- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLMT

Can Calumet's (CLMT) Jet Fuel Expansion Strengthen Its Position in Sustainable Aviation Markets?

Reviewed by Sasha Jovanovic

- Montana Renewables, in cooperation with Calumet Montana Refining, has commissioned new on-site blending and shipping facilities to supply a nominal 50/50 blend of renewable and fossil jet fuel that meets ASTM D7566 and D1655 standards, now available through AEG Fuels in select Northwestern U.S. aviation hubs.

- This development expands Calumet's reach in the renewable aviation fuel market by enabling distribution of a drop-in compatible product to key regional airports.

- We'll explore how this expansion into renewable jet fuel blending could influence Calumet's outlook in the growing sustainable fuels market.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Calumet Investment Narrative Recap

To be a shareholder in Calumet, you need to believe in the company’s ability to capitalize on expanding renewable fuel markets, especially sustainable aviation fuels (SAF), against a backdrop of volatile regulatory and commodity cycles. The commissioning of blending facilities for SAF broadens Calumet’s product reach but is unlikely to materially offset the current primary risks in the short term: heavy reliance on regulatory support for margins and persistent earnings volatility tied to market and policy uncertainty.

The upcoming Q3 2025 earnings release on November 7, 2025, stands out as a key announcement that connects directly to current catalysts and risks. These results will provide the most timely window into operational progress, cash flow visibility, and whether recent capital investments, such as SAF blending expansions, are translating into improved margins or dampening the company’s exposure to regulatory and market shifts.

By contrast, investors should be conscious that regulatory changes can reduce government support for renewables, leading to...

Read the full narrative on Calumet (it's free!)

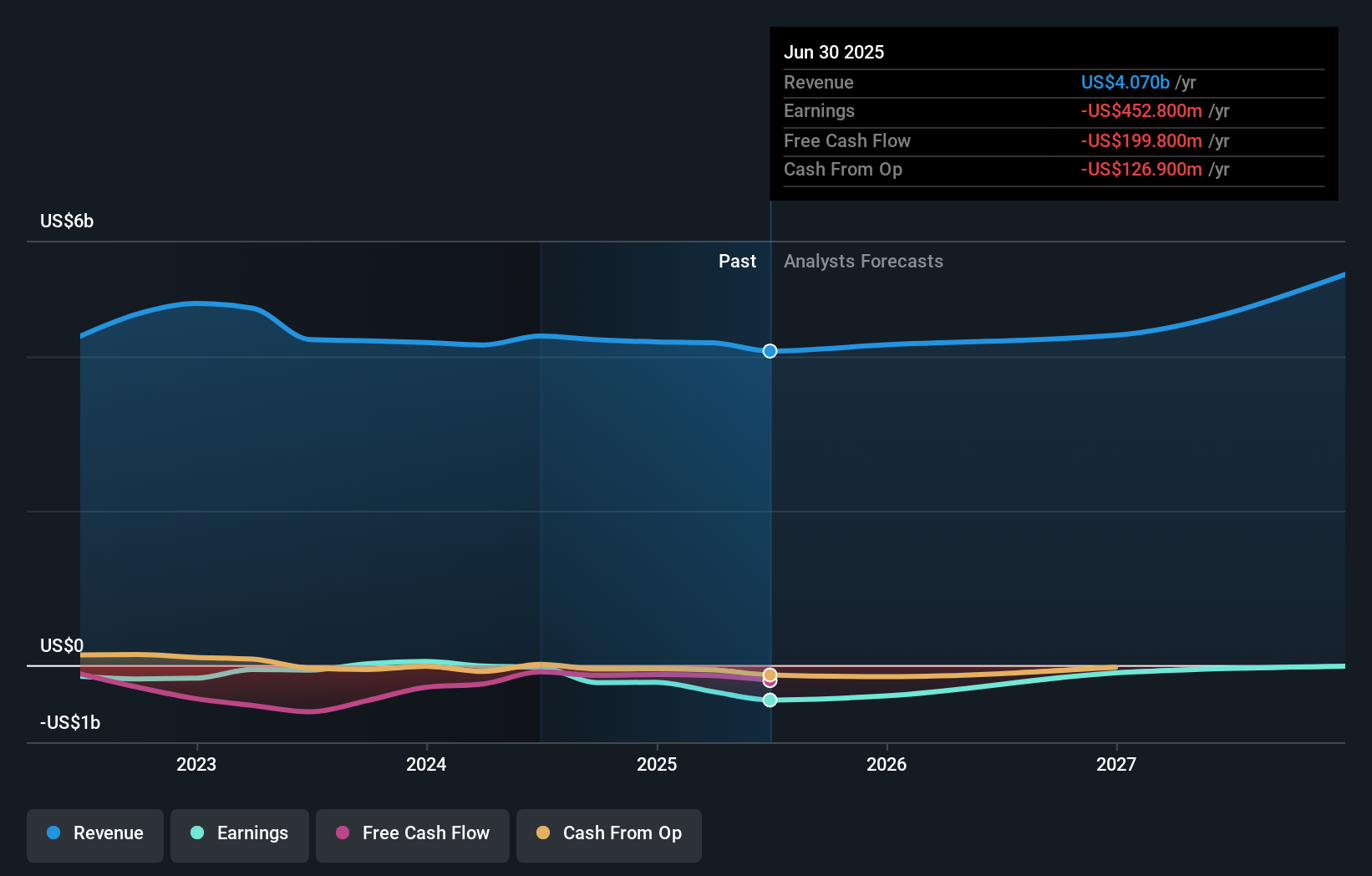

Calumet's outlook projects $5.1 billion in revenue and $40.3 million in earnings by 2028. This is based on an expected 8.0% annual revenue growth rate and a $493.1 million increase in earnings from the current level of $-452.8 million.

Uncover how Calumet's forecasts yield a $19.25 fair value, a 3% downside to its current price.

Exploring Other Perspectives

With only three fair value estimates from the Simply Wall St Community, opinions on Calumet’s worth stretch from US$19.25 to US$52.30 per share. Some community members see growth potential linked to regulatory tailwinds for renewables, yet concerns about earnings volatility and policy risk remain front of mind for others, take the time to compare these alternate outlooks.

Explore 3 other fair value estimates on Calumet - why the stock might be worth over 2x more than the current price!

Build Your Own Calumet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Calumet research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Calumet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Calumet's overall financial health at a glance.

No Opportunity In Calumet?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLMT

Calumet

Manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives