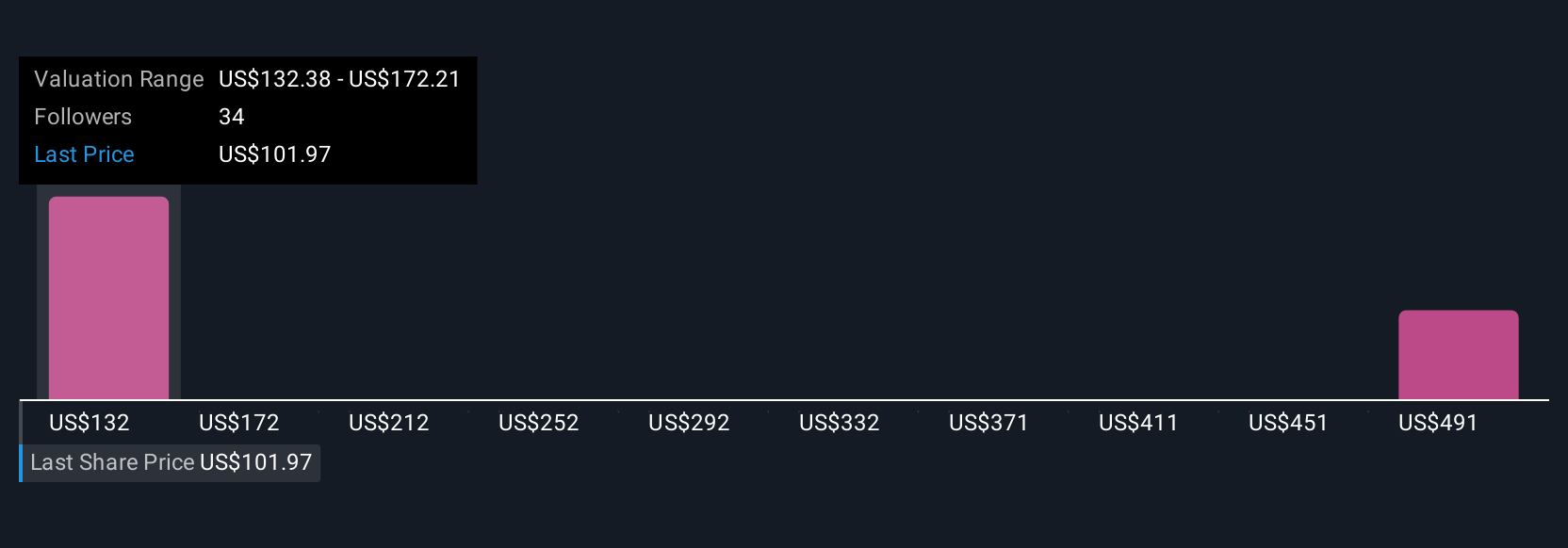

Simply Wall St Community estimates for Expand Energy’s fair value range from US$128.78 to US$386.25, based on two independent analyses. While many see opportunity in expected operational efficiencies, others caution that concentration in older basins could affect margin growth over time, consider a variety of viewpoints before making decisions.

Explore 2 other fair value estimates on Expand Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Expand Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expand Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Expand Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expand Energy's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives