- United States

- /

- Oil and Gas

- /

- NasdaqGS:APA

APA Corp (APA): Assessing Valuation as Momentum Stalls and the Energy Landscape Shifts

Reviewed by Kshitija Bhandaru

See our latest analysis for APA.

While APA’s share price has held steady lately, the bigger story is that momentum has faded over the last year, with a 1-year total shareholder return of -5.3%. This puts recent sideways action into perspective, especially given how the broader energy sector has continued to reposition around shifting demand and commodity prices.

If you’re weighing your next move, this could be a smart moment to broaden your scope and discover fast growing stocks with high insider ownership.

With APA’s price hovering near analyst targets and revenue trends sending mixed signals, the big question is whether the current valuation leaves room for upside or if the market has already factored in future growth.

Most Popular Narrative: Fairly Valued

At $23.88, APA’s closing price sits just below the most closely watched fair value estimate of $23.81. This razor-thin gap hints at market consensus and sets up a tension between fresh operational wins and tempered growth outlooks.

*Strong operational improvements, including capital efficiencies in the Permian and Egypt, are significantly reducing drilling and completion costs, driving higher production with fewer rigs and unlocking meaningful opportunities to grow margin and free cash flow. Expanded acreage in Egypt, a greater than 35% increase, and the ability to fully pursue both oil and gas under new, higher gas price agreements position APA to capitalize on robust, underexplored resources. This supports sustained volume and revenue growth in a region seeing rising energy demand.*

How did the most popular narrative land on this price? The full story hides bold assumptions about profits and shrinking shares, and a future profit multiple that diverges from industry trends. Eager to see exactly what powers this razor-sharp valuation? Only a click away.

Result: Fair Value of $23.81 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity headwinds and the possibility of APA's exit from the S&P 500 Index could spark volatility and challenge the case for "fair value" in the period ahead.

Find out about the key risks to this APA narrative.

Another View: What Does SWS DCF Analysis Say?

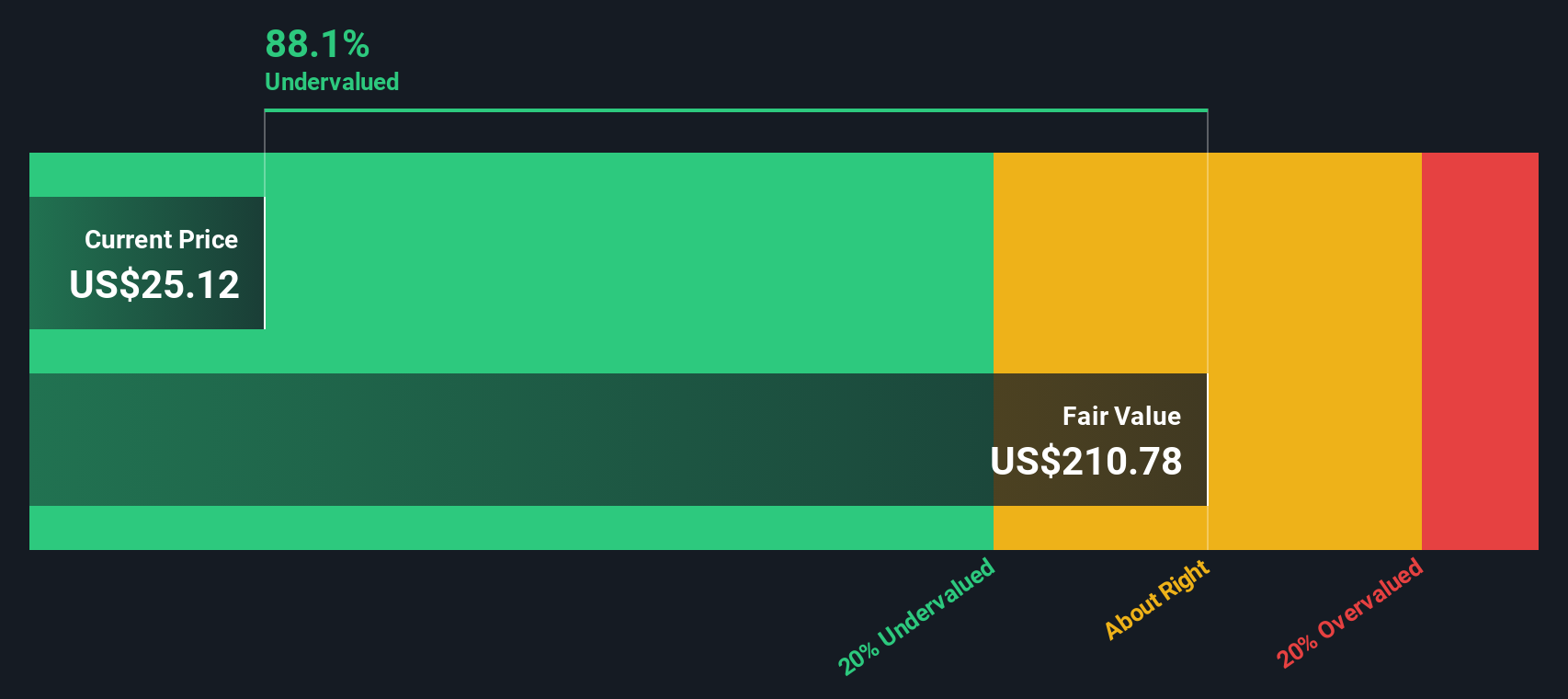

While the recent price aligns with the most popular valuation approach, our SWS DCF model suggests a very different outlook. According to this method, APA might actually be deeply undervalued, with its current price well below the model's fair value estimate. Could the market be missing something fundamental, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own APA Narrative

If you see things differently or want to dive into the data yourself, you can build your own view in just a few minutes, your way. Do it your way.

A great starting point for your APA research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep the horizon wide. There are powerful opportunities you don't want to overlook! Use the Simply Wall Street Screener to spot your next big winner before the crowd does.

- Spot high-yield income streams when you check out these 19 dividend stocks with yields > 3% delivering strong payouts and reliable growth.

- Capitalize on the AI revolution by researching these 24 AI penny stocks poised to benefit from artificial intelligence breakthroughs in multiple industries.

- Uncover undervalued opportunities and build a portfolio with untapped growth, starting with these 904 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APA

APA

An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives