- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

Should Expand Energy's (EXE) Increased Synergy Savings and Lower Capital Spending Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Expand Energy Corporation recently presented at the Pickering Energy Partners Austin Energy Conference 2025, where CEO Nick Dell Osso addressed the company's updated capital spending and synergy savings guidance following its fiscal Q2 2025 results.

- An interesting insight is that Expand Energy increased its projected annual synergy savings target to US$600 million by the end of 2026, while also lowering full-year drilling and completion capital spending by around US$100 million, in response to evolving market and operational dynamics.

- We will explore how Expand Energy's revised capital spending and higher synergy savings targets influence its broader investment narrative and future earnings outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Expand Energy Investment Narrative Recap

To be a shareholder in Expand Energy, you need to believe in a sustained demand for natural gas and the company’s ability to unlock operational efficiencies and realize significant cost savings in its core basins. The recent announcement, lowering capital spending by US$100 million and raising annual synergy savings to US$600 million, reinforces their focus on maintaining margins and free cash flow, but does not materially shift the biggest current catalyst: success in driving well productivity gains across their asset base. The main near-term risk, rising production costs if drilling efficiencies stall, remains unchanged by this event.

One announcement that stands out following the fiscal Q2 earnings is the increase in projected synergy savings to US$600 million by the end of 2026. This commitment builds on recent efforts to repurchase shares and return capital to shareholders, highlighting the importance of ongoing cost savings in supporting future earnings amid wider operational challenges.

Yet, investors should be aware that rapid cost improvements may not fully offset the risks if underlying resource productivity begins to weaken...

Read the full narrative on Expand Energy (it's free!)

Expand Energy's narrative projects $13.2 billion revenue and $4.0 billion earnings by 2028. This requires 14.3% yearly revenue growth and a $3.8 billion earnings increase from $206.0 million today.

Uncover how Expand Energy's forecasts yield a $128.78 fair value, a 19% upside to its current price.

Exploring Other Perspectives

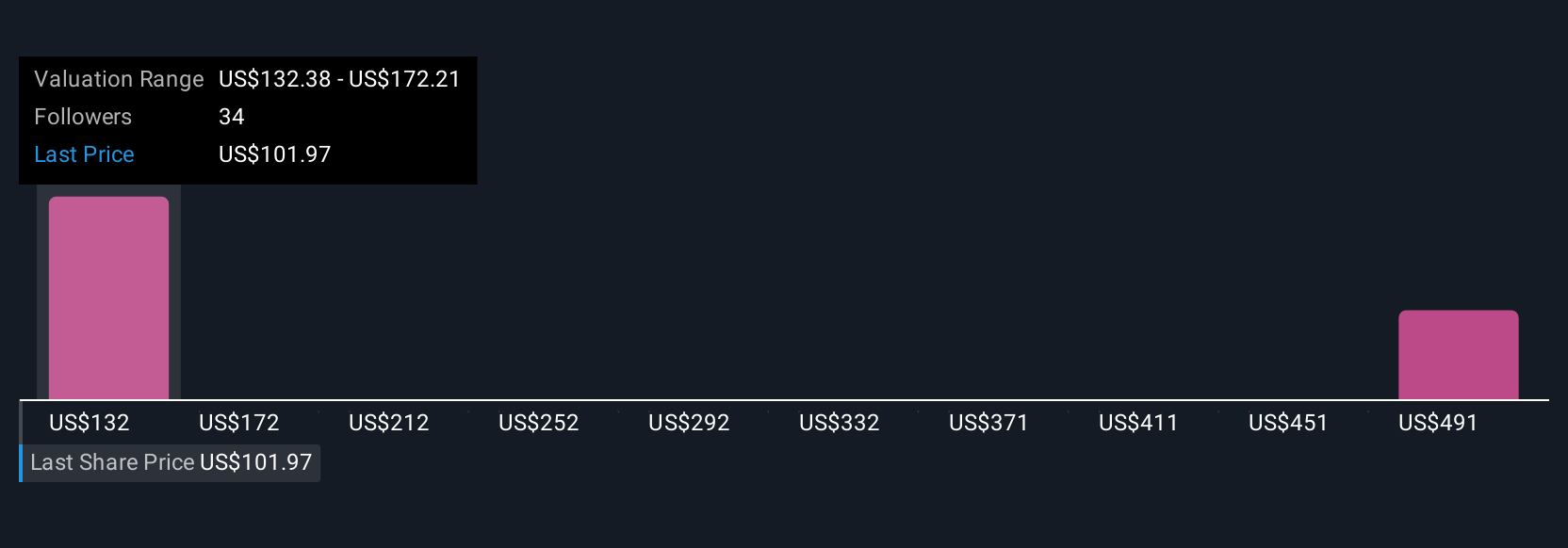

Fair value estimates from the Simply Wall St Community span from US$128.78 to US$537.99 across two analyses. Many see room for profit growth, but diverging views around drilling productivity highlight the broader debate over long-term margin strength.

Explore 2 other fair value estimates on Expand Energy - why the stock might be worth over 4x more than the current price!

Build Your Own Expand Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expand Energy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Expand Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expand Energy's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives