- United States

- /

- Oil and Gas

- /

- NasdaqGS:CHRD

Is Chord Energy's (CHRD) Steady Dividend Enough to Offset Softer Profits and Production Guidance?

Reviewed by Sasha Jovanovic

- Chord Energy Corporation recently announced its third quarter 2025 results, reporting decreased revenue and net income compared to the prior year, alongside updates to production guidance and confirmation of its quarterly dividend at US$1.30 per share.

- The company's steady overall production volumes contrasted with lower profitability for both the quarter and nine-month period, drawing attention to the balance between operational output and financial performance.

- We will now explore how the reported lower revenue and updated production outlook may alter Chord Energy's investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Chord Energy Investment Narrative Recap

For investors in Chord Energy, the case rests on confidence in the company's ability to sustain efficient operations in the Williston Basin and generate robust free cash flow, primarily through technological and operational enhancements. The latest financial results, marked by stable production but reduced revenue and net income, do not meaningfully alter the near-term catalyst of operational efficiency, though they do reinforce the risk around margin pressure from ongoing production declines in unconventional wells.

Among recent announcements, Chord's confirmation of a US$1.30 per share quarterly dividend stands out. Maintaining this payout amid lower earnings underscores the company's commitment to shareholder returns, though ongoing margin compression could challenge future sustainability.

In contrast, investors should remain mindful of region-specific risks, as the company’s focus in the Williston Basin exposes it to...

Read the full narrative on Chord Energy (it's free!)

Chord Energy's outlook anticipates $4.4 billion in revenue and $1.0 billion in earnings by 2028. This scenario assumes a 4.3% annual revenue decline and a $734 million increase in earnings from the current $265.7 million.

Uncover how Chord Energy's forecasts yield a $128.59 fair value, a 38% upside to its current price.

Exploring Other Perspectives

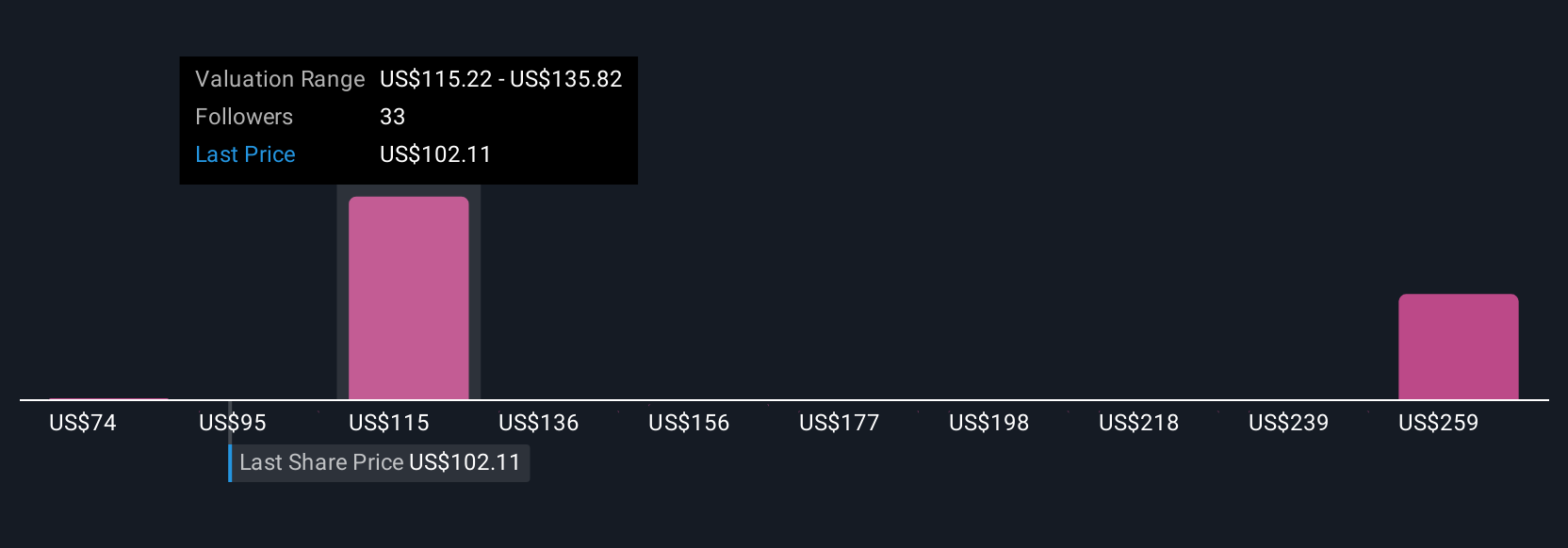

Five fair value estimates from the Simply Wall St Community range from US$74 to US$386.47 per share. Given the ongoing risk of high production decline rates impacting capital needs, these differing views highlight why it pays to consider several perspectives when assessing Chord Energy’s performance.

Explore 5 other fair value estimates on Chord Energy - why the stock might be worth over 4x more than the current price!

Build Your Own Chord Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Chord Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chord Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRD

Chord Energy

Operates as an independent exploration and production company in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives