- United States

- /

- Oil and Gas

- /

- NasdaqGS:ARLP

Alliance Resource Partners (ARLP) Profit Margin Drops to 10.2%, Challenging Bullish Value Narrative

Reviewed by Simply Wall St

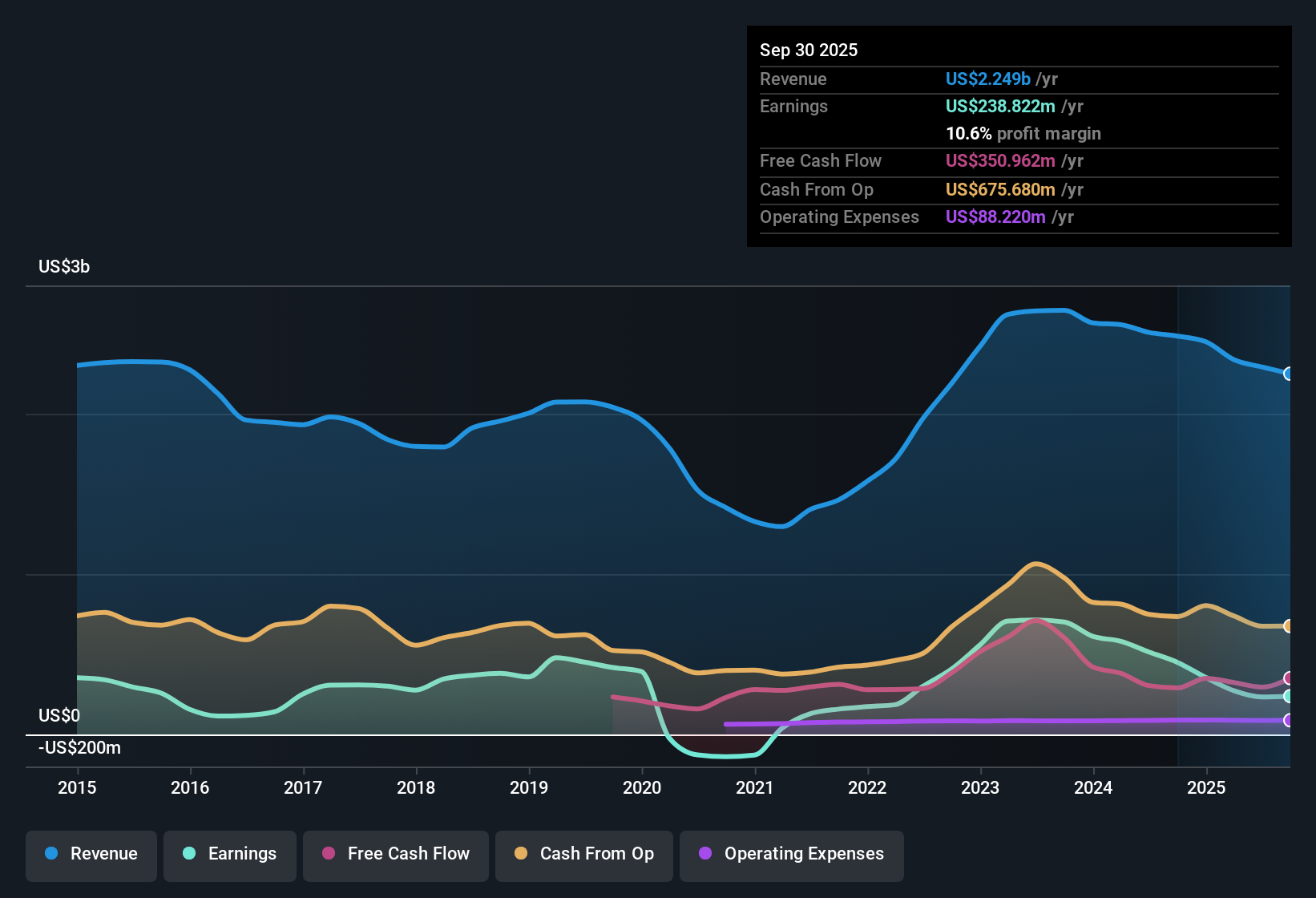

Alliance Resource Partners (ARLP) posted a net profit margin of 10.2% this year, down from 20.5% last year, with earnings growth turning negative after averaging a 29.8% annual increase over the past five years. At $24 per share, ARLP trades at a 13.2x price-to-earnings ratio, above the industry average but well below peers, and notably under the estimated fair value of $66.04 from discounted cash flow analysis. While future earnings growth is forecast at 7.8% per year, which is less robust than the broader US market’s 15.5%, investors are weighing the value appeal and high-quality earnings against shrinking margins and renewed dividend sustainability concerns.

See our full analysis for Alliance Resource Partners.Now let’s see how these results stack up against the most widely held narratives. Some perspectives will hold up, while others might need to be re-examined.

See what the community is saying about Alliance Resource Partners

Margins Set to Rebound by 60%

- Analysts expect Alliance Resource Partners’ profit margins to rise from the current 10.2% to 16.4% within three years, signaling a potential 60% improvement in profitability as cost measures and royalties from oil and gas begin to offset coal pricing headwinds.

- According to the analysts' consensus view, resilience in coal demand and new long-term utility contracts are seen as the backbone of this margin recovery.

- A tight US energy market and legislative moves to support baseload generation are extending coal plant lifespans, which adds visibility for higher-margin sales.

- Additionally, ARLP’s diversification into oil and gas royalties is helping insulate cash flow from swings in coal prices, supporting the belief in a more stable, higher-margin business.

Fueling further optimism that margins will rebound alongside new contracts and royalty revenues, many analysts think ARLP’s strategy could far outperform expectations. 📊 Read the full Alliance Resource Partners Consensus Narrative.

Coal Price Pressures Challenge Stability

- The average coal sales price per ton dropped 11.3% year over year, with management also guiding for a further 5% decrease in 2026, highlighting a persistent pricing slide as older, higher-priced contracts expire.

- Consensus narrative points out the uncertainty this brings.

- Declining contract prices threaten to limit future revenue and make it harder to sustain growing margins.

- Heavy domestic market reliance means that any rapid shift in energy policy or acceleration in coal plant retirements could further erode ARLP’s addressable market and squeeze earnings.

Valuation Discount Remains Compelling

- Despite trading at $24 per share, sharply below the DCF fair value of $66.04 and the consensus analyst price target of $30.50, ARLP’s current price-to-earnings ratio of 13.2x looks like a discount compared to its peer average of 26.6x but still sits just above the broad industry’s 12.8x standard.

- Analysts’ consensus view argues this wide value gap weighs in favor of those who see ARLP as a high-quality, undervalued play, especially since forecasts imply earnings of $389.8 million and margin strength returning within three years.

- However, persistent risks around regulatory shifts and ongoing margin compression mean investor conviction about valuation upside hinges on whether ARLP can execute on its diversification and cost strategies.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Alliance Resource Partners on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot trends that others might miss? It takes just three minutes to craft and share your own story from the latest data. Do it your way.

A great starting point for your Alliance Resource Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Alliance Resource Partners faces margin compression and revenue uncertainty as coal prices decline and as older, high-priced sales contracts expire.

If steadier profit growth is a priority, use stable growth stocks screener (2116 results) to discover companies consistently delivering reliable earnings and top-line expansion quarter after quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARLP

Alliance Resource Partners

A diversified natural resource company, engages in the production and marketing of coal to utilities and industrial users in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives