- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Will Fannie Mae’s (FNMA) Leadership Shuffle Shape Its Strategic Direction Amid Softening Earnings?

Reviewed by Sasha Jovanovic

- In October 2025, Fannie Mae announced significant executive changes, including appointing Peter Akwaboah as Acting CEO and promoting senior leaders across its Single-Family and General Counsel divisions, while reporting third quarter earnings of US$3.86 billion, down from US$4.04 billion a year prior.

- This leadership transition, coinciding with a year-over-year decline in net income, highlights a period of operational and financial restructuring at a critical point for the company.

- We will examine how these executive appointments, especially the new Acting CEO, are shaping Fannie Mae’s investment narrative and performance outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Federal National Mortgage Association's Investment Narrative?

Being a Fannie Mae shareholder means believing in the company’s ability to manage through cycles of executive changes and shifting housing market policies, while working towards profitability. The recent departure of Malloy Evans and the appointments of Peter Akwaboah as Acting CEO, along with new leaders in key roles, signal a period of transition that could impact how Fannie Mae approaches risk management and operational efficiency. With Q3 earnings showing a modest net income decline and the share price experiencing recent volatility, the big questions now are whether leadership stability can be restored quickly and if operational improvements will accelerate progress towards sustainable profitability. While these executive moves bring fresh perspectives and deep internal experience, they may also present risks in the short term, especially as the board and management adjust to their new responsibilities. Overall, the immediate effect on Fannie Mae’s core catalysts, like potential privatization and innovative product rollouts, will depend on how smoothly these transitions settle in the coming quarters.

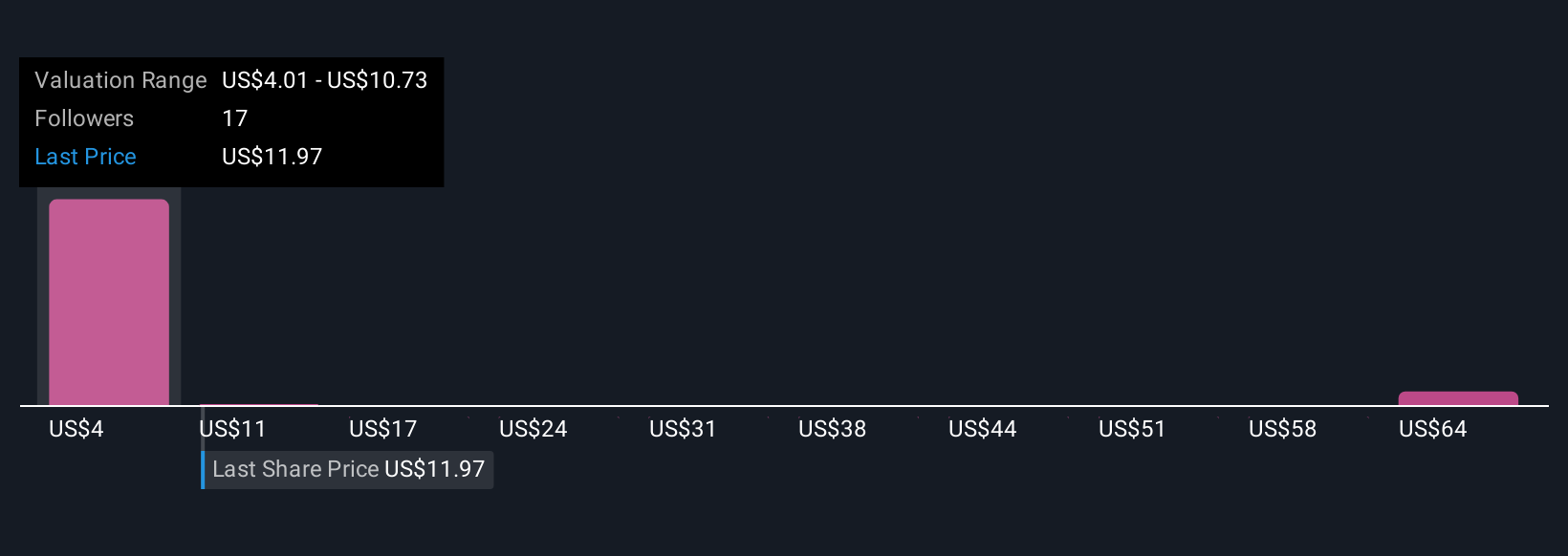

On the other hand, board and management turnover could amplify uncertainty at a sensitive time for the business. Federal National Mortgage Association's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 11 other fair value estimates on Federal National Mortgage Association - why the stock might be worth less than half the current price!

Build Your Own Federal National Mortgage Association Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Federal National Mortgage Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal National Mortgage Association's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives