- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (BKR): Exploring Valuation as Shares Rally 19% Year to Date

Reviewed by Simply Wall St

See our latest analysis for Baker Hughes.

Momentum has clearly been building for Baker Hughes lately, with a 1-month share price return of 6.3% and a solid year-to-date gain of over 19%. This recent climb follows a string of impressive long-term results, as the company's 5-year total shareholder return sits at an outstanding 186%.

If Baker Hughes’ run has you wondering where else strong momentum and growth might be playing out, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading close to analyst targets and strong momentum behind them, investors need to ask whether Baker Hughes is undervalued at this stage or if the recent gains indicate that markets are already priced for future growth.

Most Popular Narrative: 5.7% Undervalued

Based on the prevailing narrative, Baker Hughes shares last closed at $49.53, while the fair value is pegged at $52.52. The gap suggests room for potential upside, with the narrative framing this advantage in the context of sector momentum and strategic positioning.

The company's strong momentum in securing large-scale service contracts, framework agreements, and technology-driven orders (such as for data centers, LNG, CCS, and recurring gas tech services) is driving an all-time high IET backlog. This is building strong visibility into future revenue and supporting sustained earnings durability.

Curious what’s really powering this premium? The secret ingredient is a combination of surging service backlogs and ambitious future profit assumptions. Want the whole formula behind this eye-catching valuation? Take a closer look to discover which forecasts and structural bets are fueling expectations for Baker Hughes’ next chapter.

Result: Fair Value of $52.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as persistent cost inflation and continued exposure to volatile oil and gas markets could challenge Baker Hughes' projected growth and margin expansion.

Find out about the key risks to this Baker Hughes narrative.

Another View: Market Multiples Add Context

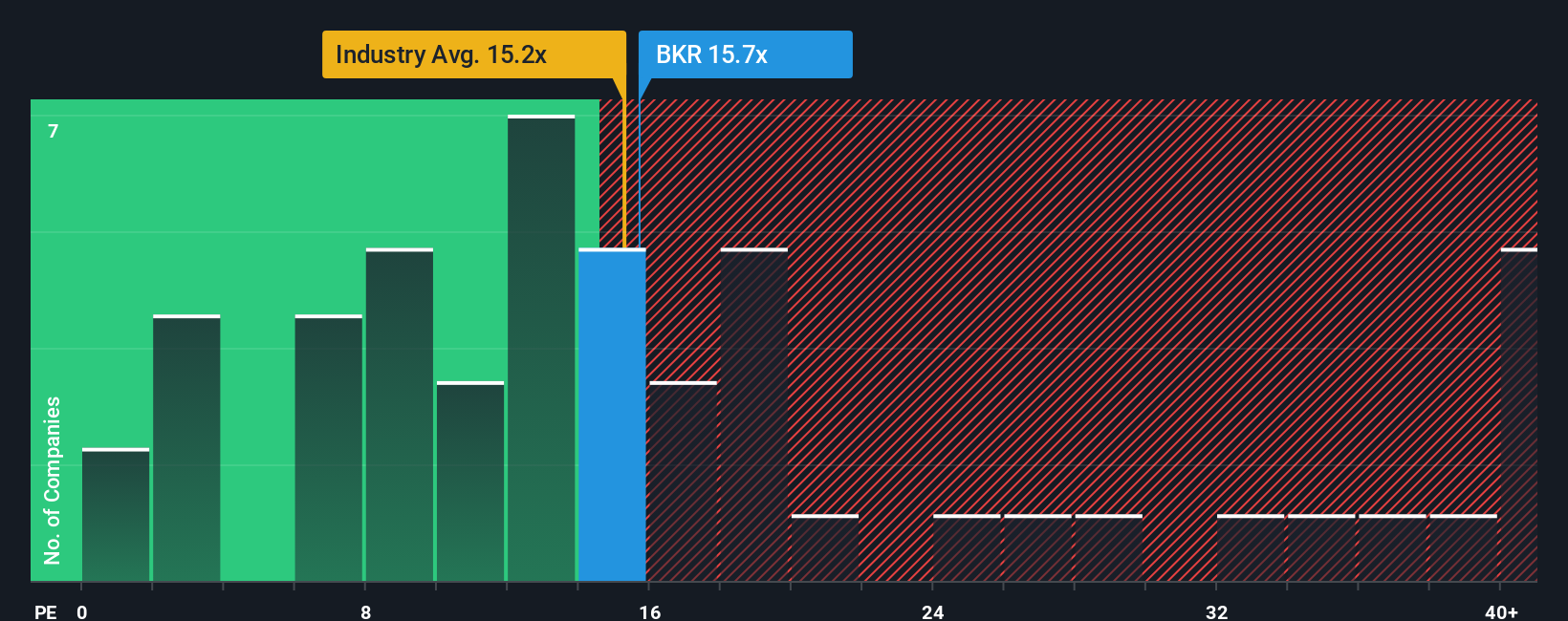

While some models see Baker Hughes as undervalued, looking at the price-to-earnings ratio paints a more nuanced picture. Baker Hughes trades at 16.9x earnings, slightly above its industry average of 16.8x and the peer average of 16.1x. However, it remains below the fair ratio of 17.7x. This suggests upside may still exist but is not guaranteed. Are investors being too cautious, or is the risk premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Baker Hughes Narrative

If you think the story goes deeper or want to bring your own data-driven perspective, it only takes a few minutes to create your own view. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Baker Hughes.

Looking for More Investment Ideas?

Smart investors never limit their watchlist. Give yourself an edge by using the Simply Wall Street Screener. These opportunities are moving fast, so secure your spot early.

- Capitalize on surging demand in artificial intelligence by tracking these 25 AI penny stocks, which are poised to disrupt industries with their groundbreaking tech and real-world applications.

- Grow your income potential by reviewing these 15 dividend stocks with yields > 3%, which features steady yields above 3% and highlights companies that stand out for consistency and financial strength.

- Step ahead of the curve by checking out these 928 undervalued stocks based on cash flows, where you’ll spot stocks trading below intrinsic value, opening the door for compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success