- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

What Baker Hughes (BKR)'s Potential Oilfield Services Spin-Off Means for Shareholders

Reviewed by Sasha Jovanovic

- On November 23, 2025, Ananym Capital Management LP publicly urged Baker Hughes to spin off its Oilfield Services and Equipment business, contending this move could unlock significant value for shareholders.

- The activist highlighted Baker Hughes' leading position in LNG turbomachinery and cited a potential for meaningful upside if the company separates its core segments.

- We’ll explore how Ananym Capital’s push for a business separation could influence Baker Hughes’ risk-reward outlook and long-term growth drivers.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Baker Hughes Investment Narrative Recap

To be a Baker Hughes shareholder, you need to believe in the company's potential to drive growth across both traditional oilfield services and newer energy technologies, balancing commodity exposure with the pursuit of higher-margin, less cyclical markets. The call by Ananym Capital to spin off the Oilfield Services and Equipment business may bring renewed focus to unlocking value, but does not fundamentally shift the biggest near-term catalyst, growth in energy transition contracts, or the primary risk: ongoing volatility in commodity-linked earnings.

One of the most relevant recent developments was Baker Hughes’ Q3 report showing sales rose slightly to US$7.01 billion, but net income declined from US$766 million to US$609 million and EPS slipped to US$0.61. This change in profitability sharpens the spotlight on operational efficiencies and underscores how earnings mix improvement is critical as the company weighs major structural decisions.

On the other hand, investors should be aware that persistent exposure to upstream oil and gas markets means Baker Hughes is especially sensitive to ...

Read the full narrative on Baker Hughes (it's free!)

Baker Hughes is projected to generate $29.1 billion in revenue and $2.9 billion in earnings by 2028. This outlook assumes a modest 1.8% annual revenue growth and a decrease in earnings of $0.1 billion from the current $3.0 billion level.

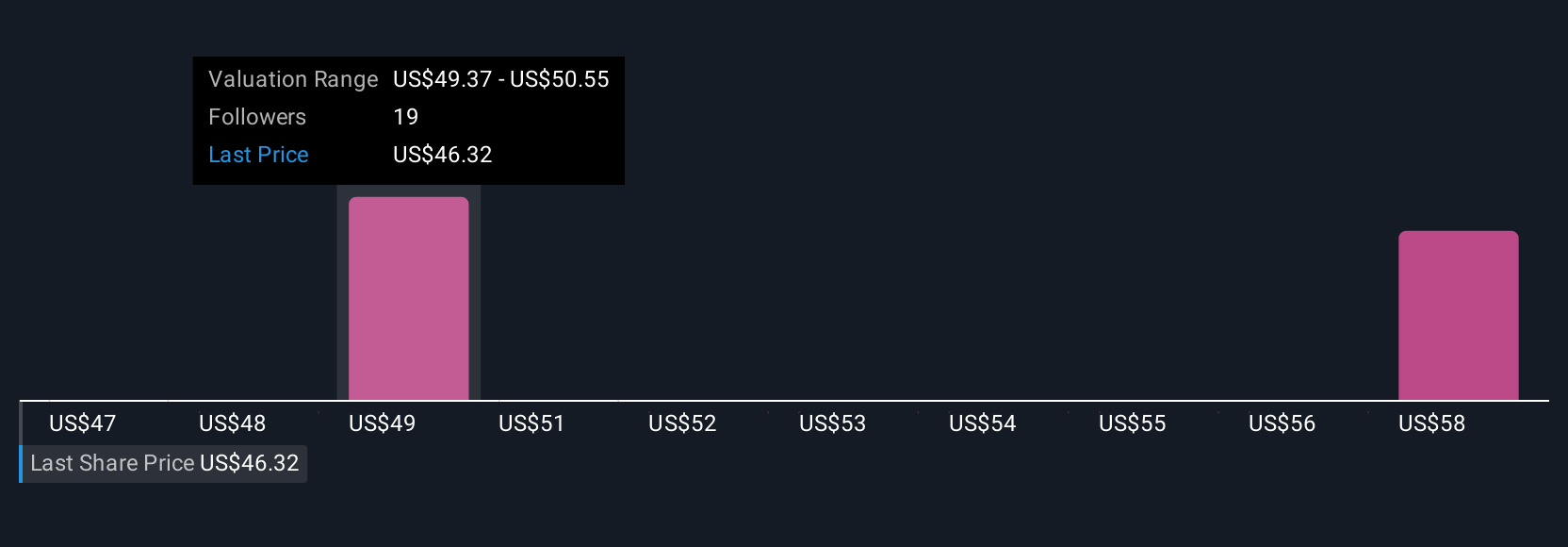

Uncover how Baker Hughes' forecasts yield a $52.52 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Four different fair value estimates from the Simply Wall St Community ranged between US$50 and US$71, highlighting contrasting expectations for Baker Hughes’ upside. In light of ongoing activist pressure around business separation, these varying viewpoints reflect how much broader company performance can depend on shifts in segment focus and earnings mix.

Explore 4 other fair value estimates on Baker Hughes - why the stock might be worth just $50.00!

Build Your Own Baker Hughes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baker Hughes research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Baker Hughes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baker Hughes' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success