- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (BKR): A Fresh Look at Value as Investor Focus Shifts in 2024

Reviewed by Simply Wall St

Baker Hughes (BKR) shares have had a mixed run this month, with recent stock moves sparking interest among investors. Some traders are weighing the company's underlying value as they look for clues in its performance trends.

See our latest analysis for Baker Hughes.

While Baker Hughes shares have seen some choppy trading in the past month, a look back reveals strong momentum in total shareholder return, up 27.37% over the past year and an impressive 239.35% in five years. This mix of recent cooling and longer-term growth keeps investors' focus on how evolving industry dynamics might shape future opportunities and risks.

If you're curious what other stocks are gaining traction this year, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With Baker Hughes now trading at a 20% discount to its estimated intrinsic value and still below analysts' price targets, the big question is whether there is real upside from here or if the market already reflects its growth potential.

Most Popular Narrative: 9.9% Undervalued

With a fair value estimate of $51.75 per share from the most popular narrative and the last close at $46.60, Baker Hughes is seen as notably below its projected worth, raising questions about what drives this valuation gap in analysts' eyes.

The company's strong momentum in securing large-scale service contracts, framework agreements, and technology-driven orders (such as for data centers, LNG, CCS, and recurring gas tech services) is driving an all-time high IET backlog, building strong visibility into future revenue and supporting sustained earnings durability.

Want to uncover what makes this estimate so bold? There is a hidden blend of recurring revenue bets and future profit multiples that could shape the next five years. The details behind the projected growth and the critical numbers that set this valuation apart are waiting for those who want the full story.

Result: Fair Value of $51.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting economic conditions or unexpected policy changes could quickly dampen the outlook and challenge Baker Hughes' long-term growth narrative.

Find out about the key risks to this Baker Hughes narrative.

Another View: Looking Beyond the Headlines

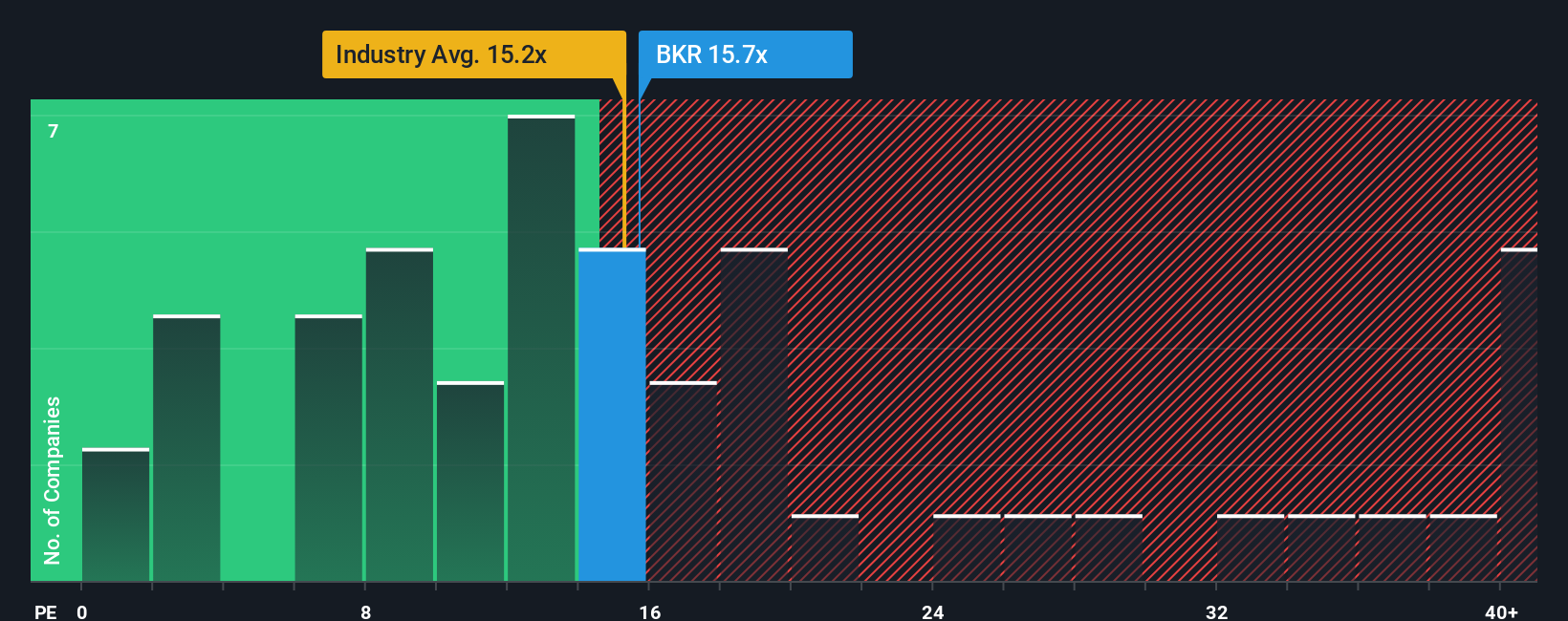

Shifting the lens to price-to-earnings, Baker Hughes trades at 15.9x earnings. This is a touch higher than the peer average of 15.0x, but a little below the U.S. Energy Services industry average of 16.3x, and under its fair ratio of 17.6x. Such a position hints at a market with mixed conviction. Do these gaps reveal hidden value or reflect uncertainty that investors should heed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Baker Hughes Narrative

If these conclusions don't quite match your outlook or you'd rather check the numbers yourself, you can easily craft your own perspective in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Baker Hughes.

Looking for More Investment Ideas?

Make your next smart investing move by acting now, not later. The right ideas set you apart, and opportunities are waiting for those who take action with confidence.

- Target rising tech by tapping into these 27 AI penny stocks, which are at the forefront of artificial intelligence and automation growth.

- Boost your passive income strategy by unlocking these 19 dividend stocks with yields > 3%, offering attractive yields and proven financial resilience.

- Tap into the potential for significant gains with these 3566 penny stocks with strong financials, featuring solid fundamentals and hidden value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives