- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (BKR): Margin Gains Reinforce Bullish Narratives Despite Slower Earnings Growth

Reviewed by Simply Wall St

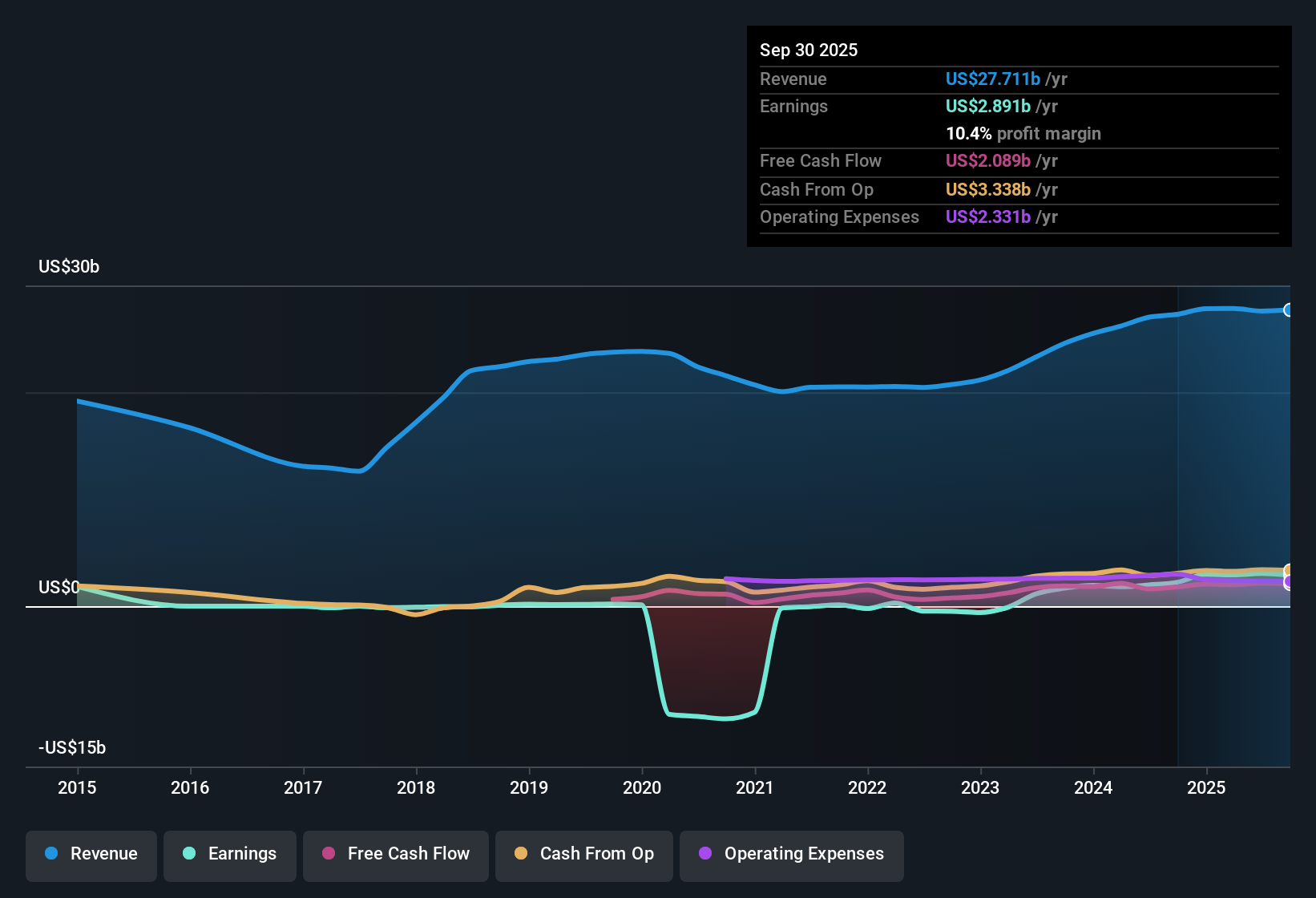

Baker Hughes (BKR) delivered robust earnings growth this period, with net profit margins rising to 11% from 7.4% a year ago. This reflects high quality profits and a solid track record. The company has grown earnings at an impressive 87.1% per year over the past five years, though the most recent annual growth of 53% indicates the pace may be moderating. Investors will note that while earnings momentum remains strong, the company’s profitability trend and valuation below intrinsic value estimates offer compelling rewards. However, the outlook for future growth is more subdued compared to the broader market.

See our full analysis for Baker Hughes.The next step is to see how this set of results compares with the consensus narratives. Some expectations may be confirmed, while others might be up for debate.

See what the community is saying about Baker Hughes

Profit Margins Signal Operational Muscle

- Net profit margins expanded to 11% from 7.4% last year, as the company's margin improvement outpaces many of its peers in the energy services industry.

- Analysts' consensus view highlights that multi-year gains in operating leverage, combined with optimized technology-driven offerings, are driving this 600 basis point margin expansion over five years.

- Consensus narrative notes the ongoing shift toward higher-margin digital and energy transition segments, which underpin both current and future profitability.

- This expansion supports the analysts' expectation that earnings durability will be maintained, even as overall market growth rates ease.

Surging margins do not tell the whole story. See what the consensus sees in Baker Hughes' big-picture outlook. 📊 Read the full Baker Hughes Consensus Narrative.

Growth Slowdown Versus U.S. Market

- Baker Hughes’ earnings are forecast to grow by 9.3% per year, and revenue by 2.6% per year, both of which are well below the US market averages of 15.5% and 10% respectively.

- Analysts' consensus view contends that while expansion into distributed power and digital infrastructure offers new recurring revenues, forecasts for margin compression to 10% in three years and limited top-line growth create tension with the optimism about long-term earnings.

- Bears argue that the reliance on slow-moving energy transition segments and market exposure make high double-digit growth unlikely in the near term.

- The consensus further points to the company's dependence on large contracts in volatile sectors, which could result in unpredictable earnings if energy trends shift suddenly.

Valuation Sits Below DCF Fair Value

- Baker Hughes trades at a Price-to-Earnings ratio of 15.3x, above its peer average of 14.8x but below the sector average of 16.3x. Its current share price of $47.29 is at a notable 23% discount to its DCF fair value of $61.44.

- Analysts' consensus view emphasizes that despite muted growth forecasts, the valuation gap implies the market sees more risk than the fundamentals alone would suggest.

- Consensus points out the analyst price target of $51.71 is only 9% above today’s share price, calling into question expectations for re-rating without a clear catalyst.

- The narrative notes investors will need to believe in higher multiples on lower projected earnings for the current market expectations to play out.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Baker Hughes on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the data? Share your unique view and shape your own story in just minutes by clicking Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Baker Hughes.

See What Else Is Out There

Baker Hughes faces uncertain growth prospects and limited top-line expansion, which may make it less appealing for those seeking predictable performance in changing markets.

If you want greater consistency instead, check out stable growth stocks screener (2099 results) to find companies with a stronger track record of steady revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives