- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

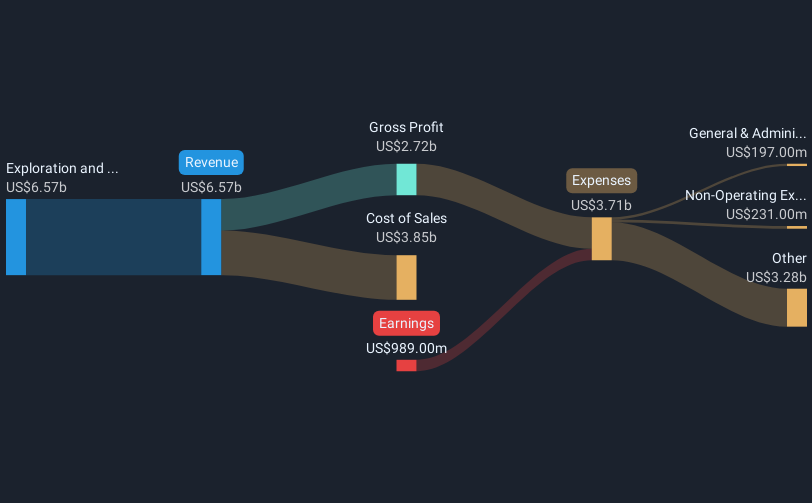

Expand Energy (NasdaqGS:EXE) Reports Higher Revenue But Posts US$249 Million Net Loss

Reviewed by Simply Wall St

Expand Energy (NasdaqGS:EXE) announced its quarterly dividend affirmation and reported a net loss of $249 million in Q1 2025, despite a significant revenue increase. The company’s share price moved up by 4.78% over the last quarter. This gain aligns with broader market trends, as the market rose 5.2% over the same period. Notably, inclusion in multiple indices, like the S&P 500, likely provided upward momentum and investor attention. While the economic conditions reflected by lower GDP and tech sector volatility posed challenges, the company’s steady dividend and index recognitions may have buoyed investor confidence.

Every company has risks, and we've spotted 2 weaknesses for Expand Energy you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent dividend affirmation and net loss announcement for Expand Energy could have nuanced impacts on the company's overall narrative. While the net loss of US$249 million in Q1 2025 may initially raise concerns, the 4.78% share price increase this past quarter indicates investor confidence, possibly driven by the company's inclusion in indices like the S&P 500. Over the longer term, Expand Energy's total return, including dividends, was 42.51% over the past three years, reflecting a solid uptrend despite short-term financial challenges. Additionally, the company outperformed the US Oil and Gas industry over the last year, which faced a 9.9% return decline.

The news could have implications for revenue and earnings forecasts as the company focuses on integration and drilling performance synergies. Projections anticipate annual revenue growth of 31.7%, with synergies helping to improve margins and reduce capital expenses. However, the inherent risks surrounding natural gas market conditions and execution of strategic plans should be considered in this context. The recent price movement, aligning closely with current analyst price targets, suggests currently balanced valuation expectations. With a consensus price target of US$123.63, the share price shows a moderate discount to projected fair value, indicating potential for continued performance if strategic milestones are achieved.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives